FIT, STATE, LOCAL TAX TABLES

Legal Disclaimer and Customer Responsibilities for tax tables and tax related issues.

The federal, state and local tax tables are used during the payroll processing procedure.

Please refer to the taxing authority’s current tax booklet before beginning for the specifics of how the tax is calculated. You will need the annual table or a computerized method of calculation. Daily, weekly, etc., tables are not useful in creating or updating a tax table. You can obtain most state information via a website. Local taxes are generally (but not always) fairly simple and may not be available in “booklet” form - the locality may just have a single sheet that can be sent to you.

Also, locate in the tax booklet whether or not to use a Standard deduction, Personal exemptions, or tax credits. Also look to see whether any other tax payments (like federal income tax or FICA) will affect the tax calculation.

Please note that the SkilMatch tax tables are annualized. This means the system will take the employee’s taxable gross earnings, multiply the total by the number of pay periods in the pay cycle selected for the employee (weekly, bi-weekly, semi-monthly, etc), calculate the annual tax, then divide the tax by the number of pay periods to arrive at the tax for a single check.

Example: Gross earnings of $125. Subtract $25 for a 401K deduction that is exempt from FIT. Taxable gross would be $100.

If the pay cycle is weekly, then the annual gross is $100 x 52 = $5,200. If the tax is $20, it is divided by 52 = .38 cents.

NOTE: Tax table adds and changes are effective

for the company number entered. You will need to repeat the setup for ALL

company numbers for which you are calculating payroll taxes.

NOTE: Tax table adds and changes are effective for both temporary and staff payroll files, within a company number.

The employee file contains the federal marital status and number of exemptions, which coordinate with Table 1 under the “Personal Exemption Dollars”.

NEW

January 2020: SkilMatch programming installed to enable NEW 2020 W4 compliance, allowing employees to calculate more accurate

withholdings. The NEW 2020 W4 requires NEW

Federal tax setup options starting January 1, 2020. Review IRS website for full details: https://www.irs.gov/forms-pubs/about-form-w-4

The new laws have created the following changes for FIT, STATE, LOCAL Tax tables file:

1)

2020 Federal tax table 01 (FIT-Standard) includes a NEW “Head

of household” table. SkilMatch will post

all tax tables online when available by IRS.

2)

2020 Federal tax table 01 requires the standard deduction

for calculating employee’s tax. NOTE: 2020 Federal tax table 02 does

not include a standard deduction.

3)

NEW Federal tax table 02 (FIT-W4 Step 2, Checkbox) for Married, Single

and Head of household. The system will

use these new tax tables during calculations for employees that “check” Step 2

box on 2020 W4.

2020 Federal 01 and 02 tax tables are available online now.

NOTE:

PRELIMINARY

step REQUIRED before Federal 02 tax

tables can be setup. New PR GL Distribution code needs setup for

Federal 02-FIT-W4 STEP2 CHKBOX,

through Menu File Maintenance, Item PR GL Distributions.

NOTE:

2020 Federal tax tables 01 and 02 need to be setup AFTER your LAST 2019

(current year) Payroll and BEFORE

your FIRST 2020 (new year) payroll.

NOTE ON HOW EMPLOYEE FILE and STATE/LOCAL TAX TABLES TIE TOGETHER:

The following information is regarding the employee file (Pay and Bill, File Maintenance, Employees, Tax Screen on Employee entry):

The employee file has fields to enter a “Primary” State and a “Primary” Locality file for an employee.

Primary State and Primary

Locality offer the ![]() button (prompt and select) option during both

of these entries.

button (prompt and select) option during both

of these entries.

All changes should be

made using the ![]() button (prompt and select) option. This gives you the opportunity to see the

taxes an employee already has setup in their file and allows immediate access

to add or make changes to all tax fields.

button (prompt and select) option. This gives you the opportunity to see the

taxes an employee already has setup in their file and allows immediate access

to add or make changes to all tax fields.

(Please refer to document Menu PBMANT, Item Employees for details and print screens.)

The following explains how this employee files relates the tables that you are currently setting up in the State and Local files below:

Primary State/Locality (State Code/Local Tax Code)

Status (Married, Single, Head of Household and Exempt)

Exemptions 1 - uses the Personal Exemption Dollars Table 1

Exemptions 2 - uses the Personal Exemption Dollars Table 2

Exemptions 3 - uses the Personal Exemption Dollars Table 3

Credits 1 - uses the Tax Credit Dollars Table 1

Credits 2 - uses the Tax Credit Dollars Table 2

Credits 3 - uses the Tax Credit Dollars Table 3

If you enter Exemptions do not duplicate into Tax Credit fields. States rarely use both exemptions and tax credits and the program is designed to automatically duplicate information from Exemptions field into the Tax Credit field. You can manually override the tax credits if you enter a tax credit amount different from the exemption amount.

The following fields cannot be

accessed from the employee file and need to be updated in the Menu

PBMANT, Item Employee State, Local, and SDI Tax File; Standard

Deduction Limit 2 (Minimum and Maximum), Gross Minimum Limits 2, and FIT

Maximum Limits 2.

NOTE: These tax fields are seldom used; contact SkilMatch support if you feel they are required for your tax setup.

As of December 2019, the following states have no personal income tax:

Alaska

Florida

Nevada

New Hampshire

South Dakota

Tennessee

Texas

Washington

Wyoming

As of December 2019, the following states have custom programs that need to be installed on your system when changes are made to the state tax tables:

Alabama

Arizona

Connecticut

Georgia

Louisiana

Oregon

Utah

SkilMatch strongly

suggests that if you set up your own tax table, process a test payroll

including employees with both married and single tax status and compare to the

source document (tax booklet) prior to processing a live payroll!

In addition, this document is designed to assist in

the translation of a tax booklet to the SkilMatch tax table programs! Because of the variations in federal, state

and local taxes, you must depend on the taxing authorities’ current booklet for

the individual specifications. The tax

booklet must be scrutinized very carefully for exact setup detail.

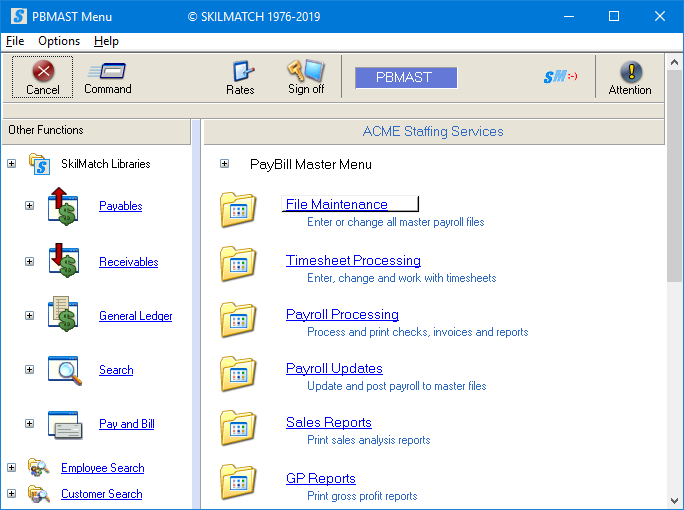

To begin, select the [File Maintenance] menu in the Pay and Bill library.

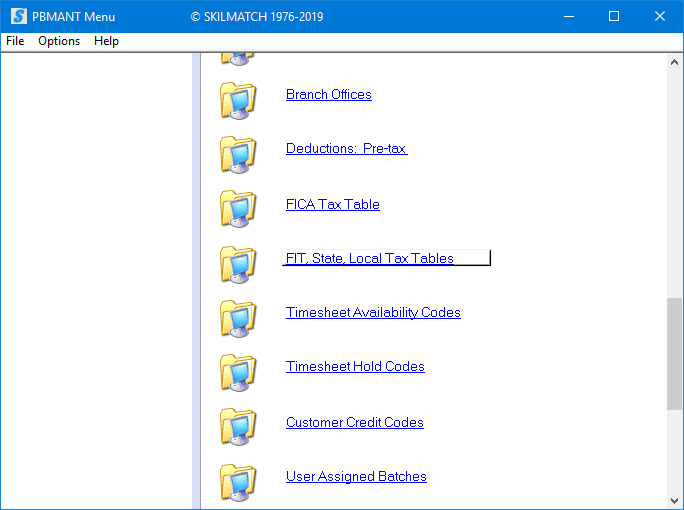

Next, scroll down or right click and select [FIT, State, Local Tax Tables].

The screen will display:

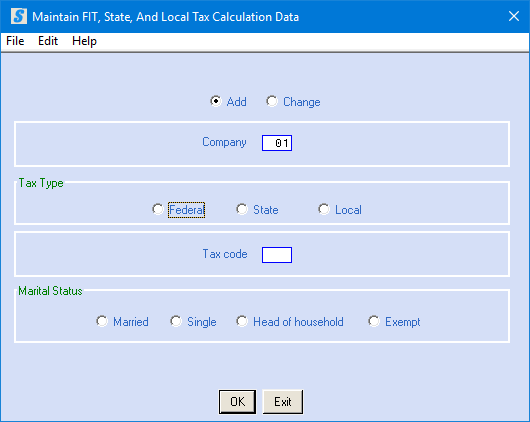

Add or Change:

Defaults to add. If you wish to change a tax table file already set up, click once on change to select (a black dot will appear next to your selection).

Company Code:

Defaults to company 01. If you wish to work with a tax table file for

a different company, key the desired company number.

Tax Type:

Select the desired tax type code by clicking once on the desired option to select (a black dot will appear next to your selection).

Select from federal, state, or local.

Tax Code:

Key the two-digit tax code.

For federal, the code for Federal FIT-STANDARD table is 01 and the code for Federal FIT-W4 STEP2 CHKBOX table is 02.

For state, the code is usually the state postal code. (i.e. TX = Texas)

For local taxes, the code is custom designed by each customer.

Each code (federal 01, state postal code or local custom design) must have been previously set up through Menu PBMANT, Item Payroll G/L Distributions before a tax table can be entered.

Marital Status:

Select the desired marital status by clicking once on the desired option to select (a black dot will appear next to your selection). Select from married, single, head of household, or exempt. Most states (CT being one of the exceptions) will have a married, single and exempt status, but only a few will have head of household.

NOTE: New in 2020, the Federal tax tables include filing status Head of household.

To continue, click [OK].

OR

To cancel and return to main menu without saving changes, click [Exit].

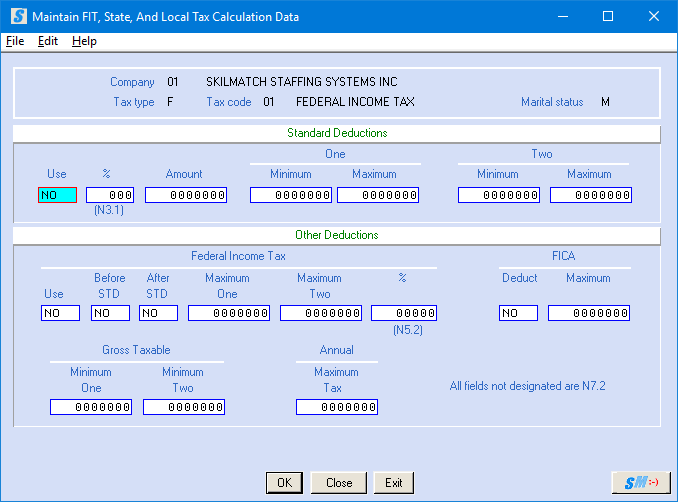

If you chose to continue, the screen will display:

Standard Deductions:

Use:

This term is generally used for an exemption for the EMPLOYEE versus an exemption for dependents. Check the taxing authority’s tables to see if this state or locality uses a Standard deduction. Most states that have this type of deduction use the term “Standard Deduction”, but occasionally a different phrase, like “Withholding Exemption, or Personal Exemption” will be used. Then, there are some states that have both a Standard Deduction and an exemption for the employee, which may be combined and entered as single figure in the Standard Deduction field. Normally if a different term is used for the Standard Deduction, a different term will also be used for what SkilMatch refers to as “Personal Exemption Dollars”.

Make certain that this area is used for the actual employee, and not for any dependents.

If the taxing authority has a deduction for the employee, key YES.

OR

Otherwise, key NO.

Standard Deduction %:

The Standard deduction, if used, will be either a percentage or an amount.

If the Standard deduction is a percentage, key in 3 digits, with 2 digits to the left of the decimal. If the percentage is a whole number, remember to key a zero at the end to hold the decimal place. (10% is keyed as 100). You may enter up to 99.9% (keyed as 999).

If the taxing authority does not use a Standard deduction, or if the Standard deduction is a dollar amount, leave zeroes in this area.

Standard Deduction Amount:

If the taxing authority uses a standard deduction that is an amount, key up to seven characters. You may enter up to $99999.99 (keyed as 9999999). Remember to hold two decimal spaces.

If the taxing authority does not use a Standard deduction, or if the deduction is a percentage, leave zeroes in this area.

Standard Deduction Minimum One:

If you are using the percentage method for calculating a standard deduction, key the minimum standard deduction amount, if there is one stated in the tax booklet.

(Example, a Standard Deduction might be 3% or a minimum of $500)

Standard Deduction Maximum One:

If you are using the percentage method for calculating a Standard deduction, key the maximum standard deduction amount, if there is one stated in the tax booklet.

(For example, a Standard deduction might be 3% or a maximum of $1000)

Standard Deduction Minimum Two: & Maximum Two:

Most taxing authorities do not have 2 types of Standard deductions. If this one does, you may enter the second set of minimum and maximum amounts in these areas. The system will not, however, use this deduction unless the employee’s state or local tax file had been changed to select the Standard deduction limits #2.

Other Deductions:

There may be other factors that affect the

employee’s taxable gross. The other

available areas to contribute toward a taxable gross are listed below.

Federal Income Tax:

Use:

If this state or locality deducts the amount withheld for FIT from the taxable gross, key YES. Otherwise key NO.

Federal Income Tax Before STD:

If the amount withheld for federal income tax is deducted BEFORE the Standard Deduction listed above is subtracted from the taxable gross, key YES. Otherwise key NO.

Federal Income Tax After STD:

If the amount withheld for federal income tax is deducted AFTER the Standard Deduction listed above is subtracted from the taxable gross, key YES. Otherwise key NO.

Federal Income Tax Maximum One:

If the amount to be withheld for federal income tax is to be deducted from the employee’s taxable gross, but is not to exceed a certain amount in a tax year, key the maximum amount of FIT that is allowed.

(Example: total amount to be deducted may not exceed $2,000.00-when the $2,000 maximum has been reached, discontinue this step).

Federal Income Tax Maximum Two:

Most taxing authorities do not have 2 types of maximums for the amount of federal income tax that can be deducted from the taxable gross. If this one does, you may enter the second set of maximum amounts in this area. The system will not, however, use this deduction unless the employee’s State/Local/SDI file had been changed to select the FIT LIMITS #2.

Federal Income Tax %:

If you are using the FIT deduction field, key the percentage of the FIT withheld that should be deducted from the taxable gross of the employee. You may enter up to 999.99 (keyed as 99999). Remember to hold two decimal spaces, otherwise leave zeroes in this area.

FICA - Deduct:

If the amount withheld for Social security should be subtracted from the taxable gross, key YES. Otherwise key NO.

FICA - Maximum:

If amount deducted for FICA is to be deducted is not to exceed a certain amount, key the maximum amount to be deducted. You may enter up to $99,999.99.

(Example: total amount to be deducted may not exceed $2,000.00-when the $2,000 maximum has been reached, discontinue this step).

Gross Taxable - Minimum One:

If the taxing authority orders tax to be calculated and withheld, even if the employee’s taxable gross earnings are below a certain annual amount, enter the minimum taxable gross on which taxes should be calculated. Remember to hold two decimal spaces.

(Example: If the minimum is $1,000.00, and an employee’s annual gross is $750.00, the employee will be taxed as if their taxable gross was $1,000.00)

Gross Taxable - Minimum Two:

If the taxing authority has 2 types of minimum, enter the second type in this area. The system will not, however, use this minimum unless the employee’s State/Local/SDI file had been changed to select the GROSS MINIMUM LIMITS #2.

Annual - Maximum Tax:

If the amount of tax to be withheld annually should not exceed a certain amount, key in the maximum tax amount for the year. The system will stop withholding once the maximum has been withheld. When the end of year zeroing occurs, the taxing will start again

To continue, click [OK].

OR

To return to add and change menu and enter new tax code, click [Close].

OR

To cancel without saving changes and return to main menu, click [Exit].

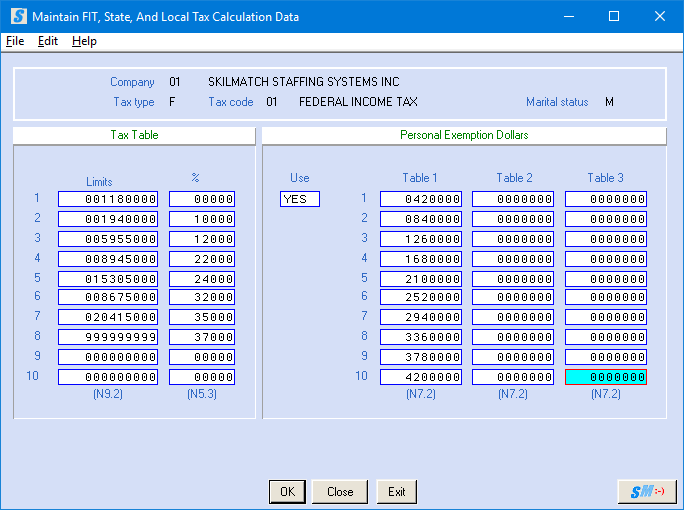

If you select [OK] to continue, the screen will display:

Screen images and examples in document may not reflect

current law; always verify rates and figures with government officials and/or

accounting professional.

NOTE: The cursor moves from left to right so you

will find that you will be moving back and forth between the Tax Table area and

the Personal Exemption Dollars area. Be

careful to watch your screen.

Tax Table:

Limits 1-10:

Once the system has arrived at an annual taxable gross, described earlier in this document, the system is ready to calculate the tax to be withheld. Each LIMIT 1 through LIMIT 10 area is a 9 digit field, with 2 of the digits to the right of the decimal (cents). You may key up to $9,999,999.99.

If every taxable dollar earned by the employee is subject to tax, key all nine’s in the TAX TABLE LIMIT 1 area, and leave zeroes in areas 2-10.

(Example: 999999999)

If you are setting up an “exempt from tax” status, or the table for this taxing authority is “hard-coded” in the SkilMatch programs, key all nine’s in the TAX TABLE LIMIT 1 area, and leave zeroes in areas 2-10.

If certain dollar amounts are subject to specific percentages, key the maximum taxable earnings amount for the lowest percentage in TAX TABLE LIMIT 1, so that it represents $0.00 through $x,xxx,xxx.xx.

(Example: $0 - $4,250.00 is keyed as 425000 and means the first $4,250 dollars of taxable earnings with be taxed at the percentage indicated in the next area).

For TAX TABLE LIMIT 2, key the difference between the amount in LIMIT 1, and the next percentage limit.

(Example: if the next limit reads $4,251.00 - $6,500.00, then you would key 225000 - which is $6500-4250)

Repeat this for each limit except the one with the highest percentage. For the final percentage, the dollar amount keyed is usually all nine’s, since the final percentage would be taxed on all dollars earned in excess of the previous limit.

(Example: if the previous limit was $6,500, and the final percentage is calculated on $6,501 and above, then every dollar over $6,500 is subject to the final - and highest - percentage)

Tax Table: % 1-10:

The percentage areas have space for 5 digits with 3 digits to the right of the decimal. You may key up to 99.999%

If you are setting up an “exempt from tax” status, or the table for this taxing authority is “hard-coded” in the SkilMatch programs, leave zeroes in TAX TABLE % areas 1-10.

If all earnings are to be taxed at the same percentage, key the percent. Remember to hold three decimal spaces.

(Example: 10% is keyed as 10000, 12.5% is keyed as 12500, .5% is keyed as 500)

Key the percent associated with the limit to the left.

Personal Exemption Dollars: Use:

There are many terms used to refer to the exemptions allowed for dependents. Examples include: Exemptions claimed (OK), Dependent Exemptions (IN), Withholding Allowances (MN), Authorized Dependents (MS).

On occasion, these fields have to be used as an extension of the Standard Deduction fields, but this is rare. Most states (and the federal government) allow exemptions for dependents based on either the federal W-4, or the states own W-4.

These dollars are deducted from the taxable gross before taxes are calculated.

Key YES to use the Personal exemption dollar table(s).

OR

If you are setting up an “exempt from tax” status, or the table for this taxing authority is “hard-coded” in the SkilMatch programs, key NO.

Personal Exemption Dollars: Table 1, Table 2, Table 3:

Very rarely will a state use more than Table 1. The number of exemptions that is keyed into the employee’s Primary State or Local Dependents 1 field in the employee file will use Table 1. This is the same as the EXEMPTIONS field in the employee State/Local/SDI file.

All three of the Personal Exemption Dollar Tables are 7 digit fields, with 2 digits to the right of the decimal. You may key up to $99,999.99 in a field.

Key the amount allowed one exemption beside the 1 in Table 1. Usually you will simply multiply the exemption amount by 2 and key beside the 2 in Table 1. Occasionally the first exemption will be for more dollars than additional exemptions. If so, then you will add the amount of the second exemption to the amount of the first exemption and key the total beside the 2. Then for the third exemption you will multiply the second exemption amount by 2, add the amount of exemption 1 and key the total beside the 3 in Table 1.

Example: Exemption is $500 for the first exemption, and $25 for each exemption thereafter - so you would key 50000 beside the 1, 52500 beside the 2, 55000 beside the 3, and so on).

Repeat this process for up to 10 exemptions. Remember to hold two decimal spaces.

If the taxing authority uses a second type of exemptions, then you will key the exemption amounts into Table 2. The system will look at the Dependent 2 field from the Primary State or Local field in the employee file, or the Additional Exemptions 1 field in the employee State/Local/SDI file.

If the taxing authority uses a third type of exemptions, then you will key the exemption amounts into Table 3.

To continue, click [OK].

OR

To return to add and change menu and enter new tax code, click [Close].

OR

To cancel without saving changes and return to main menu, click [Exit].

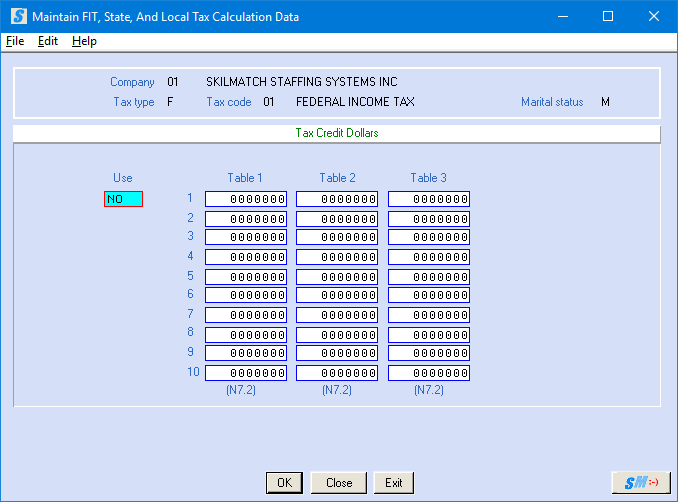

If you select [OK] to continue, the screen will display:

Screen images and examples in document may not reflect

current law; always verify rates and figures with government officials and/or

accounting professional.

Tax Credit Dollars:

Some taxing authorities allow a credit on the taxes calculated, rather than reducing the taxable gross. If tax credit amounts are entered, then the system will calculate the annual taxes, then will deduct the tax credit as a part of the tax calculation.

Key YES if the taxing authority allows tax credits, otherwise key NO.

Tax Credit Dollars: Table 1, Table 2, Table 3:

Very rarely will a taxing authority use more than Table 1. The number of credits that is keyed into the employee’s Primary State or Local Credits 1 field in the employee file will use Table 1. This is the same as the Tax Credit Exemptions/Exemption 1 field in the employee state/local/SDI file.

If the state uses Tables 2 or

3, you will need to go to the employee Primary State and Primary

Locality ![]() button (prompt and select) in order to

access the area for Tax Credit 2 or Tax Credit 3 fields.

button (prompt and select) in order to

access the area for Tax Credit 2 or Tax Credit 3 fields.

Each field is 7 digits, with 2 of the digits to the right of the decimal. You may key up to $99,999.99.

Key the amount allowed one tax credit beside the 1 in Table 1. Usually you will simply multiply the tax credit amount by 2 and key beside the 2 in Table 1. Occasionally the first tax credit will be for more dollars than additional tax credits. If so, then you will add the amount of the second tax credit to the amount of the first tax credit and key the total beside the 2. Then for the third tax credit you will multiply the second tax credit amount by 2, add the amount of tax credit 1 and key to total beside the 3 in Table 1.

(Example: Tax credit is $10.00 for the first credit, and $5.00 for each credit thereafter - so you would key 1000 beside the 1, 1500 beside the 2, 2000 beside the 3, and so on).

Repeat this process for up to 10 tax credits. Remember to hold two decimal spaces. Key up to 10 separate tax dollar credit amounts into fields 1-10 under Table 1.

Repeat if necessary for Tables 2 and 3.

To accept addition or changes of this tax code, click [OK].

OR

To return to add and change menu and enter new tax code, click [Close].

OR

To cancel without saving changes and return to main menu, click [Exit].

LEGAL DISCLAIMER and Customer Responsibilities:

When SkilMatch staff or a

SkilMatch program provides information, data, calculation, tax tables, magnetic

media or paper reporting to SkilMatch customers, a “best efforts” attempt has

been made by SkilMatch to verify that the information is correct as SkilMatch

understands it or as it has been explained to SkilMatch. SkilMatch-provided tax tables and reporting

are provided to assist customers in setting up your tax table records and to

assist customers in reporting to government authorities. Tax laws and requirements change frequently

and it is a customer’s responsibility to verify the accuracy of all

SkilMatch-provided information and reporting with your tax advisor, accountant

and/or attorney.

SkilMatch attempts to monitor

for tax table and reporting changes.

However, when a customer receives ANY notification of change from a

taxing authority, SkilMatch should be notified.

SkilMatch depends on customers who are closest to the taxing authorities

to provide information that will affect their businesses. Any and all written, verbal or electronic

information provided by SkilMatch regarding tax tables and government reporting

(1) is meant to provide general information about the payroll process, (2) is

not intended to provide tax or legal advice, (3) is not intended to address,

and is not meant to address, the entire body of federal, state and local law

and regulation governing the payroll process, payroll taxes, government

reporting or employment law. Such laws

and regulations change frequently and their effects can vary widely based upon

specific facts, circumstances and timing.

Each customer is responsible for consulting with a professional tax

advisor, accountant and/or attorney concerning its specific concerns and

compliance.