PRINTING THE PRELIMINARY REPORTS

This option may be

selected any time after the Calculate Taxes option has been processed. The reports should be used to verify payroll

accuracy prior to printing checks or invoices.

The following reports are

produced as a part of this option:

(1) Payroll

Check Register (PB506)

(2) Payroll

Journal (PB508)

(3) Payroll

Journal Void/Reissue Memo (PB508)

(4) Payroll

Journal Prepaid Memo (PB508)

(5) Payroll

Deduction Register (PB715)

(6)

Garnishments Not Fully Deducted (PB426R)

(7) Payroll

Deduction Payables Report (PB514)

(1) Payroll

Check Register – lists all checks produced in this payroll, in check number

order. Prints the check number, check

date, job order division and class, employee social security number and name, net

amount of check, type of check, and G/L cash account number from which the

check was written. It also includes the

total number of checks, and the total net amount of checks. If the Payroll Constant file was set to

print by office, then the system will produce one check register per branch

office.

(2) Payroll

Journal – lists all checks produced in this payroll, in either alphabetical

or social security number order. Prints

the employee name and social security number, check number, type of check (void/reissue),

branch office, division, GL class, week-ending worked, customer code, number of

regular, overtime and double time hours being paid, gross dollars (which is a

combination of hours and “other pay”), detail of taxes withheld, other pay

(gross pay adjustments), deductions, and net pay.

If the check had a special check

message, this prints on the journal as well.

The last page of the journal will display. Printed are Total Gross, SS Withheld, Medicare Withheld, W/H Tax,

State tax, Local tax, SDI Tax, Other Pay, Advances, Expenses, Deductions, Total

Net pay, and any employer Matching dollars.

Please note that any figure printed beside TOTAL OTHER PAY is already

included in the TOTAL GROSS figure.

We pull it out as a separate figure just for informational purposes.

(3) Payroll

Journal Void/Reissue Memo – lists all checks voided and/or reissued in this

payroll. Any check listed on this

report is also included on the regular payroll journal. This report is simply a convenience for you

to view all voids and reissues that were a part of the payroll, instead of you

having to page through the journal trying to spot them.

(4) Payroll

Journal Prepaid Memo – lists all prepaid checks processed in this

payroll. Any check listed on this

report is also included on the regular payroll journal. This report is simply a convenience for you

to view all prepaid checks that were a part of the payroll, instead of you

having to page through the journal trying to spot them.

(5) Payroll

Deduction Register – lists all deductions processed in this payroll, sorted

by deduction code. Printed on the

report are the deduction code, the employee name and social security number,

the deduction amount, and any employer matching amount. The report takes a total at the end of each

deduction code, and a grand total for all code.

(6) Garnishments

Not Fully Deducted – lists any deductions where the amount withheld from

the check is less than the amount that was scheduled to withhold. Since the system can automatically adjust

deduction amounts based on the employee’s disposable income, the report serves

as notification. Printed on the report

are the employee name and social security number, the deduction code, the

deduction priority code, the week-ending worked, the requested amount, the

amount deducted, and the reason(s) why the system was unable to deduct the full

amount.

(7) Payroll

Deduction Payables Report – prints accounts payable vendor information for

use in producing an A/P check. Included

on the report are the vendor code, name and address, the employee name and

social security number, and case/loan number.

HOW TO PRINT THE WEEKLY PAYROLL REPORTS

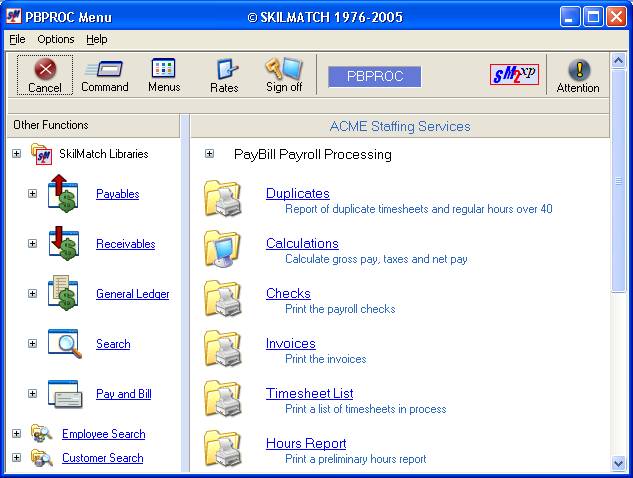

To

begin, on the “PayBill Master” menu, click [Payroll Processing].

The

screen will display:

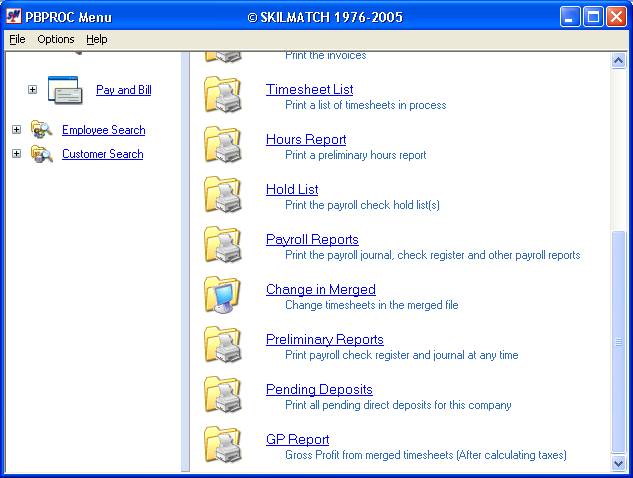

Right

click on the white space to the right, or drag down the blue bar on the far

right side of the screen to display more menu options.

Click [Preliminary

Reports]. The screen

will display:

Company Number:

Defaults to company

01. If you wish to print the

preliminary check register and payroll journal for a different company, key the

desired company number.

To continue, click [OK].

If you prefer to NOT produce the

reports, click [Exit].

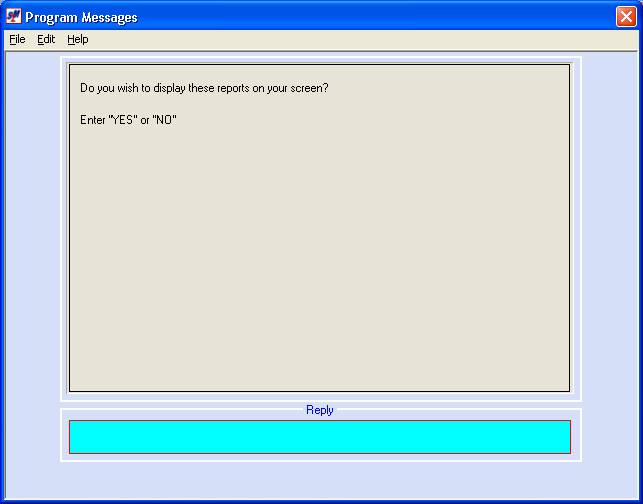

If you chose to continue,

the screen will display:

If you want the reports

to go to your outqueue without displaying on your screen, key NO and press (enter).

If

you want the reports to display on your screen, one by one, key YES and press (enter).