DEDUCTIONS:

PRE-TAX

If you designated that a

deduction is pre-tax, then you must also create pre-tax calculation records for

federal, state and local taxes. You may

create these calculation records manually, one at a time, or you may

process a command to have the system create these records for you. If you want to have the system create these

records for you, please move forward in this document to the section on TAXCRSUPD.

Use

this option to manually designate the taxes on which your pre-tax

deductions are subject.

Any deduction that is not set up as pre-tax through this option will

automatically be subject to ALL applicable taxation.

Before beginning this option,

you must have set up a federal tax record, a state tax record for each state

affected, and a local tax record for each local tax affected through Menu

PBMANT, Item Payroll G/L Distributions.

HOW TO MAINTAIN THE MISCELLANEOUS DEDUCTION PRE-TAX FILE

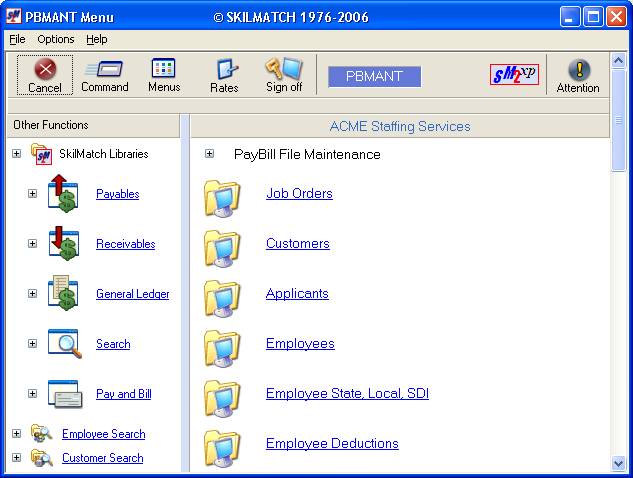

To begin, on the “PayBill Library Master menu, select File Maintenance. The screen will display:

From the File Maintenance menu, drag the blue bar down, or right-click in the white space on the right side of the screen to display more options. Click [Deductions: Pre-Tax].

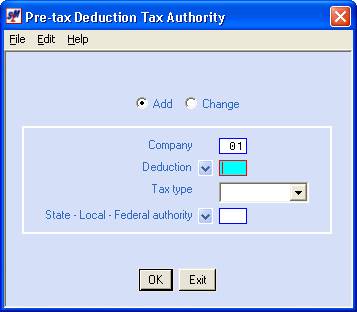

The screen will display:

Add or Change:

Defaults to add. If you wish to change a pre-tax deduction

file already set up, click once on change to select (a black dot will appear

next to your selection).

Company:

Defaults

to company 01. If you wish to work with

the pre-tax deduction file for a different company, key the desired company

number.

Deduction:

Key the desired deduction

code. (This code must have been

previously set up through Menu File

Maintenance, item PR GL Distributions.)

OR

Select a

code by clicking the ![]() button (prompt and select button).

button (prompt and select button).

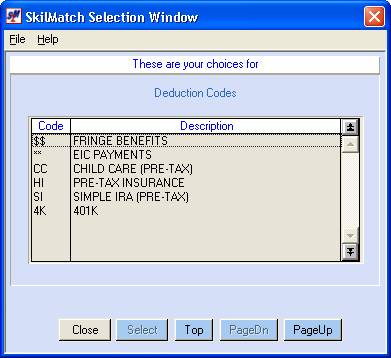

The

screen will display:

If you do not see the code you

want, and the [PageDn] button is not grayed

out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over

again. If you page down past a screen

of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

When you see the one you want to use, either <DOUBLE-CLICK>

on the description, or highlight and click [Select].

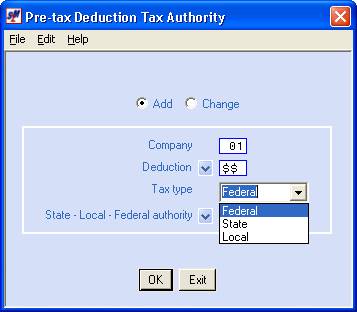

Tax Type:

Select a

tax type code by clicking the ![]() button (prompt and select button) to the

right of the tax type. Select from

Federal, State or Local.

button (prompt and select button) to the

right of the tax type. Select from

Federal, State or Local.

State/Local/Federal Code:

If you selected federal as the

tax type code, key 01 in this area.

If you selected state or local,

as the tax type code, key the code set up through Menu

PBMANT, Item Payroll G/L Distributions,

OR

Select a

code by clicking the ![]() button (prompt and select button).

button (prompt and select button).

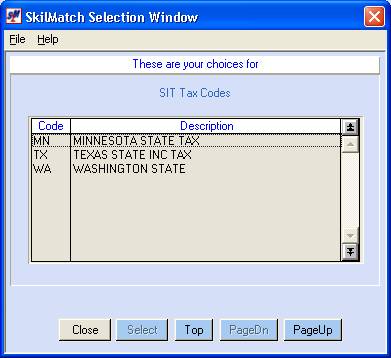

The

screen will display:

If you do not see the code you

want, and the [PageDn] button is not grayed out,

then click [PageDn] to view more. When you get to the end, [Top] will start the selections over

again. If you page down past a screen

of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

When you see the one you want to use, either <DOUBLE-CLICK>

on the description, or highlight and click [Select].

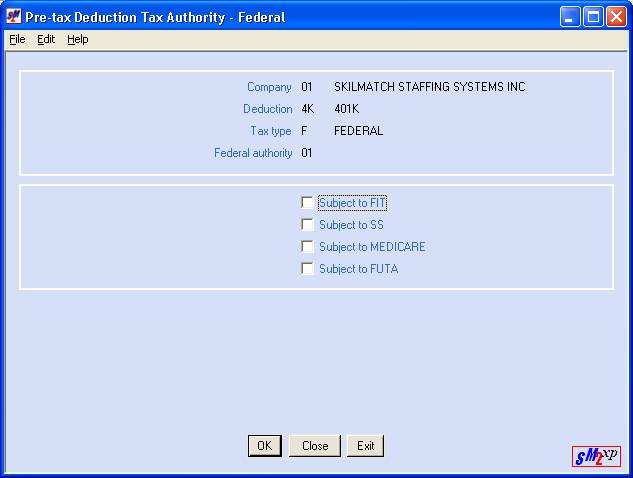

If you selected Federal/01, the

screen will display:

Subject To FIT:

If this deduction is subject to

federal income tax, click once on this option to select (a checkmark will

appear next to the selection).

If this deduction is NOT subject

to federal income tax, leave this option unselected (no checkmark will appear).

Subject To FICA:

If this deduction is subject to

FICA tax, click once on this option to select (a checkmark will appear next to

the selection).

If this deduction is NOT subject

to FICA tax, leave this option unselected (no checkmark will appear).

Subject To MEDICARE:

If this deduction is subject to

MEDICARE tax, click once on this option to select (a checkmark will appear next

to the selection).

If this deduction is NOT subject

to MEDICARE tax, leave this option unselected (no checkmark will appear).

Subject To FUTA:

If this deduction is subject to

FUTA, click once on this option to select (a checkmark will appear next to the

selection).

If this deduction is NOT subject

to FUTA, leave this option unselected (no checkmark will appear).

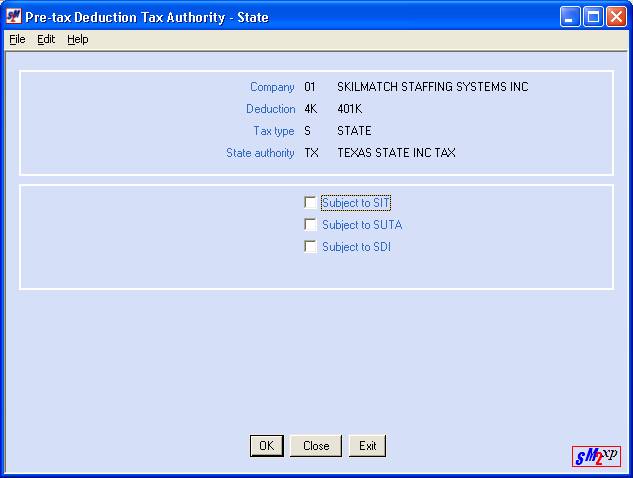

If you selected State, the

screen will display:

Subject To SIT:

If this deduction is subject to state

income tax, click once on this option to select (a checkmark will appear next

to the selection).

If this deduction is NOT subject

to state income tax, leave this option unselected (no checkmark will appear).

Subject To SUTA:

If this deduction is subject to

SUTA tax, click once on this option to select (a checkmark will appear next to

the selection).

If this deduction is NOT subject

to SUTA tax, leave this option unselected (no checkmark will appear).

Subject To SDI:

If this deduction is subject to

state disability insurance (SDI) tax, click once on this option to select (a

checkmark will appear next to the selection).

If this deduction is NOT subject

to SDI tax, leave this option unselected (no checkmark will appear).

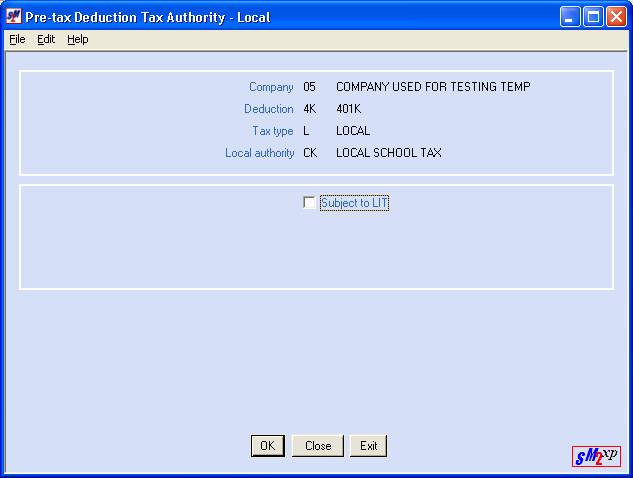

If you selected Local, the screen

will display:

Subject To LIT:

If this deduction is subject to

local income tax, click once on this option to select (a checkmark will appear

next to the selection).

If this deduction is NOT subject

to local income tax, leave this option unselected (no checkmark will appear).

To add, change, or delete this

data, click [OK].

To NOT add, change, or delete

this data, click [Exit].

You will be returned to menu.

If you do NOT wish to add,

change, or delete this data, but wish to begin again, click [Close].

You will return to the previous screen to try again.

If you wish to set up additional

pre-tax deduction files or change existing ones, follow the preceding steps.

When you have finished with this

option, click [Exit]. You will

be returned to menu.

When finished, you should go to

the File Printing menu and print the Miscellaneous Deduction Pre-tax file to

verify the accuracy of your data entry.

Creation of Pre-Tax records

If you have created a new

deduction that is pre-tax, or if you have existing pre-tax deductions, and are

adding a new state, or a new locality, you may use a command to have the system

create them automatically. Before

processing this command, make certain that the W-2 box areas are set up

correctly for the current year. The

system will use your responses to identify the deduction type.

To have the system create the

records automatically, using the 2006 specifications from the American Payroll

Association, you will key a special command.

Your user profile must have the SKMANAGE group in order to process this

command.

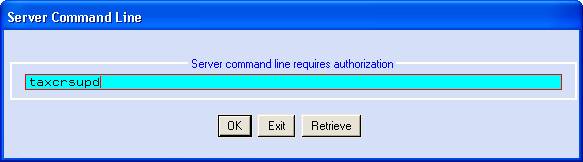

From a menu, click the ![]() button at the top of the screen. On the command line, key TAXCRSUPD and

click [OK].

button at the top of the screen. On the command line, key TAXCRSUPD and

click [OK].

The screen will display:

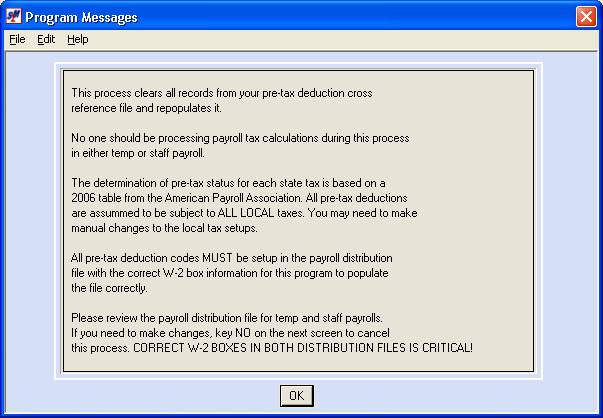

The system will ‘clear’ out the

pre-tax record file of all existing records, and will re-populate the file with

the ‘hard-coded’ 2006 specifications.

If your system has local taxes

or SDI, please be aware that the system automatically makes every pre-tax

deduction code SUBJECT to SDI and local taxes.

If this deduction is EXEMPT from

local tax or SDI, you must manually correct the Pre-Tax record when the

automated program has finished.

You will have to make these

adjustments EACH time the command is processed, since the file is completely

cleaned out and re-populated each time.

Click [OK] after you have read the

screen.

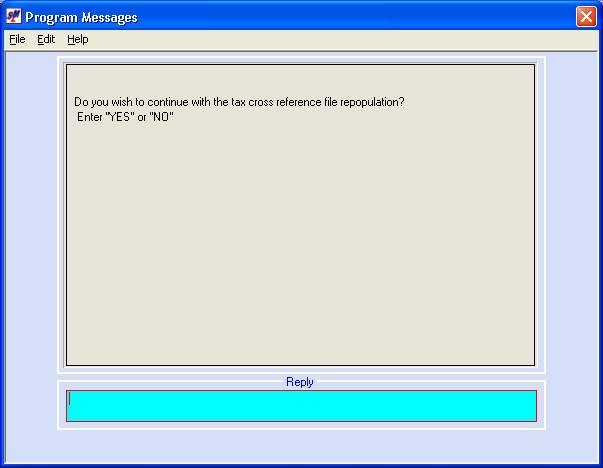

If you are certain that your W-2

boxes are current, and you want to continue with this process, key YES

and press <enter>.

If you do NOT wish to continue,

key NO and press <enter>. You will return to menu.

If you keyed YES, the screen

will remain displayed while the program processes. When it has finished, you will return to menu. You should go to the File

Printing menu and print the Miscellaneous

Deduction Pre-tax file to verify that there are not any local

taxes or SDI responses that need to be adjusted.