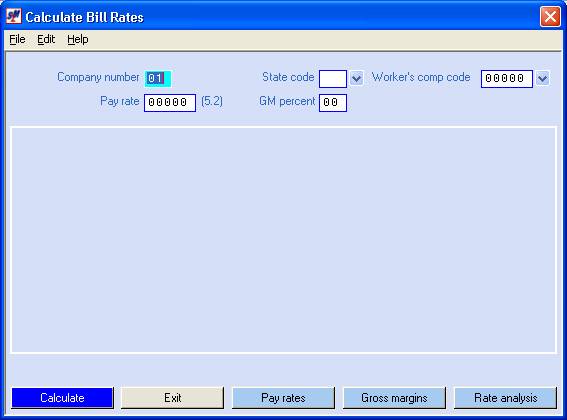

RATE CALCULATION PROGRAM

If you would like the system to calculate a pay

rate, a bill rate, a gross margin, or if you would like to view a breakdown of

an hourly pay/bill rate structure, click [Rates].

The screen will display:

Note: the options listed at the bottom of the

screen will vary, based on the selection made.

Select the option desired.

To return to the previous

screen, click [Exit]

from any screen.

Bill

Rates:

If you wish to calculate a bill rate, complete this

screen and click [Calculate].

Note: if your company established a minimum pay

rate then you will not be allowed to do a rate calculation on a pay rate less

than the company minimum.

The screen will display:

The system displays a table of bill rates that

reflect incremental increases in pay rate and gross margin percent. In this example, a $10.00 pay rate with a 20% gross margin results in a bill rate

of $13.95. The 20% margin translates to

a 39.50% markup.

(Remember that gross margin includes your

organization’s cost for FUTA, SUTA, Social Security, Medicare, Workers comp,

and any other employer paid taxes. It

might also include a percentage to account for overhead costs. Please inquire

of your management whether this additional overhead percentage has been

included.)

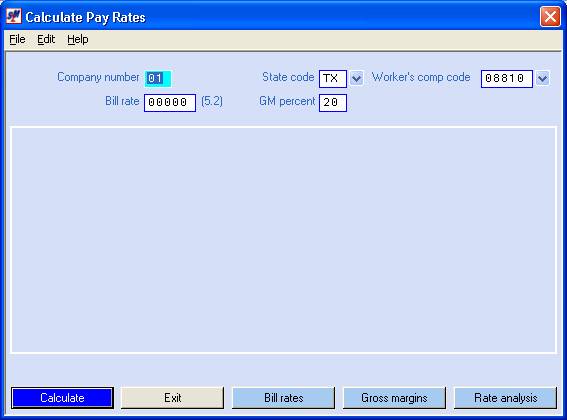

Pay

Rate:

If you wish to calculate a pay rate, click [Pay rates].

The screen will display:

If you wish to calculate a pay rate, complete this

screen and click [Calculate].

Note: if your company established a minimum pay

rate and if your bill rate is too low to keep the pay rate above the minimum

set, you will receive a warning message to that effect.

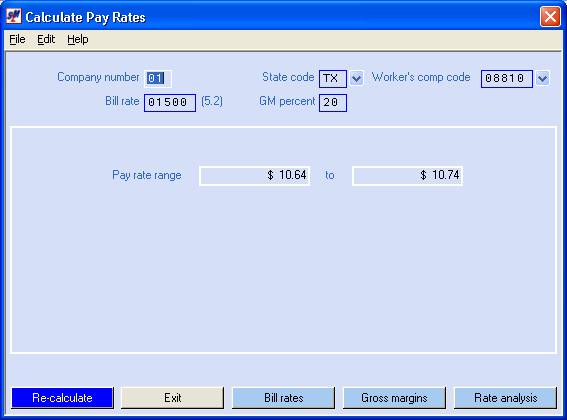

The screen will display:

The system will display a range of pay rates that

are within the 20% gross margin selected.

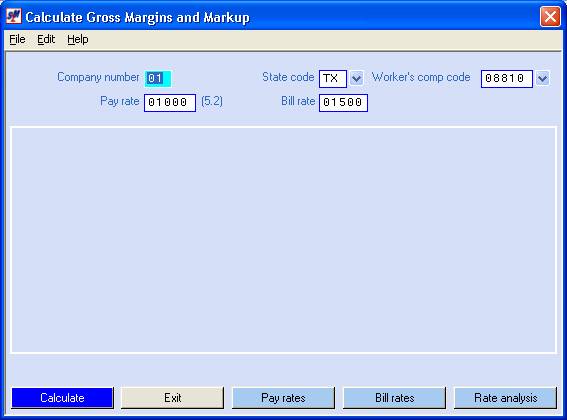

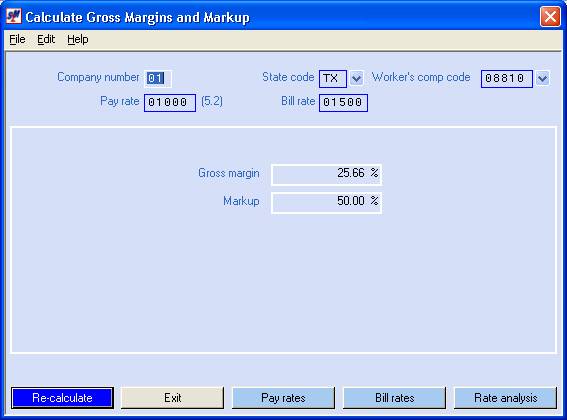

Gross Margin:

If you want to see the gross margin that would be

earned on a specific pay/bill rate, click [Gross margins].

The screen will display:

Complete this screen and click [Calculate].

Note: if your company established a minimum pay

rate then you will not be allowed to do a rate calculation on a pay rate less

than the company minimum.

The screen will display:

The system will display both the gross margin and

markup percentages that are based on the pay/bill and worker’s comp selections.

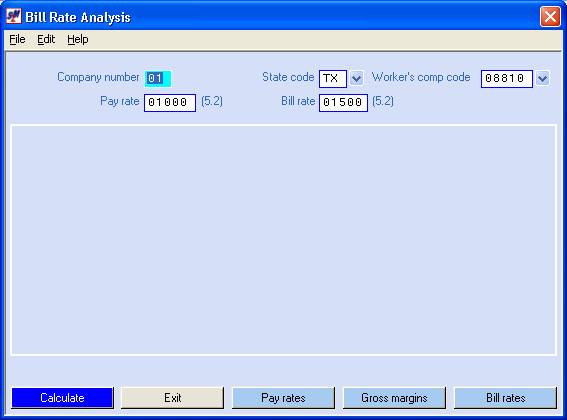

Rate Analysis:

If you would like to see a breakdown of the costs of

an hourly pay/bill rate structure, click [Bill rate

analysis].

The screen will display:

The screen may already display selections. If not, complete this screen and click [Calculate].

Note: if your company established a minimum pay

rate then you will not be allowed to do a rate calculation on a pay rate less

than the company minimum.

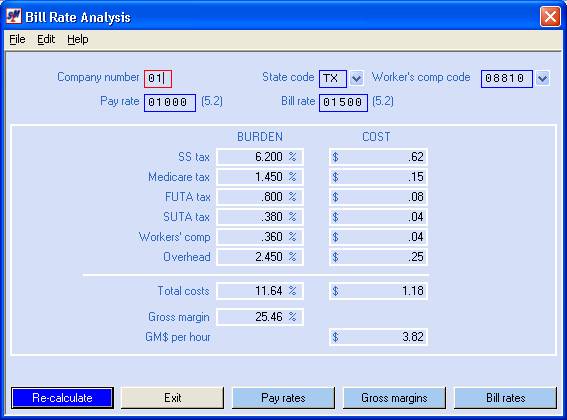

The screen will display:

The system will analyze your burden in terms of both

percentage and dollar amounts. You will

see the exact costs per hour of all employer payroll taxes, workers’

compensation, and overhead (as defined by your company in the payroll systems

requirements file).

The gross margin % displayed is the gross margin $

per hour divided by the bill rate.

The gross margin $ per hour is the bill rate minus

the pay rate minus the total costs.

To return to the original screen, click [Exit]

from any screen.