FICA TAX TABLE

Use this option to maintain the Social Security (SS) and Medicare tax percentages and limits, and the Advanced Earned Income Credit (AEIC) maximum dollars allowed for payment. CURRENT FICA Table: Current year FICA table figures are located on the SkilMatch Website under “Additional Documentation”, Tax Tables section.

IMPORTANT: FICA tax table changes are effective for the

company number entered. You will need

to repeat the setup for ALL company numbers for which you are calculating

payroll taxes.

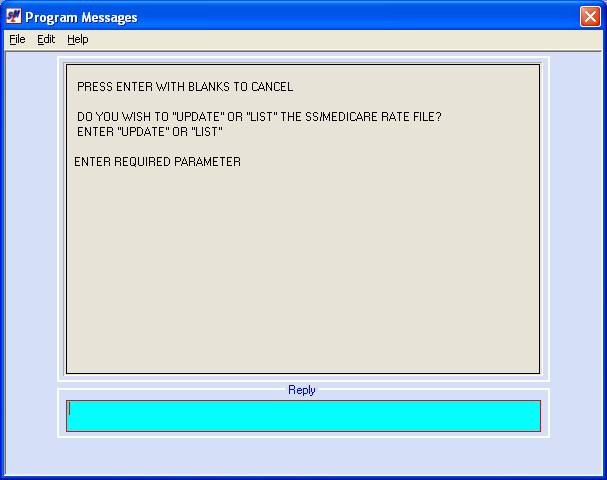

A new “LIST” option is available that allows you to print and review the FICA tax tables. When you select the FICA tax table option, you will receive a new screen that asks if you would like to “UPDATE” or “LIST” the SS/Medicare rate file. This will allow you to verify the Employee and Employer setup in your FICA tax tables.

The percentages for SS and Medicare have remained the same for many years. In 2011, federal regulation created a separate rate for Employee SS and the Employer SS rate. This federal rate change made it necessary for the SkilMatch program to convert to a two-screen layout that allows for separate Employee and Employer rates and limits. It is critical that you update BOTH the Employee and Employer screens, as needed.

The Medicare rate has not changed and remains at 1.45% for both Employee and Employer. As of 2016, there is no maximum on the amount of non-exempt wages subject to Medicare. In SkilMatch, the Medicare tax area is a 9-digit area, which holds a maximum of $99,999.99. To make certain that everyone stays within this limit, we have established an arbitrary maximum for the wages that are subject to Medicare. This arbitrary maximum is $6 million. This in turn sets a maximum tax dollar to be withheld of $87,000.00.

‘Advanced Earned Income Credit’ is federal income tax dollars that gets paid to employees, rather than being withheld. Employees must qualify for this program and should have completed a federal form in order to participate. There are special tax tables to calculate the amount of AEIC to pay, but there is a limit on total amount of payments that can be made each year.

*CHANGE in 2011 - The option of receiving advance payroll

payments of EIC expires on December 31, 2010.

Individuals, who qualify for EIC, are now responsible for requesting

this on their 2011 income tax returns.

It is CRITICAL that you update the AEIC Federal tax tables (see menu

File Maintenance, option Federal, State, Local Tax tables) AND Maximum

gross $ Allowing Advanced EIC amount (shown below), REGARDLESS if you have

employees signed up for this program or not.

This will ensure that AEIC is not being credited on a weekly basis

during payroll.

The FICA Tax Table, Maximum Gross $ Allowing Advanced EIC needs to be 00/zero on the Employee screen, until notified otherwise.

The annual Circular E issued by the IRS lists the amounts and percentages for SS, Medicare and AEIC. In addition, SkilMatch provides, as a free service, the new amounts and percentages each year with the ‘End of Year Preparation and/or Checklist’.

To begin, select the [File Maintenance] menu in the Pay and Bill library. The screen will display:

Next, scroll down or right click and select [FICA Tax Table].

The screen will display:

Update or List?:

To “UPDATE” the FICA Tax Table, key UPDATE and press [Enter].

OR

To “LIST” and print out the

details of the FICA Tax Table, key LIST and press [Enter].

If you select LIST, a report will be in your printer output queue.

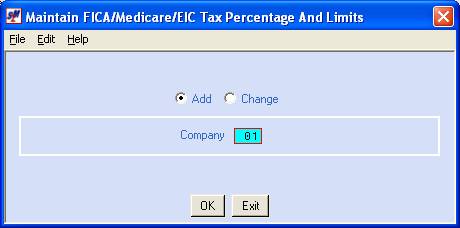

If you select UPDATE, to make changes to the file, the screen will display:

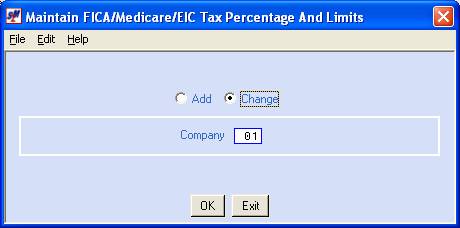

Add or Change:

Defaults to add. To change a FICA tax table file already set up, click once on change to select (a black dot will appear next to your selection).

Company:

Defaults to company 01.

To work with the FICA tax table file for a different company, key the

desired company number.

To continue, click [OK].

OR

To cancel and return to main menu, click [Exit].

If you select [OK] to continue, the screen will display:

CURRENT FICA Table: Current year FICA table figures are located on the SkilMatch Website under “Additional Documentation”, Tax Tables section.

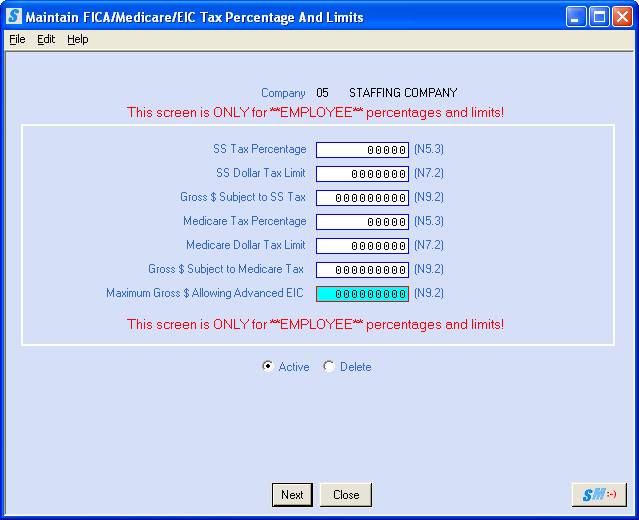

EMPLOYEE SCREEN - New in 2011, the federal SS rate change has made it necessary for the SkilMatch program to convert to a two-screen layout that allows for separate Employee and Employer rates and limits. This screen shows that the figures entered are for the EMPLOYEE file (employer screen details are shown below).

(EMPLOYEE) SS Tax Percentage:

Key the current Social Security (SS) percentage.

N5.3 means this is a numeric area with a total of 5 digits, with 3 positions to the right of the decimal.

Example only: 6.2% is keyed as 6200

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYEE) SS Dollar Tax Limit:

Key the maximum SS tax that can be withheld this year.

N7.2 means this is a numeric area with a total of 7 digits, with 2 positions to the right of the decimal.

Example only: $6,200.00 is keyed as 620000

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYEE) Gross $ Subject To FICA Tax:

Key the maximum amount of wages that are subject to SS tax this year.

N9.2 means this is a numeric area with a total of 9 digits, with 2 positions to the right of the decimal.

Example only: $100,000.00 is keyed as 10000000

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYEE) Medicare Tax Percentage:

Key the current MEDICARE dollar tax limit.

N5.3 means this is a numeric area with a total of 5 digits, with 3 positions to the right of the decimal.

Example: 1.45% is keyed as 1450

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYEE) Medicare Dollar Tax Limit:

There is currently no limit on the amount of Medicare tax to be withheld. Technically, 100% of non-exempt wages are subject to Medicare tax. The SkilMatch tax area, however, is limited to $99,999.99. To ensure that a user will not exceed this amount, we have set an arbitrary maximum of $6 million as the gross dollars subject to Medicare (see next area). The calculation of 1.45% on $6 million dollars is $87,000.00.

N7.2 means this is a numeric area with a total of 7 digits, with 2 positions to the right of the decimal.

Please key 8700000 into this area.

(EMPLOYEE) Gross $ Subject To Medicare Tax:

There is currently no limit on the amount of Medicare tax to be withheld. Technically, 100% of non-exempt wages are subject to Medicare tax.

N9.2 means this is a numeric area with a total of 9 digits, with 2 positions to the right of the decimal.

Since the SkilMatch tax area, however, is limited to $99,999.99, we have set an arbitrary gross dollars subject to Medicare of $6 million.

Please key 600000000 into this area.

(EMPLOYEE) Maximum Gross $ Allowing Advanced EIC:

Each year the federal government sets a maximum dollar amount of wages on which earned income credit can be calculated and paid. Key the current maximum.

N9.2 means this is a numeric area with a total of 9 digits, with 2 positions to the right of the decimal.

The maximum gross dollars

allowing advanced EIC for 2011 is $ 00.00 (zero).

Example: $00.00 is keyed as 0000 (or field exit to clear figure)

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

Active/Delete:

To delete this FICA tax table file, select delete by clicking on the option once (a black dot will appear next to your selection).

To continue and update the EMPLOYER FICA Tax Tables (required to save changes), click [Next].

OR

To cancel and return to main menu without saving changes, click [Close].

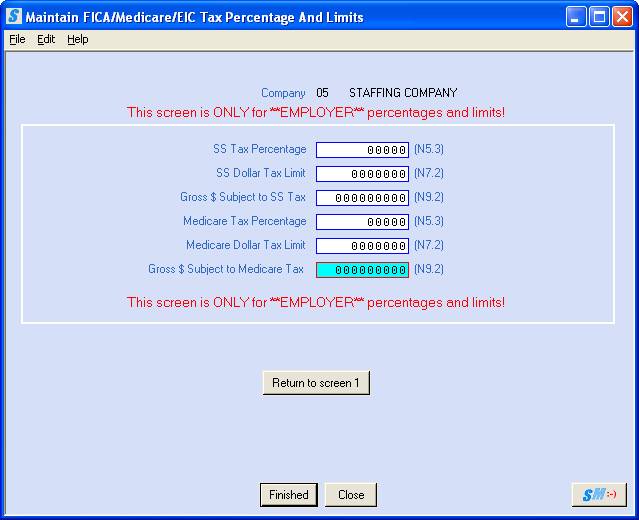

If you select [Next] to continue, the screen will display:

CURRENT FICA Table: Current year FICA table figures are located on the SkilMatch Website under “Additional Documentation”, Tax Tables section.

EMPLOYER SCREEN - New for 2011, the federal SS rate change has made it necessary for the SkilMatch program to convert to a two-screen layout that allows for separate Employee and Employer rates and limits. This screen shows that the figures entered are for the EMPLOYER file (employee screen details are shown above).

(EMPLOYER) SS Tax Percentage:

Key the current Social Security (SS) percentage.

N5.3 means this is a numeric area with a total of 5 digits, with 3 positions to the right of the decimal.

Example only: 6.2% is keyed as 6200

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYER) SS Dollar Tax Limit:

Key the maximum SS tax that can be withheld this year.

N7.2 means this is a numeric area with a total of 7 digits, with 2 positions to the right of the decimal.

Example only: $6,200.00 is keyed as 620000

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYER) Gross $ Subject To FICA Tax:

Key the maximum amount of wages that are subject to SS tax this year.

N9.2 means this is a numeric area with a total of 9 digits, with 2 positions to the right of the decimal.

Example only: $100,000.00 is keyed as 10000000

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYER) Medicare Tax Percentage:

Key the current MEDICARE dollar tax limit.

N5.3 means this is a numeric area with a total of 5 digits, with 3 positions to the right of the decimal.

Example only: 1.45% is keyed as 1450

Screen images and

examples in document may not reflect current law; always verify rates and

figures with government officials and/or accounting professional.

(EMPLOYER) Medicare Dollar Tax Limit:

There is currently no limit on the amount of Medicare tax to be withheld. Technically, 100% of non-exempt wages are subject to Medicare tax. The SkilMatch tax area, however, is limited to $99,999.99. To ensure that a user will not exceed this amount, we have set an arbitrary maximum of $6 million as the gross dollars subject to Medicare (see next area). The calculation of 1.45% on $6 million dollars is $87,000.00.

N7.2 means this is a numeric area with a total of 7 digits, with 2 positions to the right of the decimal.

Please key 8700000 into this area.

(EMPLOYER) Gross $ Subject To Medicare Tax:

There is currently no limit on the amount of Medicare tax to be withheld. Technically, 100% of non-exempt wages are subject to Medicare tax.

N9.2 means this is a numeric area with a total of 9 digits, with 2 positions to the right of the decimal.

Since the SkilMatch tax area, however, is limited to $99,999.99, we have set an arbitrary gross dollars subject to Medicare of $6 million.

Please key 600000000 into this area.

To return to Employee FICA tax screen to review or make additional change, click [Return to screen 1].

OR

To accept addition or changes to this FICA tax table, click [Finished].

OR

To cancel without saving changes, click [Close]. You will be returned to the add or change screen.

If you select [Close], the screen will display:

To set up additional FICA tax table files or change existing ones, follow the preceding steps.

When you have finished with this option, click [Exit]. You will be returned to menu.