Setup for city of San Francisco

Sick

Leave Ordinance

You must perform several setup steps in order to

‘activate’ the San Francisco Sick Leave program. These steps include:

1) Adding a new Payroll GL distribution local tax code of

*F

2) Setting up a new local tax table for *F

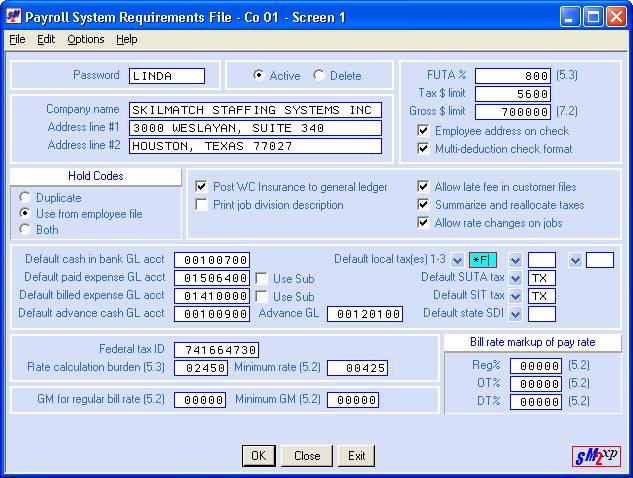

3) Adding a response to the PR System Requirements

4) Adding 91 to the Sick leave days in each participating

employee’s file

5) Adding *F as a local tax code to every participating

job order

6) Optionally adding *F as a default tax code to either

the PR System Requirements file, or to each San Francisco customer file.

7) Optionally create a new Labor Distribution to expense

the Sick leave wages to a different wage expense account.

Continue reading below for detailed instructions on performing

the steps listed above.

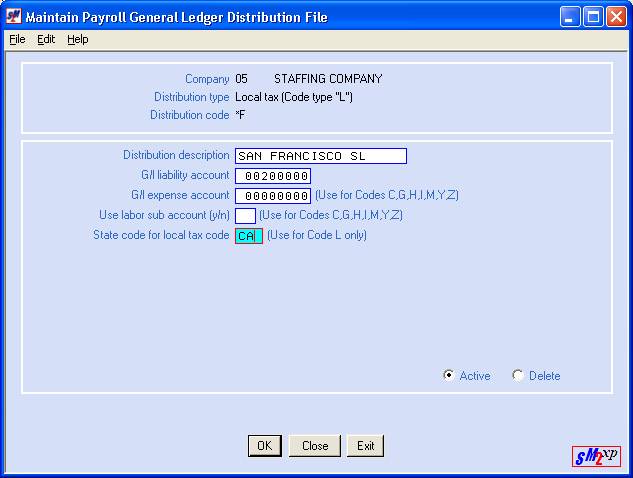

Step 1: In the

Pay and Bill library, go to the File Maintenance menu.

Select

Payroll GL Distributions.

Add Local

Tax, using distribution code *F, using whatever GL account number you choose.

(No dollars will ever post to this account.

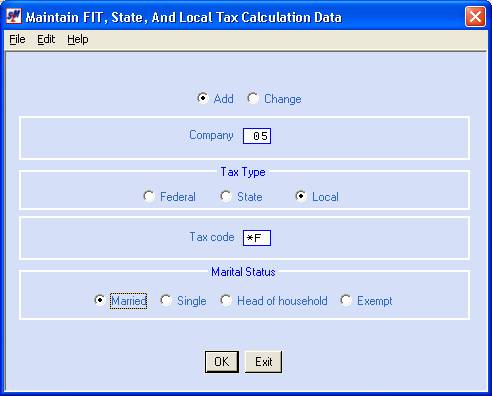

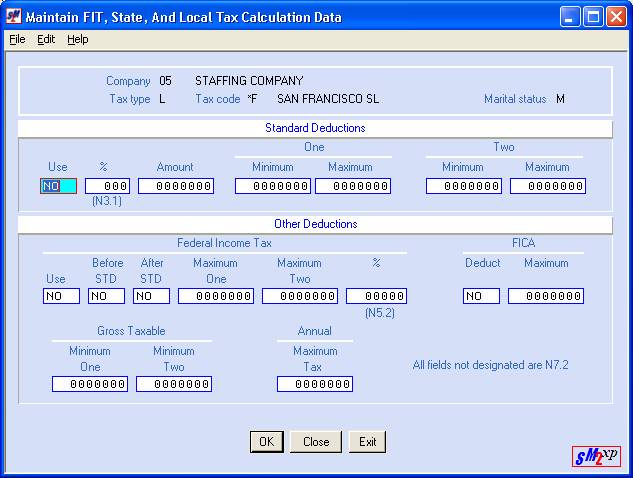

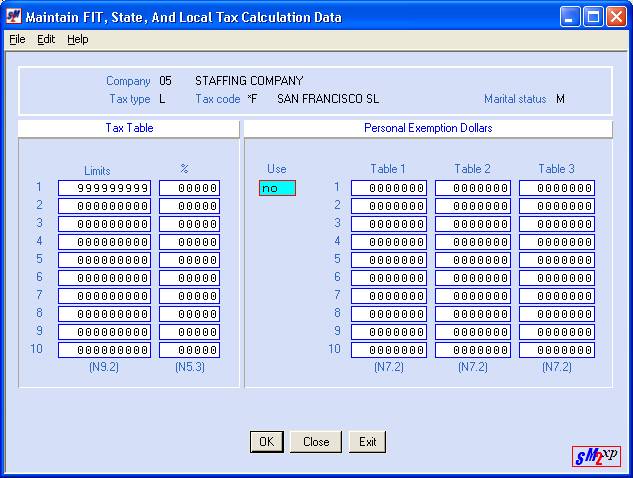

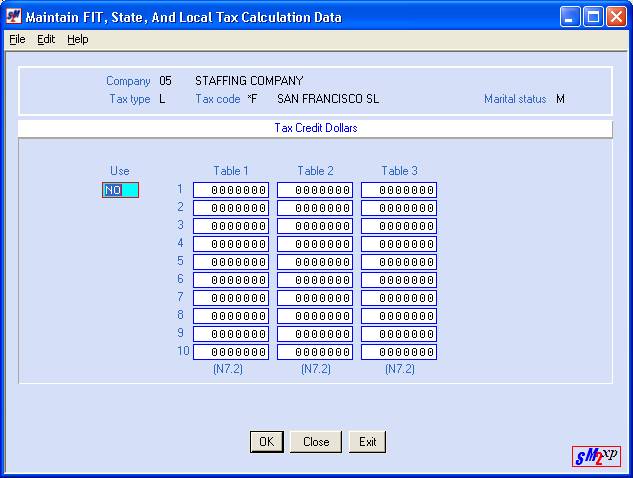

Step 2: Next,

while still on the File Maintenance menu, select FIT, State, Local Tax tables.

Create a

Married and Single record for Local Tax code *F that match the following

screens:

Repeat for Single

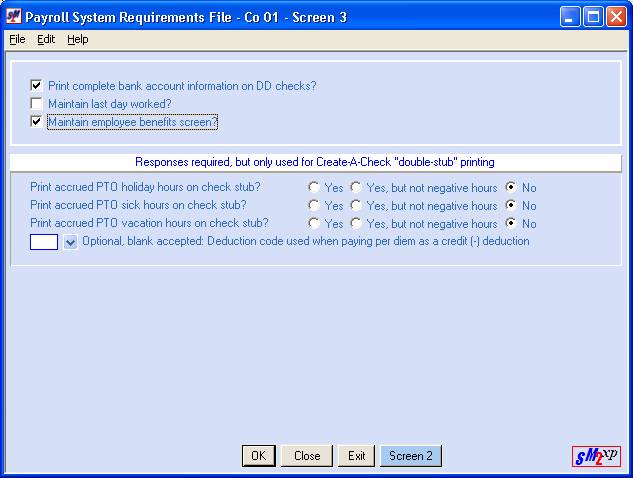

Step 3: Next, while

still on the File Maintenance menu, select Payroll System Requirements.

Bring up

the file for your G/L Company, and continue to click [OK] until you reach

Screen 3.

Check the box marked ‘Maintain

Employee Benefits Screen.

If you are a Create-A-Check user,

you may also want to print the accrued PTO sick hours on the CAC check

stub. Choose from Yes, Yes except if

negative, or No.

Click [OK] after all choices are

made.

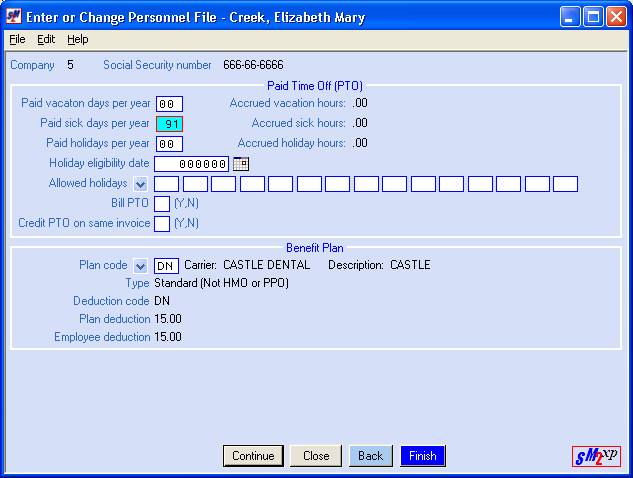

Step 4: Bring up an employee’s file through Maintenance, or the Name Search.

Update the employee file by keying ‘91’ as the Paid sick days per year on the PTO screen.

As long as the 91 displays in this area, the system will accumulate the necessary sick time.

If there is a ‘lapse’ when you do not want the employee to accumulate time, remove the 91 from this area.

If you want to show the customer

that you are paying this Sick Leave benefit to your employees, key Y to

both the Bill PTO and Credit PTO areas. Answering Y to both will,

in effect, demonstrate to the customer that you are indeed paying the benefit

to the employee, but without ultimately billing the customer, since both the

billing and the credit will appear on the same invoice.

If you do not want the Sick

Leave PTO payment to be reflected in the invoice, key N to both the Bill

PTO and Credit PTO areas.

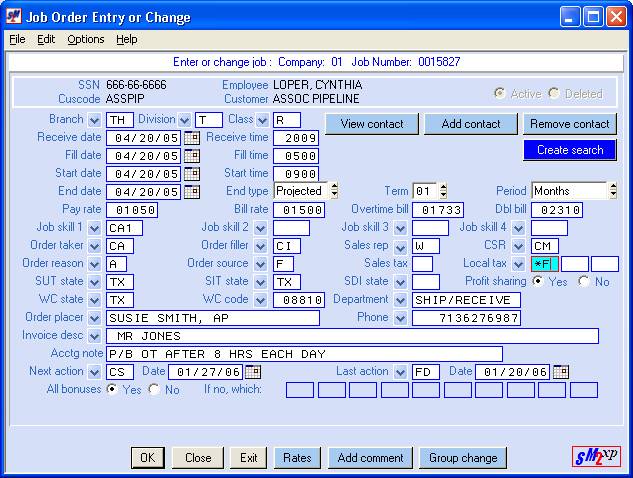

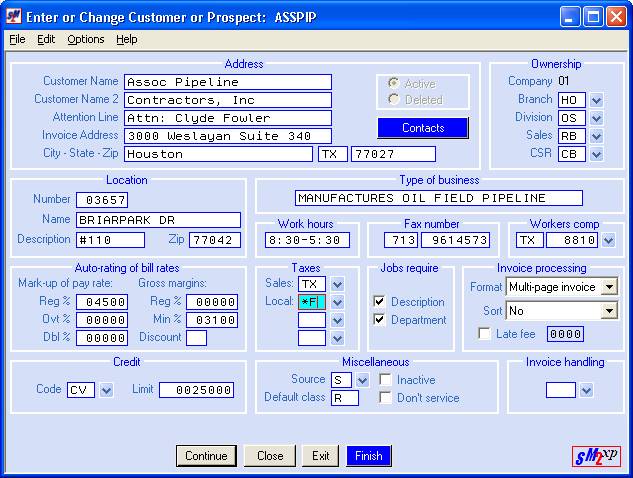

Step 5: Every

employee who will participate must have *F as a local tax code on the jobs for

which they are paid.

Go into every existing job that

is eligible for the SF Sick Leave and add *F into any one of the three Local

Tax areas.

Step 6: (optional) If you want the *F to be added automatically to future job orders, you must set it as a default in one of two places. To add the *F to EVERY job order, add the *F to the Payroll System Requirements file:

If you do not want the *F added to ALL jobs, just those for San Francisco customers, then you will not add it to the System Requirements, instead, you will add the *F to the Customer file.

Step 7: (optional) If you want to expense San Francisco

sick time to a special expense account, you will need to:

1) create a unique Labor

Distribution,

2) add a job order using this

unique Labor Distribution, and

3) process a separate ‘timecard’

against this job.

Please call SkilMatch if you need assistance in creating a

new Labor Distribution.

Paying SF Sick Leave:

If you plan to expense the SF Sick leave wages to the same

wage account as the regular job, you may add the Sick time payment to the

regular weekly timecard off of the employee’s regular job. If you have created a new Labor Distribution

to expense the wages to a different account, then you must add a separate

job order and process a separate timecard against the Sick Leave job.

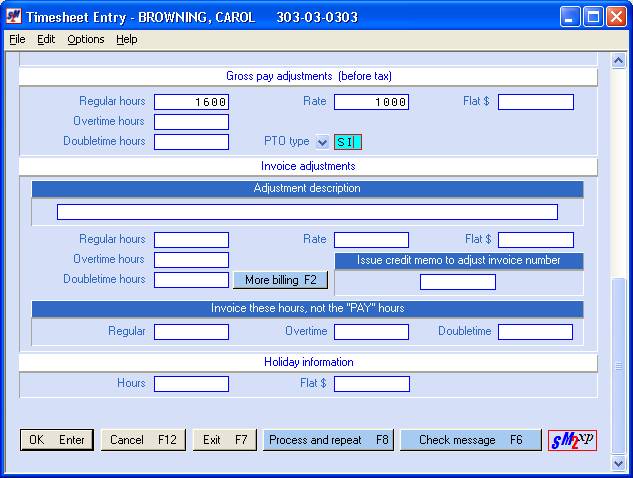

Regardless of the job order used, however, San Francisco

Sick time should be paid as a Gross Pay Adjustment (hours x rate) on a

timecard, using SI as the PTO code. See

example below:

If you use Create-a-Check, then this will print separately

on the check stub, as will the accumulated sick leave benefit. If you do not use Create-a-Check, then we

recommend that you add a special check message to the timecard to identify the

‘Other pay’ that will print on the check stub.