POSTING PAYROLL TO THE GENERAL

LEDGER

The system will not allow you to

process this option until you have processed and posted paychecks and

invoices. Options from the Payroll

Updating menu should be processed one at a time from the same session. Do not start an option on one session

and another option on another session.

If you get an error message when processing this option, stop

immediately and call SkilMatch! Do NOT

simply try another menu option. All

Update options use the same file (the merged file). You CANNOT process more than one PBUPDT option simultaneously.

This option makes a journal

entry into the general ledger for all costs associated with the payroll,

including all payroll taxes (employee and employer), wages, deductions,

workers’ compensation, and cash. The

general ledger account numbers are pulled from the Payroll Labor Distribution

records, the Payroll G/L Distributions, and the Payroll System Requirements

file. (The posting of workers’

compensation costs for this payroll is optional).

The “Payroll Journal Transaction

Register" (PB464) is generated as a result of posting payroll to the

general ledger. This report lists in

detail all entries posted to the general ledger. When you print this register, a copy is automatically saved in

the printer's outqueue.

The system requires that you

process this option ONCE for every payroll cycle, even if the payroll is

billing only.

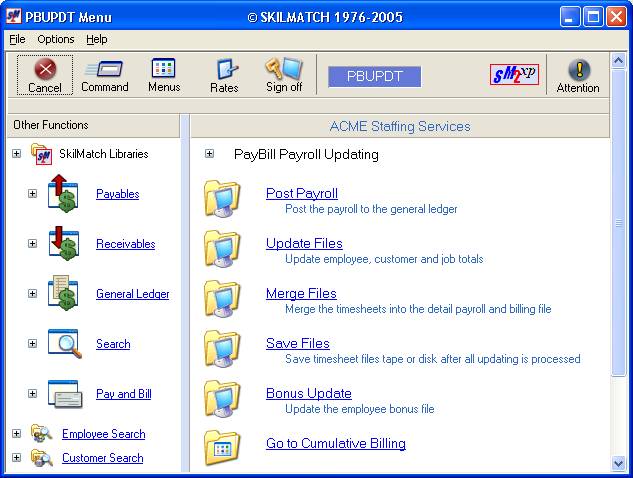

To

begin, on the “PayBill Master” menu, click [Payroll Updates].

The

screen will display:

Click [Post Payroll].

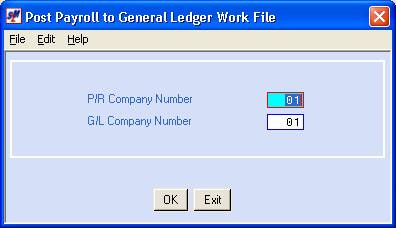

The

screen will display:

P/R Company Number:

Defaults to company

01. The PR company contains the

employee, customer and job order files.

If you wish to post the payroll to a different payroll company, key the

desired company number.

G/L Company Number:

Defaults to company

01. The GL company will receive the

journal entry for the payroll expense.

It is normally the same as the PR company, but may differ. If you are uncertain, please contact your

own accounting department. If you wish

to post the payroll to a different general ledger company, key the desired

company number.

To NOT proceed, click [Exit].

You will be returned to the “PayBill Payroll Updating” menu.

To proceed, click [OK].

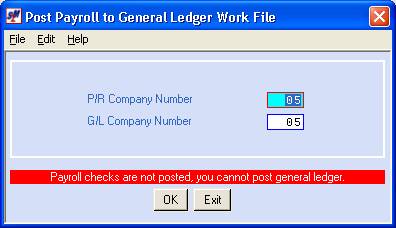

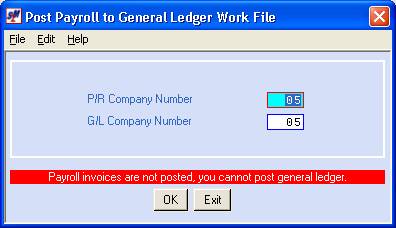

The system will check the

internal “monitor” to verify that paychecks and invoices have been posted

before you will be allowed to post to the general ledger. If either the paychecks or invoices have not

been posted, the screen will display:

Click [Exit]

to return to menu. Print and post

paychecks and/or invoices before attempting to post to the general ledger.

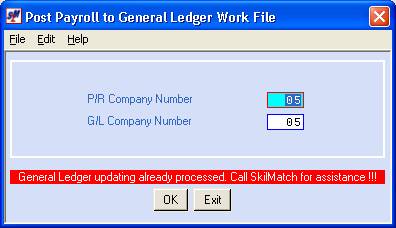

The system will prevent you from

posting more than once. If the system

sees that this option has already been processed, the screen will display:

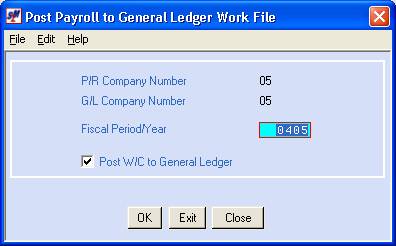

If paychecks and invoices have

been posted, and if you have not already posted to the general ledger for the

company selected, the screen will display:

Fiscal Period/Year:

Defaults to the last date used

for posting payroll for this G/L company number. If this is the correct fiscal period/year, leave the date

unchanged. If this date is NOT correct,

key the correct fiscal period/year (without dashes/slashes).

(If your company defines valid

GL posting periods, then the fiscal period/year you select must be on the

current list of valid period/year combinations.)

Post W/C To General Ledger:

Displays the default from the

system requirements file for this G/L company number.

If you wish to post workers’

compensation to the general ledger, then this option should be selected

(checkmark should be displayed).

If you do NOT wish to post

workers’ compensation to the general ledger, this option should be unselected

(checkmark should NOT be displayed).

Note: click once on the option

to select/unselect.

To NOT proceed, click [Exit].

You will be returned to the “PayBill Payroll Updating” menu.

To proceed, click [OK].

Your screen will remain “input inhibited” (tied up) while the option

processes. The merged timecard file

will be edited for posting. The data is

edited for missing or deleted G/L chart of account numbers, figures out of

balance, and much more.

No Errors Detected/Report

Produced:

If no errors are detected, all

appropriate journal entries will post and you will return to the “PayBill

Payroll Updating” menu.

The “Payroll Journal Transaction

Register" (PB464) is generated as a result of posting payroll to the

general ledger. This report lists in

detail all entries posted to the general ledger. When you print this register, a copy is automatically saved in

the printer's outqueue.

Note: do not delete this register from the outq

until the original is safely in your payroll binder. Because the report is produced as the result of posting and

because you cannot post payroll to the general ledger twice (nor would you want

to), this report cannot be reproduced.

Do not lose your copy and do not delete the saved copy until the

original is safely filed away.

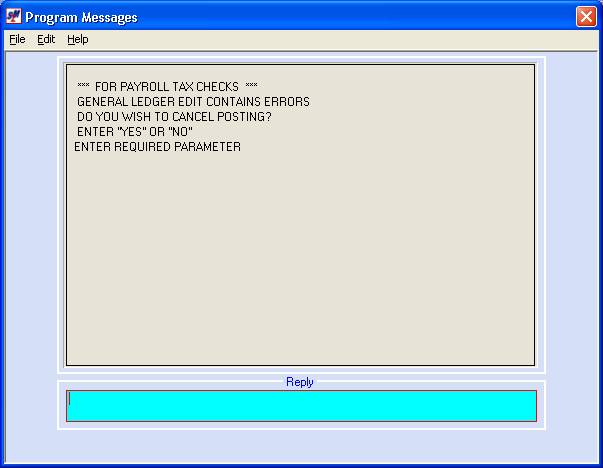

Errors Detected/Report Produced:

If errors are detected, a

“Payroll Journal Transaction Edit” displays in your outqueue and the screen

will display:

Do not respond to this message

until you have investigated the problem.

Examine the Edit report to determine what the problem is. It is usually one of 2 problems – either there

is an account number missing from the general ledger, or the journal entry

debits and credits do not equal other.

MISSING ACCOUNT NUMBER:

If the error is a missing

account number (or numbers), then either an account number has been deleted by

accident from the general ledger, or you are posting to a new cost center or

line of business and an account number for a payroll expense was omitted

inadvertently. To find the account

number(s) in question, search the Payroll Journal Transaction Edit report for

the word EXIST (as in DOES NOT EXIST).

FINAL TOTAL DOES NOT EQUAL ZERO:

As with any journal entry, the

total amount being posted as credits must equal the total amount posted as

debits. If they do not match, then the

final total will not be zero, and the entry will be out of balance. The system will not allow you to post an

entry that is out of balance. Look at

the bottom of the Edit report to see if the final total is zero.

TO CANCEL OR NOT TO

CANCEL:

Once you locate the error on the

edit, you can decide whether or not to cancel the posting. If you choose to cancel, then you can come

back later after the problems have been identified and corrected and attempt

the post again.

OR

If you choose NOT to cancel,

then you can go to another session and add the missing account number(s).

OR

If you choose NOT to cancel,

then you can bring up the transaction in error, and change the account number

to a valid, existing account.

If you key YES to cancel

the posting you will return to the “PayBill Payroll Updating” menu without

posting.

If you key NO to NOT

cancel the posting, the screen will display:

If you have added the missing account

numbers using another session, click [Exit] and the system will re-edit the journal entry. If all account numbers are now present, then

the posting will complete, and you will return to menu. If there are still account numbers missing,

then the system will display the error message screen again.

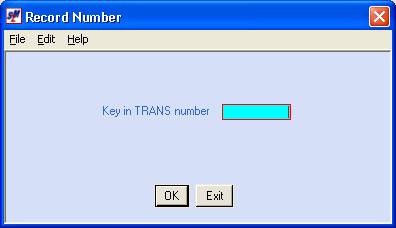

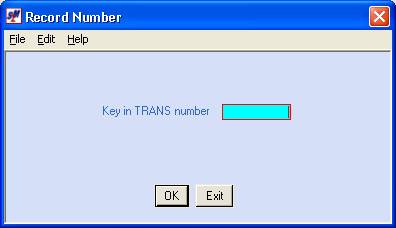

If you did not add missing account number, instead, you

want to change the account number that the system is trying to use, then key

the transaction number of the record and click [OK]. (Look for the TRANS number of the record on the Edit report.)

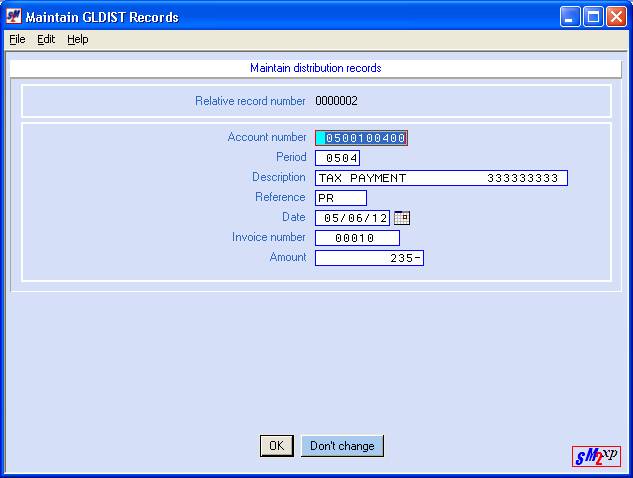

The screen will display:

BE

VERY CAREFUL WITH THIS SCREEN! CHANGE ONLY

THE ACCOUNT NUMBER! If you change anything else, then the journal entry

could become out of balance.

If you decide not to make a change to this

transaction, click [Don’t change]. No

updating will take place; you will be returned to the previous screen.

If appropriate, key the correct account number and click [OK]. Repeat for any additional transaction numbers.

When all transactions have been changed, click [Exit] and the system will re-edit

the journal entry. If all account

numbers are now present, then the posting will complete, and you will return to

menu. If there are still account

numbers missing, then the system will display the error message screen again.

When the screen returns to the

Payroll Updating menu, the posting is complete. The “Payroll Journal Transaction Register" (PB464) is

generated as a result of posting payroll to the general ledger. This report lists in detail all entries

posted to the general ledger. When you

print this register, a copy is automatically saved in the printer's outqueue.