PRINT CUSTOMER INVOICES

This option produces a print

file of invoices and posts customer invoices to both accounts receivable and

general ledger.

If you are processing a cumulative

billing payroll cycle, you should NOT process this option. Instead, when all payrolls for this pay

period are complete, go to Menu PBCMBL to process cumulative billing

invoices. Refer to document Menu

PBCMBL, Item Invoices for assistance.

(Cumulative billing allows you

to process checks WITHOUT processing billing until all payrolls for the period

are complete)

You had the opportunity to

verify invoice-printing information (beginning invoice number, invoice date,

etc.) during the Begin Cycle. You are

given another opportunity during this option to verify and make changes, if

necessary, before creating the print file of invoices.

If you have customer files that

are set to sort timecards into groups by job order department, you will get a

report to inspect before the invoice print file is produced. If you find errors on the report, you can

cancel the invoices and go back into the job orders to make changes to the

department. The system does not pick up

the job order department until this menu option is processed. (ANY OTHER JOB

ORDER CHANGES WILL BE IGNORED).

The system will also edit the

invoices for potential errors. Some

errors will prevent an invoice from posting to A/R or G/L, some are just

warning errors that will not prevent the invoice from posting. Examples of “terminal” errors are duplicate

invoices numbers, invalid customer codes, or G/L account numbers that no longer

exist. Example of an error that is a warning

only is “will result in a credit balance”.

Credit balances will post anyway.

Your system may be set up to

save invoice detail for reprinting purposes.

(If disk space is an issue, then your system probably is NOT set up for

the invoice reprint option.)

“Create-A-Check” (CAC) is a

software interfaced with SkilMatch to allow printing of invoices (as well as

paychecks, A/P checks, W2s, and more) using specific types of laser

printers. You must purchase the CAC

interface and SkilMatch staff must set it up for you before it will be active during

your payroll.

SkilMatch customers are divided

into 2 groups: those who lease space on the SkilMatch/E (SM/E) server,

and those who own a server. Make

certain before proceeding that you know your group. There is a separate set of steps for SM/E users.

During the Print Invoice option,

the system will process the following:

Step 1 - Verify invoice printing data

Step 2- Check for cumulative billing

Step 3- Check for New Jersey Voucher

Step 4- Check for restored files

Step 5- Check for invoices sorted by department

Step 6- Check for existence of Create-A-Check invoice

printing

Step 7- Check Edit for errors

Step 8– Post Invoices to A/R and G/L.

This option produces up to 5

reports:

Invoices

by Customer Department (PB451A)

Actual

invoices (REPRINTINV or PB450)

Invoice

Edit (AR120)

Invoices

Register (AR130)

List

of invoices not added to the Invoice reprint file (INVSAV)

If your invoices get added to the Invoice reprint

file (INVSAV), you may reprint individual invoices at any time after they have

been posted. Click reprint

for instructions.

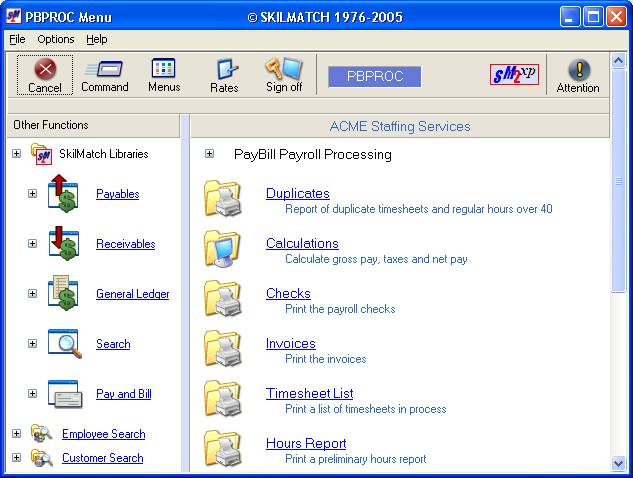

HOW TO PRODUCE AND POST INVOICES

To

begin, on the “Pay and Bill Master” menu, click [Payroll Processing].

Click [Invoices].

Note: if you are re-running this option during the

same payroll process, you will get an additional screen. Please refer to documentation previous attempt for assistance.

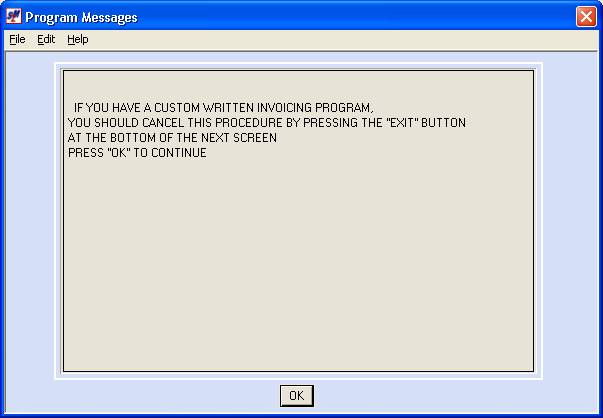

The

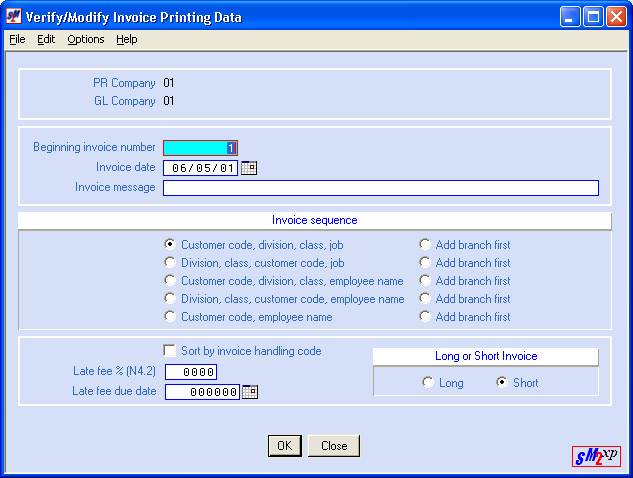

screen will display:

You should not be using this

menu option if you have a custom written invoice program, or if this is a

cumulative billing payroll. Click [OK] to continue after reading the warning.

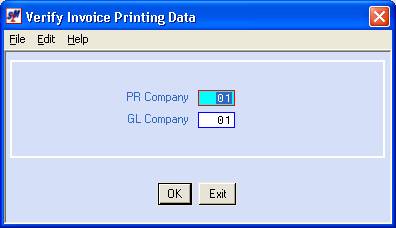

The screen will display:

Custom

Invoice Program or Cumulative Billing:

If you have a custom invoice

program or if this is a cumulative billing payroll, you should NOT be using

this option. Click [Exit]

to cancel the processing.

P/R Company Number:

Defaults

to company 01. If you wish to print

invoices for a different payroll company, key the desired company number. This company contains the employee, customer

and job order files.

G/L Company Number:

Defaults

to company 01. If you wish to post the

invoices to a different general ledger company, key the desired general ledger

company number. This is the company

that will receive the journal entry for the costs associated with the

payroll. For most SkilMatch customers,

the G/L company is the same number as the Payroll Company.

To continue, click [OK].

The screen will display:

Changes made on this screen affect this payroll only--they will not permanently change the system file. Make any desired changes on this screen.

Refer to Menu

PBMANT, Item Payroll Constant for assistance with fields on this screen.

Refer to Menu

PBMANT, Item Payroll System Requirements for assistance with ‘Sort by

Invoice Handling Code’ field on this screen.

To continue creating invoices,

click [OK].

If you wish to NOT continue, but

wish to try again with a different payroll company number and/or a different

general ledger company number, click [Close]. You will be returned to the Verify Invoice

Printing Data screen.

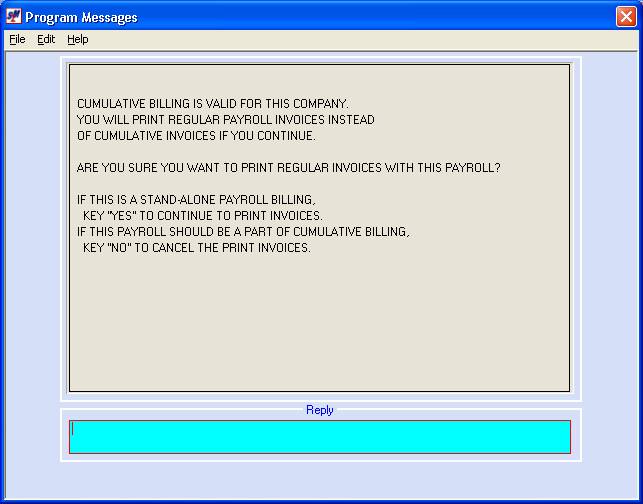

Cumulative

Billing Valid For This Company:

If cumulative billing is NOT

valid for this company number, proceed to New Jersey

Voucher.

If cumulative billing is valid

for this company number, the screen will display:

If these billing records should

not be added to the current cumulative billing file, but should stand-alone as

an independent set of invoices, key YES to continue printing invoices.

If this payroll should be part

of cumulative billing, you should not have selected this option for

processing. Key NO to cancel the

printing of invoices.

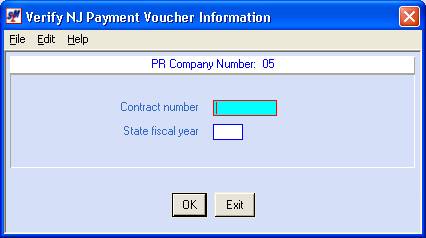

New Jersey vouchers:

The system checks next for the

existence of the New Jersey voucher program.

If you print New Jersey payment vouchers, the screen will display:

Contract Number:

Will display the New Jersey payment voucher information from the New Jersey state file. If this information is incorrect, make the desired change.

State Fiscal Year:

Will display the New Jersey

payment voucher information from the New Jersey state file. If this information is incorrect, make the

desired change.

To continue printing invoices,

click [OK].

To NOT continue printing

invoices, and return to the “Paybill Payroll Processing” menu, click [Exit].

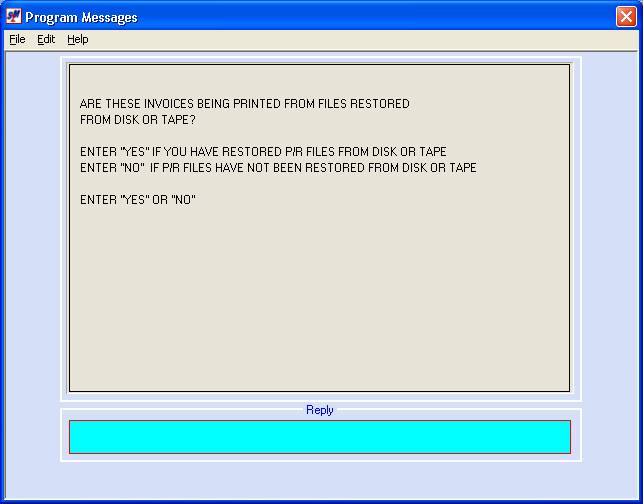

Step 4:

If previous attempt to print invoices was cancelled:

If you have to re-process the

invoice option during the same payroll cycle, you will get a message during

each attempt following the first (even if you did not post invoices in the

first attempt) until a new payroll cycle begins. The system will display:

If the invoices being

re-processed are from a previous payroll and were restored from disk or tape

(this means you restored old payroll files from disk or tape in order to

reprint invoices), key Yes and press (enter).

If the invoices being

re-processed are NOT from a file restored from disk or tape (this means you did

NOT restore the payroll from disk or tape in order to reprint invoices), key NO

and press (enter).

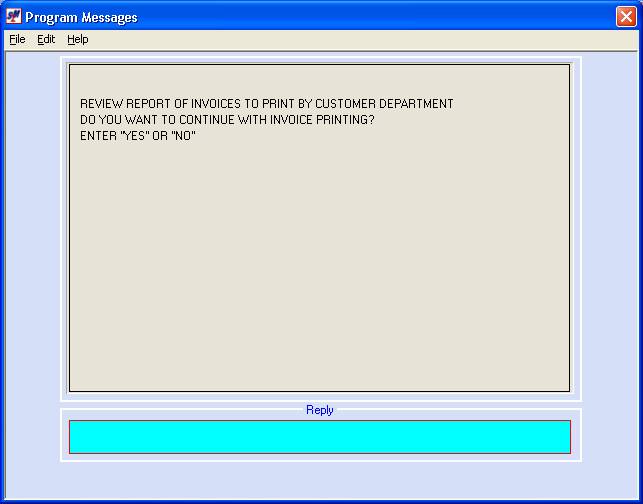

If at least one invoice is being

sorted and printed by job order department, you will get the following

screen:

Check your outqueue for a report (PB451A) that will display all invoices being sorted by customer department. The report will display which temporaries are going to print on each invoice. Inspect the report to make certain that the customer departments are correct and that each temporary is showing up under the correct department.

If you do not find any errors on

the report and wish to continue with printing of invoices, key YES and

press (enter).

If you find errors and need to

change the department on the job order, key NO and press (enter).

You will be returned to the “PayBill Payroll Processing” menu. After making the desired department changes

to the job order(s), select this option again.

The next screen to display will

depend on whether or not you have CAC installed. “Create-A-Check” (CAC) is a

software interfaced with SkilMatch to allow printing of invoices (as well as

paychecks, A/P checks, W2s, and more) using specific types of laser

printers. You must purchase the CAC

interface and SkilMatch staff must set it up for you before it will be active

during your payroll.

If you do NOT use CAC to print, click Next to move forward to your next step.

If you are an SM/E customer (leasing space on the SkilMatch server) using CAC to print invoices, click SM/E to move forward to your next step.

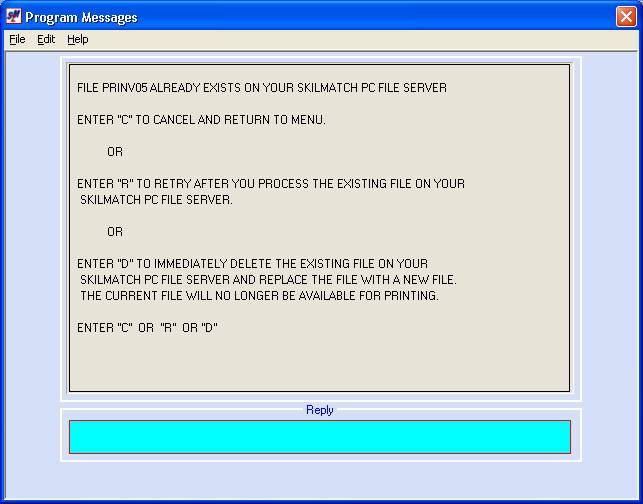

For SkilMatch CAC customers who own a server, the system will check to make certain that you do not already have invoices waiting to print. If the system finds an existing invoice file, then the screen will display:

C - If

you do not know why the file exists, key a C to cancel this job and go

investigate.

R - If the

file exists because you have not yet printed the invoices from the last

payroll, go print the invoices, then come back to this screen and key R

to retry the process.

D - If the file exists because you have processed this option but did not print or post the invoices created, and are re-creating the invoice file, key D to delete the existing file and create a new file.

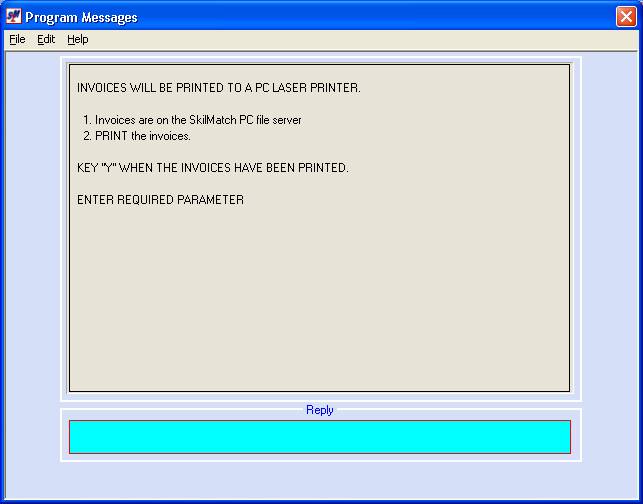

Once the system does not detect an existing file of invoices, the screen will display:

When

this screen displays, the system will have created a print file of CAC

invoices. If you prefer to hold off

doing the actual printing until AFTER you have viewed the Invoice Edit, go

ahead and key Y and press (enter).

Viewing and approving the edit

BEFORE printing could save you from printing invoices that are not correct!

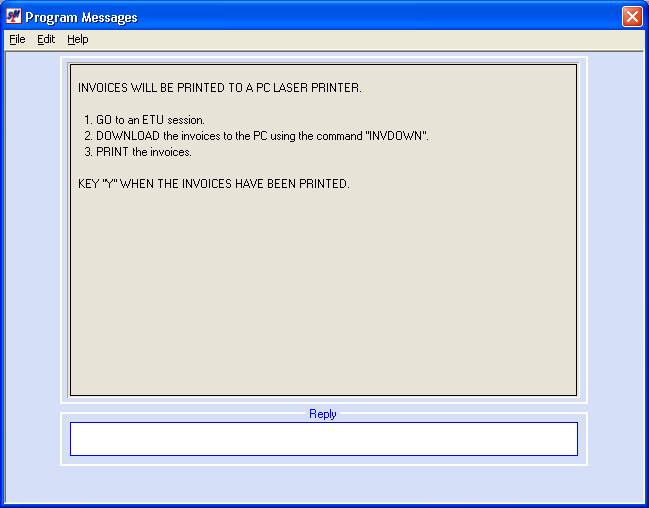

The system will not check to see

if the previous print file of invoices was ever printed. Instead, it will

replace any existing invoice file with a new one. Your screen will display:

When

this screen displays, the system will have created a print file of CAC

invoices. If you prefer to hold off

doing the actual printing until AFTER you have viewed the Invoice Edit, key Y and press (enter). Viewing and approving the edit BEFORE printing could

save you from printing invoices that are not correct!

Check edit for errors:

The

next step in the invoicing process is to edit the invoices for errors. Some errors will result in the invoice not

being posted to Accounts Receivable or General Ledger. Other errors are just warning messages, and

the invoice affected will post anyway.

You should REVIEW the

edit (AR120) and the print file of invoices (REPRINTINV

or PB450) before proceeding!

The

system will display one of the following 2 screens:

-OR-

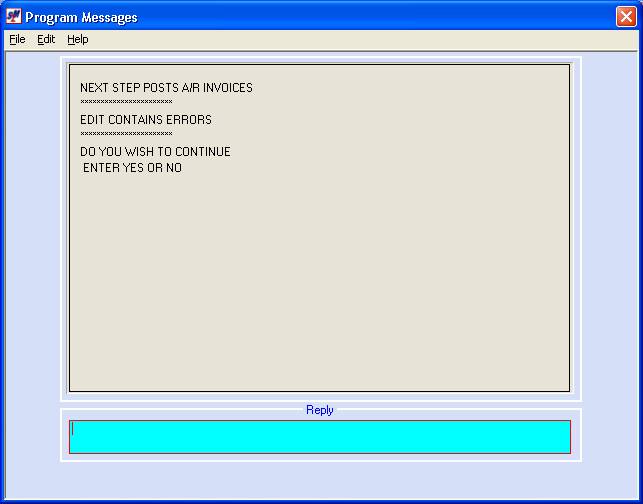

Invoice Edit Contains Errors:

If your screen also has the

words “EDIT CONTAINS ERRORS”, you will need to decide whether or not to

continue with invoice processing.

Inspect the Edit report and the invoice file carefully. Depending on the error shown on the edit,

you will decide whether or not to proceed.

If the edit has the words WILL NOT BE POSTED, then you should be

aware that the system will post everything on the edit except those

invoice(s). All invoices will be posted

to accounts receivable and general ledger except the items in error.

If the edit has errors that do not contain the words WILL NOT BE POSTED, then the messages are alerting you to situations you should be aware of before you make the decision to post.

Again, you need to decide

whether to continue based on the errors listed on the edit. You may wish to call SkilMatch to discuss

the problem before continuing. There

are some situations where it is appropriate to answer NO, make corrections, and

try again. There are other situations

where you must continue, even with the errors.

If the error is a duplicate

invoice number due to an incorrect starting invoice number, you should cancel

the post, delete the invoice print file, and start the invoice option

again. If the problem is with a general

ledger account number, you should cancel the post, delete the invoice print

file, correct the account number problem and start the invoice option

again. If the error is with a timecard,

you cannot do anything to the timecard once paychecks have been posted. Call SkilMatch for assistance.

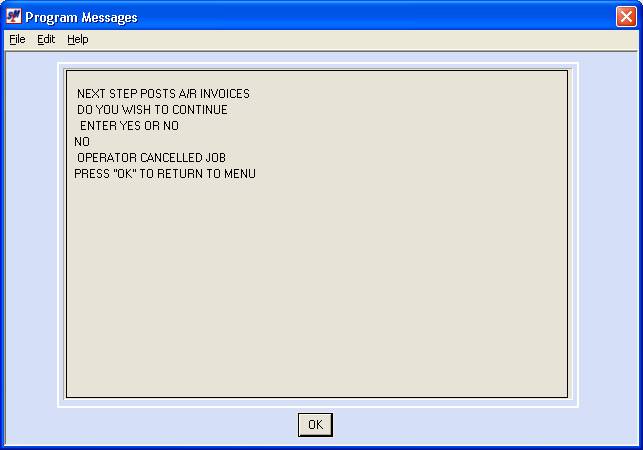

If you need to cancel the post,

key NO and press (enter), and the

screen will confirm the cancel.

Click [OK] to confirm that you know the job is

cancelled. You will be returned to the

“Payroll Processing” menu.

After you have approved

the edit report and have looked through the invoice print file, you are ready to

post. Many customers prefer to print

the actual invoices before posting. As

long as you have approved the edit and reviewed the invoices, you may post

before doing the actual printing.

If you wish to print your invoices before posting, you will

temporarily leave the screen as is without responding, and will go to another

document for instructions on printing.

For assistance with printing invoices not using CAC, click How To

Print.

For

assistance printing CAC, click INV.

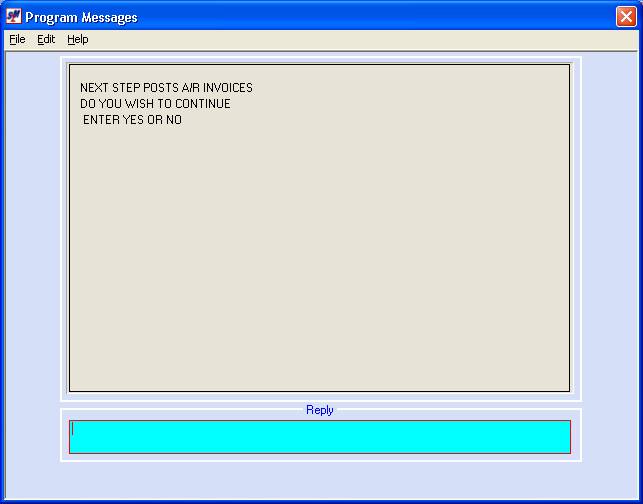

Once you are ready to

post the invoices to Accounts Receivable and General Ledger, key YES and click [OK].

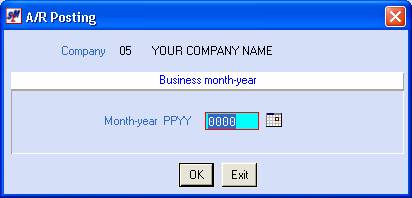

Posting Invoices to A/R

and G/L

This step not only posts the

invoices to A/R, and the sales and A/R amount to the general ledger, but if you

have the Invoice Reprint option, the invoices get added to the Reprint file at

this time.

The

fiscal period may be keyed (without punctuation) or may be selected by clicking

the ![]() button (prompt and select button) to the

right of dates throughout SkilMatch2. The

button (prompt and select button) to the

right of dates throughout SkilMatch2. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to select the date. If your accounting

department has set up valid posting periods for Invoices, then the date you key

must match a valid period/year or you will receive an error.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to select the date. If your accounting

department has set up valid posting periods for Invoices, then the date you key

must match a valid period/year or you will receive an error.

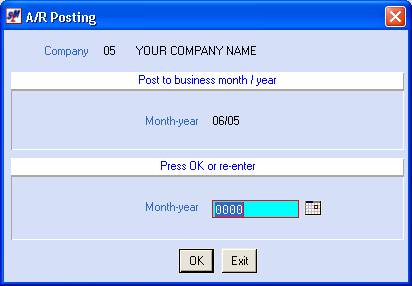

The screen will display:

If the date displayed in the top

portion of the screen is correct, click [OK].

Do not re-key the date unless it is wrong.

(Each time you re-key the date,

the date will re-display for verification.)

You will be returned to the

“PayBill Payroll Processing” menu.

You will receive one or two

reports as the result of posting. The

system will produce the Accounts Receivable Invoice Register (AR130), and if

the Invoice Reprint option is active, a report named INVSAV.

(You do not need to keep the

Invoice edit.)

If you delayed the actual

printing of invoices until after you finished the posting step, you should

print your invoices now. Delaying

the printing could result in someone accidentally deleting your print file!

For assistance with printing invoices not using CAC, click How To

Print.

For

assistance printing CAC invoices to a laser printer, click INV.

Reprinting

An Original Invoice:

There are 2 possible ways to

reprint an original invoice.

(1) If you print invoices to a

laser printer using CAC, you may be able to reprint an invoice using the CAC PC

laser printer program.

(2) If

you do NOT print invoices using CAC, or if the invoice no longer exists in CAC,

and IF your system utilizes the REPRINTINV file, you may

reprint an invoice by keying INVRP on a command line.

If the

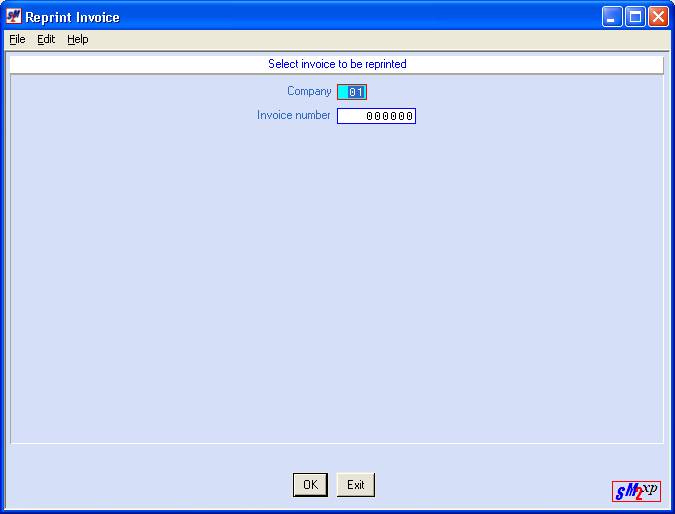

file exists on your system and if you key INVRP on a command line and click [OK], the screen will display:

Company Number:

Defaults

to company 01. To reprint an invoice

for a different company number, key the desired company number.

Invoice Number:

Key the

number of the invoice you wish to reprint.

(If you have multiple invoices to print, you must process them one at a

time.)

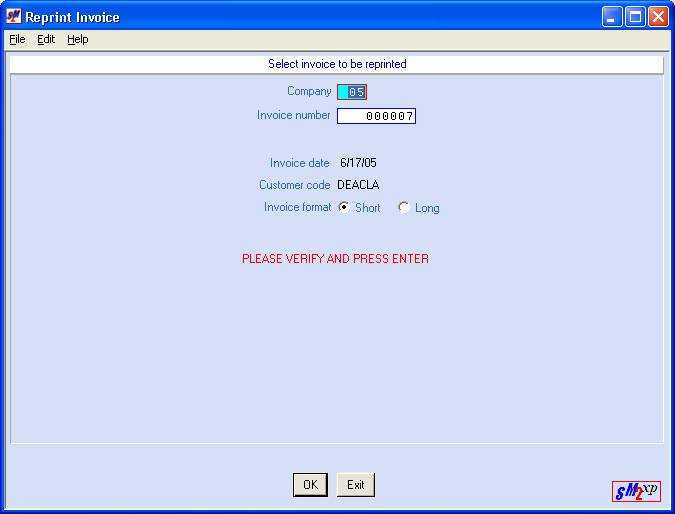

The system will display the

customer code, invoice date, and invoice format so that you can verify that

this is correct invoice number. If

correct, click [OK]. If incorrect, click [Exit]. From this point forward, use your standard

procedure for printing the actual invoice.