CALCULATIONS

This option calculates taxes, deductions, net pay, and invoice amounts for all timesheets in the merged file for a specified company. You may select this option as many times as necessary prior to the printing of checks without causing problems.

You MUST process this option before you can print the Preliminary reports or the Gross Profit report that prints from the merged file. There are 7 reports produced by this option. Each report will print with a message that no records were found with the potential problems, or will list the employees and their timesheet key number that is or may be a problem. There are several problems that will cause this program to terminate, and you will not be allowed to continue without making corrections. Please review each report carefully before processing with any other menu option.

NEW 2013 - For years prior to 2013, every Medicare gross dollar earned by an employee required Medicare tax to be withheld at the rate of 1.45% with a matching 1.45% paid by the employer. The Affordable Care Act establishes a NEW “Additional Medicare Tax” of .9% employee only tax on Medicare gross earnings on wages exceeding $200,000.00 starting 1-1-13. SkilMatch is utilizing a user-designated Deduction Code to withhold the additional Medicare tax and automatically adding the calculated "deduction" to a timesheet in the "one-time deduction" area during this tax "Calculations" process. This new programming will monitor the employee wages and will be activated when a $200,000 Medicare wage limit is reached. When an employee does reach the $200,000 wage limit, you will then be prompted and required to setup (if you have not already done so) and review employee calculations/withholding going forward. Full “Additional Medicare Tax” setup can be found on this link, Additional Medicare Tax. The additional screens have been documented below and can be reviewed for full details. This process will create new detail on report PB420/PB420S, see details below. NOTE: The "Calculations" program looks at the check date keyed during the payroll "Begin Cycle" step (and changeable in the Payroll Constant File) to determine on/off activation of this process, check dates before 2013 will not activate processing.

PB405

– Duplicate Voids – If two or more voids are found for the same

check number, then the process will terminate. You will not be able to continue with the

payroll process.

Review this report for the key numbers of the duplicates. You will need to delete the duplicate from

the merged file before you can continue.

PB420S

– FIT, SS & Medicare Taxes Calculated – the system will

check each employee’s file to see whether or not they are exempt from FIT,

Social Security, and Medicare. If they

are exempt, then the system checks the employee’s YTD tax dollar areas to make

certain the amount is zero for the exempt areas. If it is not zero, then the system will return the tax dollars

back to the employee. If the amount to

be returned for any one of these 3 tax areas exceeds $999.99, then the

remaining taxes will be returned the next time the employee is paid. FYI – the taxes are only returned on current

week-ending timecards. This report will

list any employee who is receiving repayment of taxes on a paycheck.

If

any employee prints on this report, you should call SkilMatch. We will need to make a manual adjustment to

the employee’s internal earnings file. This will not terminate the payroll process.

PB425S - Local & State Taxes Calculated – an employee will appear on this report if they have local or state taxes calculated for this payroll but have NOT had local or state tax withholding data entered in the personnel file. If you have an employee print on this report you have two options: do nothing and the system will process these employees' state and/or local taxes according to their federal tax exemptions (example: if federal taxes are set up as married with 1 dependent, state and local taxes will be calculated as married with 1 dependent), OR set up employee state and local tax master records (refer to online documentation Menu PBMANT, Item Employee State, Local, SDI). Once you have created the state and/or local tax records for these employees, re-calculate taxes by processing this option again. This time the report should be blank; there should be no employee names listed. This will not terminate the payroll process.

PB426RP

– Garnishments not fully deducted – if an employee

was scheduled to have an automatic deduction of a garnishment withheld from a

paycheck, but the system was not able to deduct the full amount, then the

employee will print on the report. The

report includes the employee’s name, social security number, deduction code,

deduction priority, week-ending worked date, requested deduction amount, deduction limit amount, the deduction amount being withheld, and the reason(s) why.

The reasons include:

1. Deduction Reduced: The net pay was going to be less than the

allowed minimum check amount

2.

Deduction Reduced: Multiple garnishments so the maximum percentage of

net or gross applied

3.

Deduction Reduced: There was not enough

money available for the deduction

4.

Deduction Reduced: The garnishments for

this priority were greater than the maximum percent of net or gross allowed

5.

Deduction Reduced: The maximum deduction dollars to withhold was

reached

6.

Deduction Increased: The minimum

percent of net or gross was applied

This

will not terminate the payroll process.

Locate the “Reasons” column on the far right of the report

and review deduction based on the reason provided.

NEW 2012 Enhancements has updated the current Garnishment report to include additional detail. Newly added descriptions are shown in bold above.

PB426RP1 NEW 2012

Enhancements - Non-Garnishment

Deduction Modifications - if an employee was

scheduled to have an automatic deduction (non-garnishment) withheld from a

paycheck, but the system was not able to deduct the full amount, then the

employee will print on this report. The

report includes the employee’s name, social security number, deduction code,

week-ending worked date, original deduction amount, calculated amount being

withheld, and the reason(s) why.

The reasons include: 1.

Deduction Reduced: Maximum percentage

of Net or Gross Taken

2.

Deduction Increased: Minimum percent of

Net Gross Applied

3.

Deduction Reduced: Maximum deduction

dollars to withhold was reached

4.

Deduction Reduced: Employee YTD Gross

pay exceeds maximum 401K gross Wages

This will not terminate the payroll process. Locate the “Reasons” column on the far right of the report and review deduction based on the reason provided.

PB435 - Negative Net Pay Calculated for These Timesheets - a message should appear on this report that reads "No Negative Pay Calculated" and "No Gross $ Exceed $12,000.00”. If employees are located who have negative net pay, or whose gross exceeds $12,000, then the payroll process will terminate.

PB516P – Employees with Previously Issued Checks for Same Week-ending worked – if an employee was paid for the same week-ending in a previous payroll, then the person will be listed on this report. This could be important if deductions were already withheld from the previous check and should not be withheld again. This report will print in the same sequence as the Payroll Journal (either alphabetical, or by SS#). This will not terminate the payroll process.

PB438 – Direct Deposits

Allocated – The system will print a list of all employee direct deposit

checks. It will look for possible

problems by comparing the timecards in the merged file that have an *D hold

code against the employee files to make certain that: a) employee DD status is

still active, b) the DD active date in the employee file is equal to or prior

to the timecard’s week-ending date. The

system will also verify that all timecards for an active DD employee are marked

with the *D hold code. If the system

finds any irregularities, they will print on the report with an error

message. It is not too late to make a

change to the hold code in the merged file, or to change the active date on the

employee’s DD screen. Until corrections

are made, this will terminate the payroll process.

PB420

– FIT, SS, and Medicare Taxes Calculated -

Beginning with all payroll checks dated in 2013, the system will now review the

Medicare Wage dollars. The first

indication that an employee has exceeded the $200,000 wage limit is a terminal

error message received during payroll check processing. You may receive 1 or more of these terminal

error messages depending on the steps required to setup and process the New

Additional Medicare tax withholding.

Beginning with all payroll checks dated in 2013, the

system will now review the Medicare Wage dollars. The first indication that an employee has exceeded the $200,000

wage limit is a terminal error message received during payroll check

processing. You may receive 1 or more

of these terminal error messages depending on the steps required to setup and

process the New Additional Medicare tax withholding.

New programming installed

with 2012 updates will monitor employee YTD earnings and NOTIFY customers when

an employee has reached the income threshold amount of $200,000. During tax calculations, if an employee

exceeds the $200,000 threshold, the system will generate a TERMINAL ERROR

MESSAGE and the NEW REPORTS, PB420 and PB420S.

These reports NEED to be reviewed and instructions followed for SETUP

and MAINTENANCE of the Medicare Additional Tax. The reports provide a list of individuals that require

additional withholding and the

instructions for setup.

The following is a list of the different scenarios described in this documentation:

Additional Medicare Tax

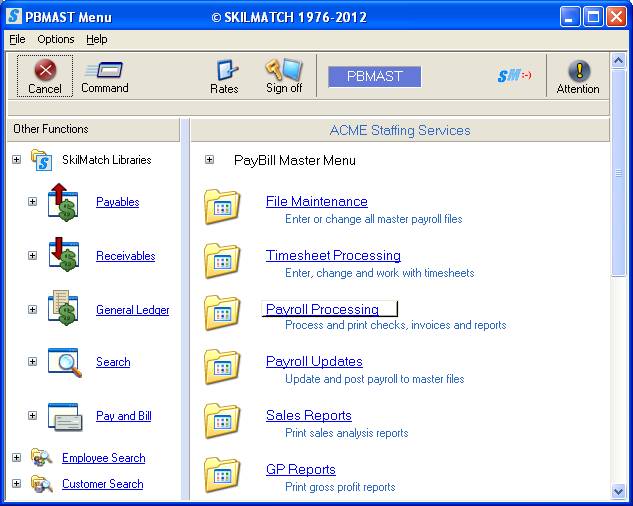

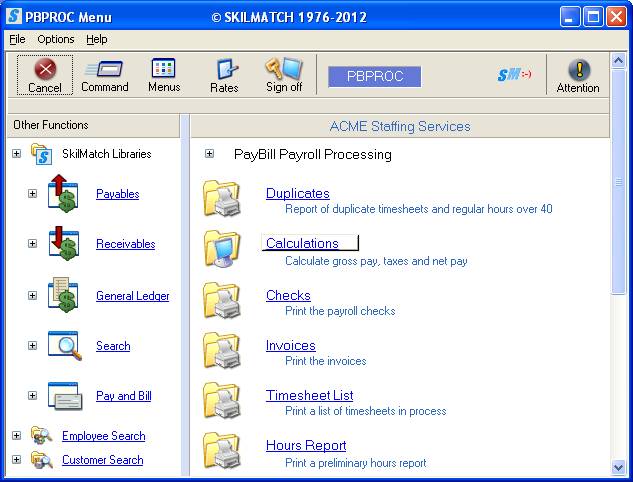

To begin, select the [Payroll Processing] menu in the Pay and Bill library.

The screen will display:

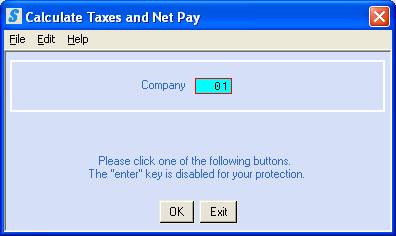

Click [Calculations], the screen will display:

Company Number:

Defaults to company 01. To calculate taxes for a different company, key the desired

company number.

To continue, click [OK].

OR

To cancel and return to main menu, click [Exit].

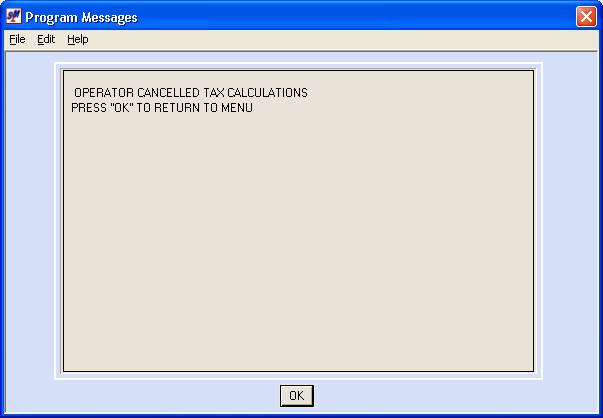

If you cancel tax calculations, the screen will display:

Click [OK] to cancel, you will be returned to the Payroll Processing menu.

If you chose to proceed on the prior “select company number” screen, the net pays will be monitored for negative amounts and gross pays will be monitored for gross exceeding $12,000.00, direct deposits will be validated, and the system will check for duplicate voids.

If there are no critical problems, you will be returned to the “PayBill Library Payroll Processing” menu.

Even though the system may not locate any critical errors, the 7 reports described above should be inspected very carefully for additional problems.

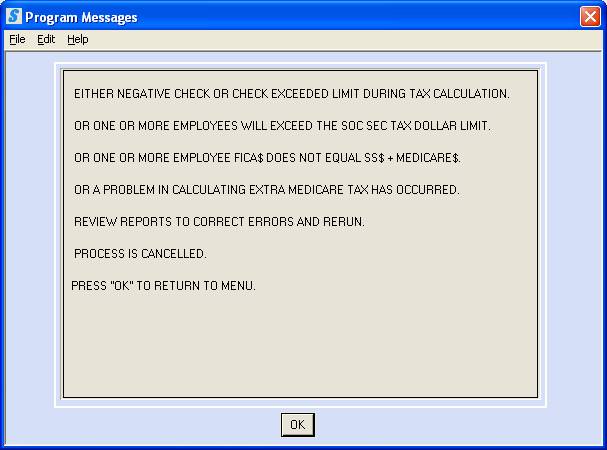

Possible Messages when running tax calculations:

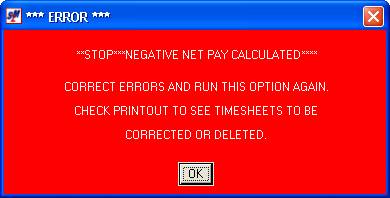

If negative net pay is detected, the screen will display:

Click [OK] to continue.

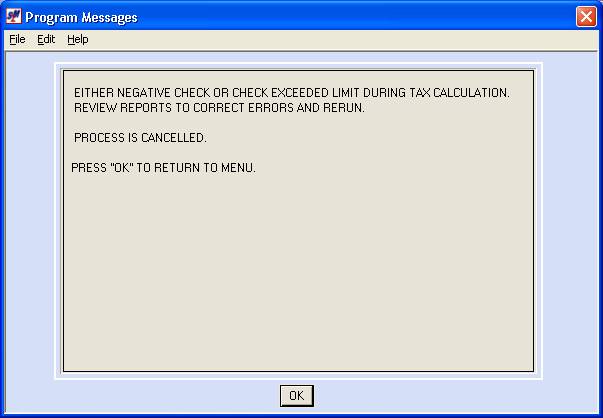

Click [OK] to continue. You will be returned to the Payroll Processing menu.

Once you are back to menu, a report titled "Negative Net Pay Calculated for these Timesheets" (PB435) will be produced. Use this report to find out which timesheet needs correction.

The negative net pay is usually due to one of these reasons:

(1) Advance was written for too much - you overpaid them.

(2) Deductions are too high for the amount the person earned on this timesheet.

(3) The employee has "extra" tax being withheld and not enough net pay to cover it.

If the problem is #2 or #3, then you may be able to make adjustments to the employee's tax file (refer to online documentation Menu PBMANT, Item Employees) or deduction file (refer to online documentation Menu PBMANT, Item Employee Deductions) and then re-calculate taxes by processing this option again.

OR

If the problem is #1, then you must delete the timesheet from the merged file (refer to online documentation Menu PBPROC, Item Change in Merged), re-enter the timesheet with a lower advance amount (refer to online documentation Menu PBENTR, Item Timesheets), select that batch for merging (refer to online documentation Menu PBENTR, Item Select Batches), and then re-calculate taxes by processing this option again. (You have several options for getting the rest of the advance amount back - like taking remainder from their next check or just taking the loss.)

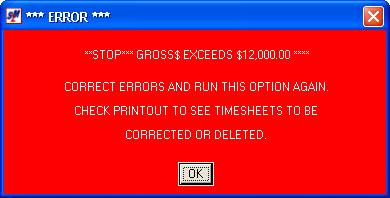

If gross pay exceeding $12,000.00 is detected, the screen will display:

Click [OK] to continue.

Click [OK] to continue. You will be returned to the Payroll Processing menu.

Once you are back to menu, a report titled "Negative Net Pay Calculated for these Timesheets" (PB435) will be produced. Use this report to find out which timesheet needs correction.

You must delete the timesheet from the merged file (refer to online documentation Menu PBPROC, Item Change in Merged), a report titled "Negative Net Pay Calculated for these Timesheets" (PB435) will be produced. Use this report to find out which timesheet needs correction.

You must delete the timesheet from the merged file (refer to online documentation Menu PBPROC, Item Change in Merged), and re-enter as two or more timesheets, splitting the hours or dollars between timesheets to avoid having any one timesheet with gross exceeding $12,000.00 (refer to online documentation Menu PBENTR, Item Timesheets), select that batch for merging (refer to online documentation Menu PBENTR, Item Select Batches), and then re-calculate taxes by processing this option again.

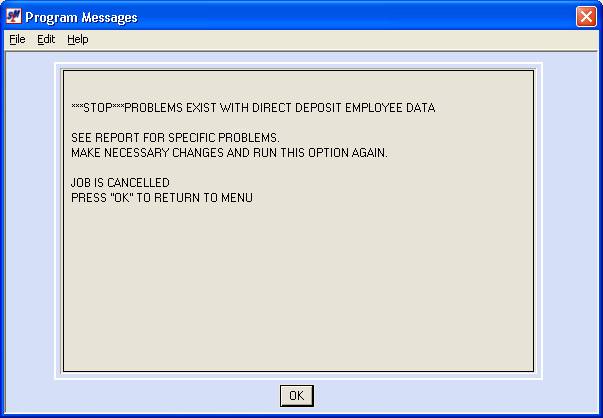

Problems with Direct Deposits:

If the system finds a problem with the direct deposits, the screen will display:

Click [OK] to continue. You will be returned to the Payroll Processing menu.

Once you are back to menu, a report titled "Allocated Direct Deposits" (PB438) will be produced. Use this report to find out which timesheet needs correction. The problem will be identified with an error message. You must either make a change to the hold code on the timecard, or make a correction to the employee’s direct deposit data.

If the system finds that a check has been marked to be voided more than once, the screen will display:

Click [OK] to continue. You will be returned to the “PayBill Payroll Processing” menu.

Once you are back to menu, a report titled "Duplicate Voids" (PB405) will be added to your outqueue. Use this report to find out which timesheets are involved.

You must delete all but one of the timesheets associated with this check from the merged file (refer to online documentation Menu PBPROC, Item Change in Merged). Once the duplicate timecards have been deleted, attempt this option again.

Additional Medicare Tax

needs withheld:

Beginning with all payroll checks dated in 2013, the

system will now review the Medicare Wage dollars.

SUMMARY: The system generates a terminal error message and report based on 3 Situations (described below individually):

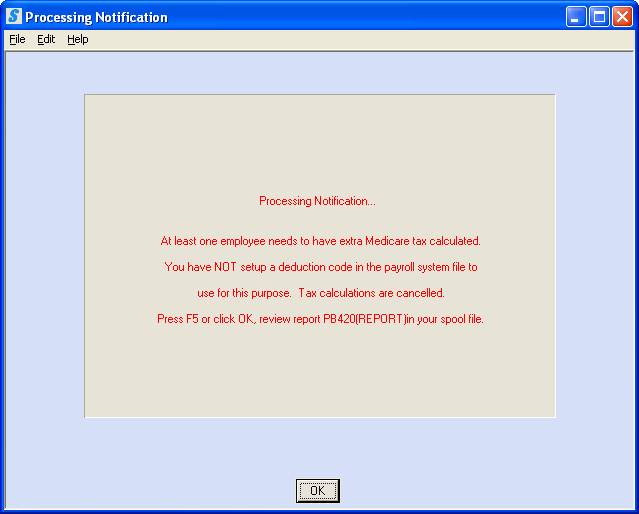

1.

You have NOT setup a

Deduction Code for Additional Medicare Tax withholdings.

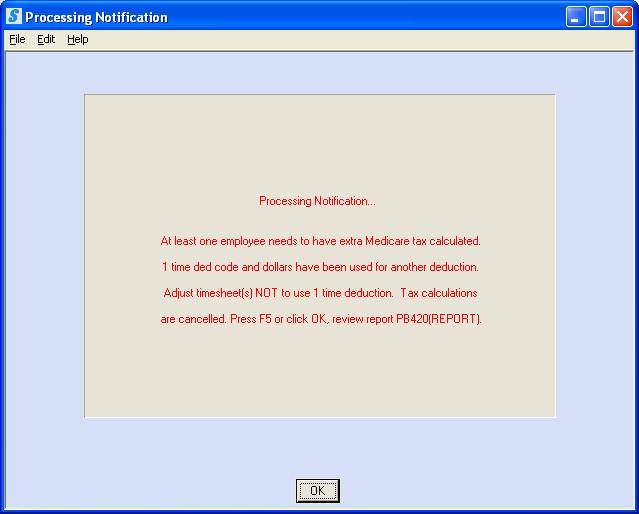

2.

A timesheet requiring

Additional Medicare Tax does not have the “one time deduction field available

for use.

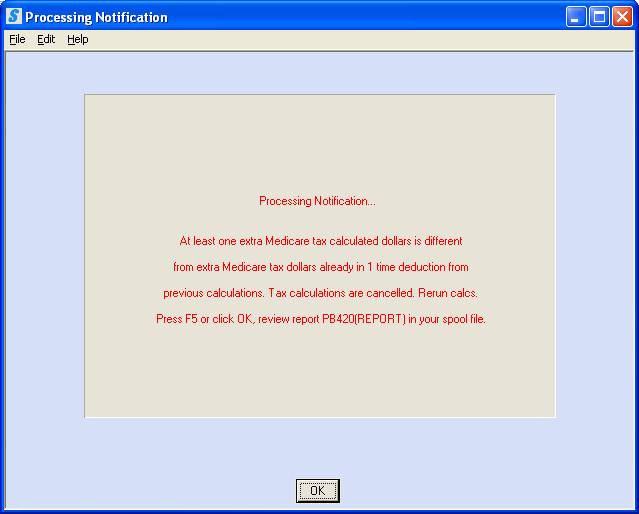

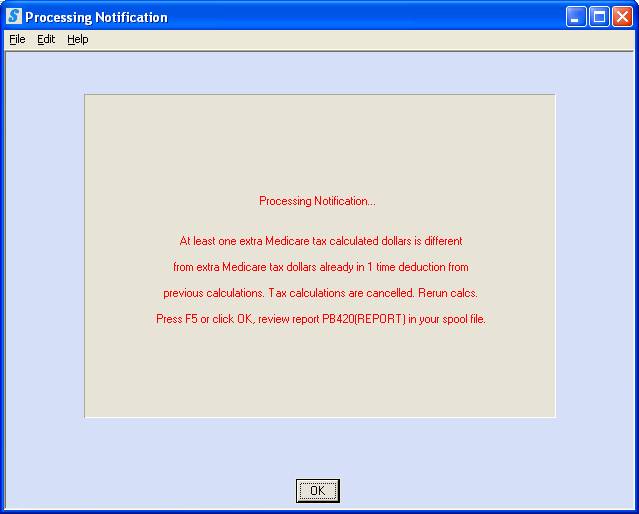

3.

Calculations for

Additional Medicare Tax (for at least one employee) are different from the previous

payroll tax calculations.

The first indication that an employee has exceeded

the $200,000 wage limit is a terminal error message received during payroll

check processing. You may receive 1 or

more of these terminal error messages depending on the steps required to setup

and process the New Additional Medicare tax withholding.

If you receive the following message, you will need

to Create an “Additional

Medicare tax” Deduction Code and Setup

in the Payroll System Requirements file (SETUP 1 and SETUP

2, instructions shown below).

AND/OR

If the employee who is having Additional Medicare

withheld for their paycheck, has a “ONE TIME” deduction being withheld on their

timesheet, you will need to make adjustments on the employee timesheet (Adjustment

needed, instructions shown below) if you may receive the following message:

AND/OR

The system has identified an employee that needs

additional tax withheld (and setup is complete), but you will need to RERUN

the “Checks” option to verify Additional Medicare withholdings (Reprocess

“Checks”, instructions shown below), if you may receive the following

message:

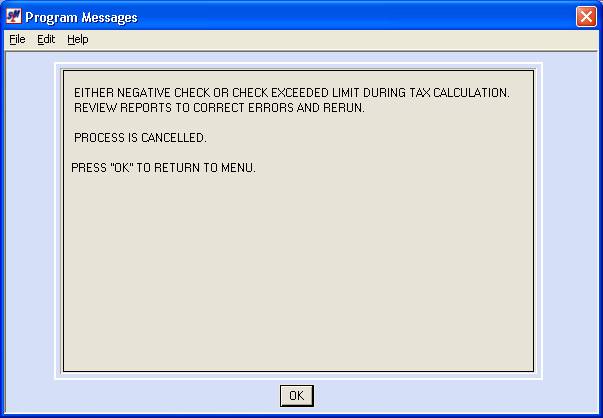

AND in addition you will receive the following terminal

error message as a summary, which will “confirm that the ‘checks’ process is

cancelled”.

The system will create report PB420/PB420S and it

will be available in your spool file for review and assistance. You will need to make the adjustments

described in the report; the payroll process CANNOT proceed unless you follow the directions

indicated.

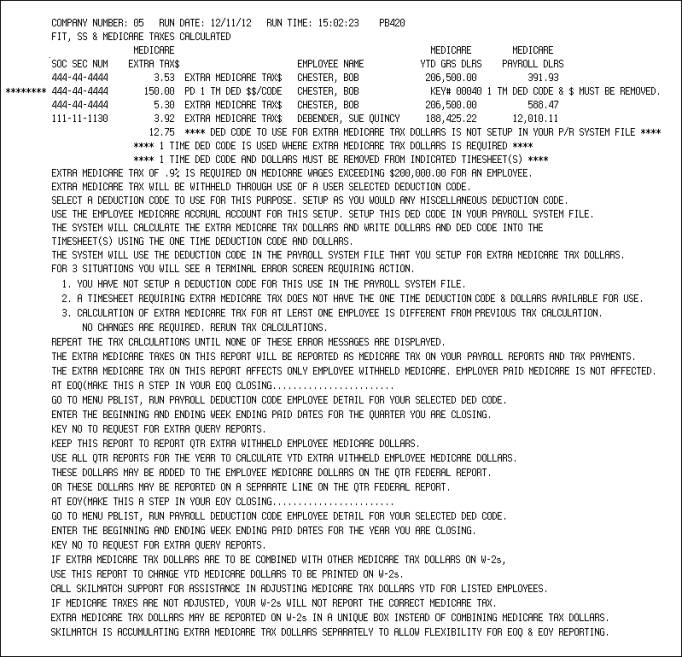

REVIEW the report for details (sample below):

This report provides a detailed description of the

employees that have Medicare wages that exceeded the $200,000 threshold AND the

steps needed to process the “Additional Medicare Tax”.

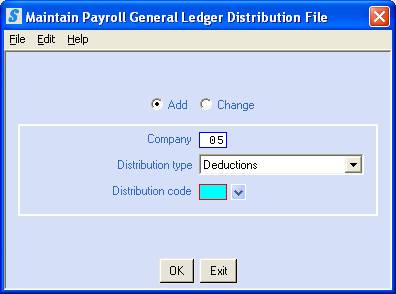

SETUP 1: Setup PR GL Deduction Code for Additional

Medicare Tax

The

system needs a deduction code setup to deduct and track the Additional Medicare

Dollars. This will be a one-time setup

in the Payroll GL Distribution File,

accessed in the Pay and Bill library, File Maintenance menu, option Payroll GL

Distribution File. Your company can

determine the deduction code, review current codes and create a new deduction

code (refer to online documentation Menu PBMANT,

Payroll G/L Distributions).

Add/Change: Add a new Deduction code for the “Additional Medicare Tax”

Company:

Key the

desired company number.

Distribution Type:

Select a distribution type “Deductions” by clicking the ![]() button

(prompt and select button) to the right of the distribution type.

button

(prompt and select button) to the right of the distribution type.

Distribution Code: Design your own 2-character code for all other deduction types.

If you are setting up in both temp payroll and staff payroll,

we recommend (but not required) you assign the same code in both places.

To continue, click [OK], the screen will display:

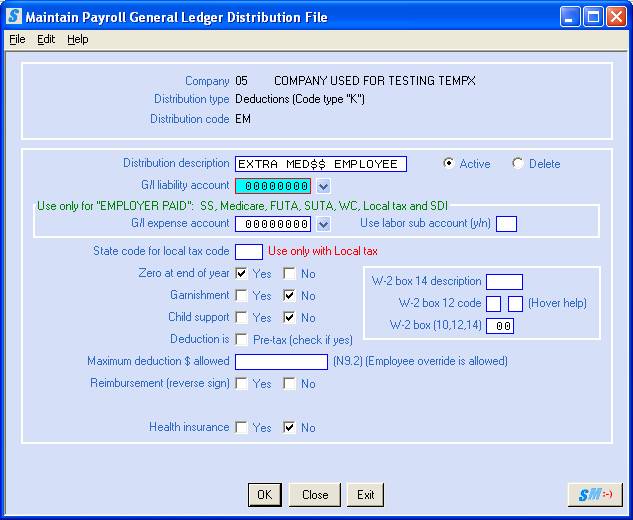

Distribution Description:

15-character deduction description

Active/Delete:

Defaults to active, leave marked “Active”.

G/L Liability Account:

Key the 8-digit general ledger EMPLOYEE MEDICARE accrual

account number. It is important to use

the same EMPLOYEE Medicare GL accrual account number so that

Additional dollars are posted with the Employee Medicare dollars.

G/L Expense Account:

Leave blank, no expense for the employer.

Zero At End Of Year:

Select “Yes” for this Additional Medicare Tax setup.

Garnishment:

Select “No” for this Additional Medicare Tax setup.

Child Support: Select “No” for this Additional Medicare Tax setup.

DO NOT check “Deduction is

Pre-Tax”- Medicare

is NOT pre-taxed. Make very certain you make the correct

response to this area.

Maximum deduction $ allowed:

There is no Maximum for this Medicare Additional tax setup, key the

amount $9,999,999.99,

W-2 Box 14 Description:

Leave Blank, no Federal Requirements have been established for EOY

reporting.

W-2 Box 12 Code:

Leave Blank, no Federal Requirements have been established for EOY

reporting.

W-2 Box (10,12,14):

Leave Blank, no Federal Requirements have been established for EOY

reporting.

Reimbursement? (Reverse Sign): Do Not Select Yes or No.

Health Insurance: Select “No” for this Additional Medicare tax setup.

Review setup

and click [OK] button when

complete.

NOTE: As

needed, REPEAT this setup for EACH company number and STAFF payroll if

required.

NOTE: The IRS created a revised 941 Form in 2013

to report this new Additional Medicare tax withholding.

SETUP 2: Setup

Payroll System Requirements File with Deduction Code

Go to Pay and Bill library, File Maintenance menu, option Payroll System Requirement File.

(Refer to online documentation for

complete instruction on Employee Deductions setup.)

Key desired company number press click [OK].

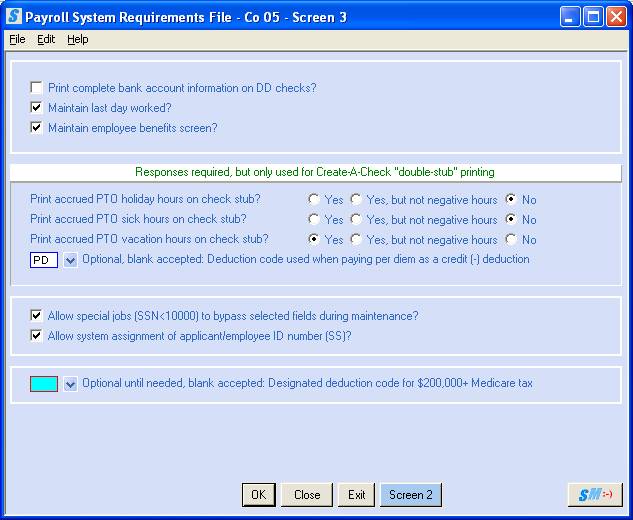

Proceed to the 3rd page (shown below) to

add the New Deduction code created in STEP 1.

The

last field requests:

“Optional until needed, blank accepted:

Designated deduction code for $200,000+ Medicare tax.”

Key the new deduction code created in SETUP 1 for the Additional Medicare tax withholding, or select code by

clicking the ![]() button

(prompt and select button).

button

(prompt and select button).

When deduction code has been entered, click [OK] to save changes and return

to main menu.

NOTE: As needed, REPEAT this setup for EACH company number and STAFF payroll if required.

ADJUSTMENT:

Timesheet “Check Adjustment, Deduction $” on PB420/PB420S Report

(Report example ***** $150/Chester, Bob

Key 40)

ADJUSTMENT

ONLY NEEDED IF INDICATED ON REPORT: The new programming for Additional Medicare

tax requires the use of the “Check Adjustment,

Deduction $” field on the timesheet during payroll.

The report PB420/PB420S will flag any timesheet that ALREADY includes a manual deduction entered into this field. See example above for Bob Chester, ***** marks the timesheet and details indicate, deduction amount $150.00, deduction code “PD”, and timesheet key record number40. The following must be adjusted to continue:

1) This deduction can no longer be entered on the

timesheet. A deduction must be setup

in File Maintenance menu, item Employee Deduction. If this is

a one time deduction, SkilMatch recommends the Employee Deduction file is setup

with

the full amount of the deduction entered in both the “Deduction $ Amount” and

the “Maximum Deduction $ Allowed” fields.

2) The timesheet (in example above, Key Record 40)

will need to be “deleted” from the merge file and a new timesheet will need to

be created to replace the original timesheet.

The new timesheet will need to be merged.

3) Calculate taxes and review preliminary payroll

journal to verify this one-time deduction was withheld accurately.

If Setup 1 and 2 are complete, you are ready to

process the “Checks” option again.

Re-running the “Checks” option will:

1)

Check that setup for

SETUP 1, SETUP 2, and Time Sheet ‘Check Adjustment” are complete

2)

Review and Compare the

Additional Medicare tax withholding

Reselect this Checks option.

Key desired company number press click [OK].

The program will review

setup, calculate taxes and compare the Additional Medicare tax withholding (see

NOTE below). You MAY or MAY NOT receive

a “Terminal Error Message” that will require user to once again REVIEW messages

and PB420/PB420S report.

NOTE: The first time the program runs during check calculations, it inputs the Additional Medicare tax amount into the one-time deduction field in the time file. To verify accuracy, the second time the program runs, it must “see” the same Additional Medicare tax amount as the “previous” calculation. The program requires you to REPEAT the “Checks” option, until it “sees” the same calculation in the deduction file as it did previously. Even when you have only one employee with the Additional Medicare tax you will still need to run this option twice.

RERUN the “Check” option and review reports until this terminal error message is NO

LONGER displayed and the check process is allowed to proceed. Contact SkilMatch if you are unable to

proceed after ALL setup has been completed.

NOTE: For EVERY 2013 payroll in the following weeks, you will be

required to review reports and RE-RUN the “Checks” option to process the

Additional Medicare tax.