EMPLOYEE

DEDUCTION FILE

Once you have created valid

deduction code types using Menu

PBMANT, Item Payroll G/L Distributions, you may begin setting up

individual employee deductions.

The

following is a list of the different features described in this documentation:

Deduction

Percent Amount (Deduction Percent Of Gross Or Net)

Maximum or Minimum Deduction Percent

(% of Gross or Net; % is Maximum or Minimum)

Multi-Garnishment Maximum Percent

(% of Gross or Net)

Split

Multi-Deduction Same Priority

Deductions

Used In Net Pay Calculations

Maximum Deduction $ In Distribution File

This

Is A Garnishment/Child Support

Setting

up Accounts Payable Data

(1) The

calculation of deductions is based on the week-ending worked date of a

timecard. If an employee has multiple

timecards for the same week-ending worked date, the system will divide

the deduction amount proportionally between the paychecks. If an employee has multiple timesheets in a

payroll process, but with different week-ending worked dates, deductions

will be calculated on each separate week-ending worked date.

(2) If a

deduction code has been set up as a “garnishment” (through Menu

PBMANT, Item Payroll G/L Distributions), a NEGATIVE NET CHECK will

NEVER occur as a result of the deduction.

If there is not enough payroll to withhold the full amount of the

garnishment, then the deduction program will automatically adjust the amount of

the garnishment withheld to prevent a negative net check calculation.

(Non-garnishment

deductions, however, may cause a negative net check amount.)

(3) If, for

the same week-ending worked date, you have a VOIDED check and a REISSUED check

(voided and reissued through Menu PBENTR, Item Voided Checks), the deductions

on the REISSUED check will be exactly the same as on the original check –

regardless of how a deduction may have been changed for future calculations.

(4) If you

are VOIDing a check that had a deduction withheld, and you key in a REGULAR

timesheet (rather than selecting a reissue) for the same week-ending as the

check you are voiding, then the amount of the deduction being VOIDed will not

affect the calculation of deductions being withheld from the new REGULAR

timecard. The only exceptions to this

“rule” are: if the deduction on the original check had met the maximum

deduction amount allowed and the act of voiding causes the “to-date” deduction

dollars to fall back below the maximum; or if the maximum amount allowed has

been increased since the previous maximum was met; or if the amount of the

deduction itself has been changed.

Example One:

If Deduction code XX was set to

withhold $10.00/week-ending at the time the original check was issued, then the

VOID check will be processed with an XX deduction of $10.00-. If the original deduction met the limit for

the deduction maximum, then the REGULAR timesheet will have also have an XX

deduction of $10.00.

Example Two:

If Deduction code XX was set to

withhold $10.00/week-ending at the time the original check was issued, but has

been changed since then to withhold $25.00/week-ending, then the VOID check

will be processed with an XX deduction of $10.00-. The REGULAR timesheet will have an XX deduction of $25.00.

(5) If, for

the same week-ending worked date, you have a PRE-PAID check and a REGULAR

timesheet, then the amount of the deduction entered on the PRE-PAID will be

included as a part of the calculation for that week’s deduction from the

REGULAR timesheet.

Example One:

Deduction code XX is currently

set up to withhold $25.00/period-ending. PRE-PAID check has an XX deduction of

$5.00. The REGULAR timesheet will have

an XX deduction of $20.00.

Example Two:

Deduction code XX is currently

set up to withhold $25.00/period-ending.

The maximum deduction allowed amount for XX has not been met, but the “to-date”

amount withheld to-date is only $2.00 short of the maximum allowed amount. The PRE-PAID check has an XX deduction of

$5.00 (which must be withheld, because the amount was keyed during in

the entry of the pre-paid check). The

REGULAR timesheet will not have an amount withheld. Since the $5.00 withheld on the PRE-PAID exceeds the maximum

allowed for deduction XX by $3.00. This

$3.00 will be refunded automatically for deduction XX during the next

payroll process.

(6) If a one-time deduction

(entered during timesheet entry), is a garnishment or pre-tax

deduction, it must have been previously set up just as recurring deductions

are, otherwise you will get a “terminal” error in the timecard batch.

(7) Throughout this document NET is calculated as GROSS minus

EMPLOYEE-PAID TAXES (taking into account pre-tax deductions) minus the total

dollars of DEDUCTION CODE(S) entered in the

“Deductions Used in Net Pay Calculations” field below.

HOW TO ADD OR CHANGE A DEDUCTION

(If this

deduction is a garnishment, then you must have already created an Accounts

Payable vendor code before you begin entry of the employee’s garnishment

deduction. The system will REQUIRE a

valid A/P vendor during data entry.)

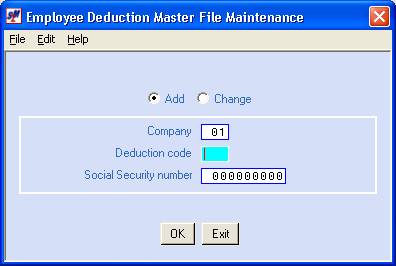

To

begin, on the “PayBill Library Master Files: Data Entry of …” menu, click [Employee

Deductions].

The

screen will display:

Add or

Change:

Defaults to add. If you wish to change a deduction already

set up for an employee, click once on change to select (a black dot will appear

next to your selection).

Company

Code:

Defaults to company

01. If you wish to work with deductions

for an employee in a different company, key the desired company number.

Deduction

Code:

Key the desired (valid)

deduction code. This code must have

been previously set up as valid using the Payroll Distribution option on the

Maintenance menu.

Social

Security Number:

Key the social security number

of the employee.

To NOT proceed, click [Exit]. You will be returned to the “PayBill Library

Master Files: Data Entry of …” menu.

To proceed, click [OK].

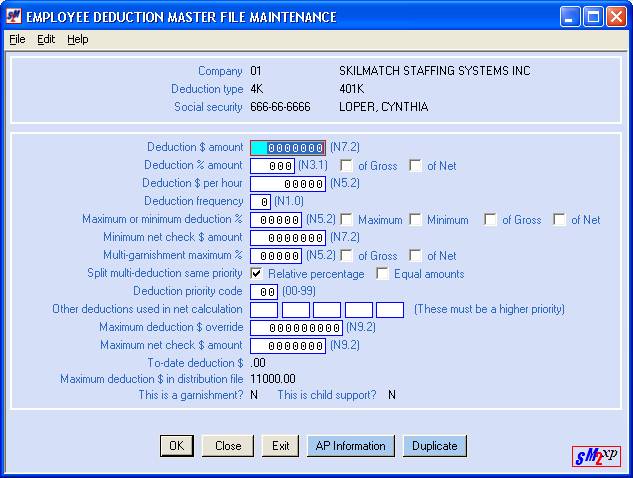

The screen will display:

You may choose between deducting a FLAT DOLLAR

amount, a PERCENT or an AMOUNT PER HOUR.

You may only select one of these. (If you are going to

use the MAXIMUM NET CHECK $ AMOUNT field, then you must leave these fields

blank.)

Deduction $ Amount: (N7.2)

* N7.2 means numeric

field, seven numbers long, two numbers to the right of the decimal. $20.00 is entered as 2000.

If a

flat dollar amount is to be deducted, enter the specific amount to be deducted

from the combined week-ending worked date timecards during a payroll process.

-OR-

Deduction % Amount: (N3.1) of Gross / of Net:

* N3.1 means numeric

field, three numbers long, one number to the right of the decimal. 17.5% is entered as 175.

If a

percentage is to be deducted, enter the specific percentage to be deducted from

the combined week-ending worked date timecards during a payroll process.

If you enter a deduction

percent, you must also select whether this amount is to be a percentage of

GROSS or NET. If you did NOT enter a

deduction percent amount, leave this area blank.

-OR-

* N5.2 means numeric field, five numbers long, two numbers to the

right of the decimal. $.25/hour is

entered as 25.

If a dollar amount per hour is

to be deducted, enter the specific amount per hour to be deducted from each

hour worked in a payroll process.

* N1.0 means numeric field, one number long, no decimal place.

* This is a required entry; every deduction must have a frequency.

Select from 1, 2, 3, or 9.

“Frequency” refers to how often

a deduction should be withheld from an employee’s paycheck. Having a selection of frequencies allows you

to distinguish between deductions that are withheld from each payroll process

(like child support), from deductions that are withheld only monthly (like

health insurance), from deductions that are withheld quarterly or yearly (like

a United Way contribution).

During the “Begin Cycle”, the

deduction frequency for that payroll is established on the “Constant

File”. If this is the payroll where

health insurance deductions are to be withheld in addition to child support,

you may choose a deduction frequency code that withholds multiple deduction

frequencies within a single payroll - like deductions frequencies 1 and

2 (“every payroll” deductions and “monthly” deductions).

SkilMatch has defined the following deduction frequencies:

1

represents withhold from every payroll

9

means do not withhold

Your organization should

determine what deduction frequencies 2 and 3 represent:

2

might be monthly, and

3

could be quarterly

Maximum

or Minimum Deduction %: (N5.2)

Maximum/Minimum of Gross / of Net:

* N5.2 means numeric

field, five numbers long, two numbers to the right of the decimal.

* This is an optional entry; not every deduction will have this

parameter.

If the Deduction

Amount/Percent/Percent per hour selected earlier should not exceed a certain percentage of the gross or net check

amount, key the percent, <TAB>, select Maximum, <TAB>, and select

either Gross or Net.

Examples:

(1) deduction must not exceed 50% of the employee’s net

pay. Enter 5000, Maximum, Net.

(2)

deduction must not exceed 20% of the employee’s gross pay. Enter 2000, Maximum, Gross

If the Deduction

Amount/Percent/Percent per hour selected earlier should be at least a certain percentage of the gross or net check

amount, key the percent, <TAB>, select Minimum, <TAB>, and select

either Gross or Net.

Examples:

(1)

deduction must be at least 25% of the employee’s net pay. Enter 2500, Minimum, Net.

(2)

deduction must be at least 50% of the employee’s gross pay. Enter 5000, Minimum, Gross.

Minimum Net Check $ Amount: (N7.2)

* N7.2 means numeric

field, seven numbers long, two numbers to the right of the decimal.

* Other deductions could

further reduce the actual net of the

check.

* This is an optional

entry; not every deduction will have this parameter.

* You may NOT use this

field and the Maximum Net Check

Amount field listed below.

* This field can only be used for the deduction codes have been pre-defined as a garnishment using Menu PBMANT, Item Payroll G/L Distributions.

If the employee’s net check

amount must be at least a certain amount, key the amount.

Multi-Garnishment

Maximum %: (N5.2) of Gross

/ of Net:

* N5.2 means numeric

field, five numbers long, two numbers to the right of the decimal.

* This is an optional entry; not every deduction will need this option.

* This field can only be used for deduction codes that have been set

up as garnishments using Menu PBMANT, Item Payroll G/L Distributions.

If this employee has multiple garnishments

(not just multiple deductions, but multiple garnishments),

and the grand total of these

garnishments are not to exceed a certain percent of the employee’s gross or net

pay, key the percent.

* All garnishments must

be assigned the same percent. If garnishments are assigned different

percentages, then the system will use the percentage of the first code it comes

to (alphabetically by deduction code) for ALL garnishment deductions.

If you entered a

multi-garnishment maximum percent, select Gross pay or Net pay. If you did NOT enter a multi-garnishment

maximum percent, leave this area blank.

Split

Multi-Deduction Same Priority:

* This is an optional entry; not every deduction will have this

parameter.

* If garnishment deduction codes of the same priority are assigned

conflicting methods of split, then the system will use the Relative Percentage

method.

* This field can only be used for deduction codes that have been set

up as garnishments through Menu PBMANT, Item Payroll G/L Distributions.

Look at the next field for a description of PRIORITY. This split only occurs between deductions of the same priority.

If the employee has multiple

types of deductions to withhold, but the total amount of the deductions is more

than is allowed (because there is not enough net pay, or because of a deduction

restriction), then you may designate how much of each deduction type should be

withheld.

Select from either RELATIVE

PERCENTAGE or EQUAL AMOUNTS.

Relative percentage means

the system will withhold a portion of each deduction. Each deduction’s “portion” is based on the amount that would be

deducted if all amounts COULD be deducted.

Example: if a deduction of

$100.00 and a deduction of $200.00 (total $300) would be deducted if no

restrictions existed, but for “restricted reasons” total deductions must not

exceed $250.00, then the RELATIVE PERCENTAGE of the $100.00 deduction is 33.34%

and the RELATIVE PERCENTAGE of the $200.00 deduction is 66.66%. The $100.00 deduction becomes $83.35 (33.34%

of $250.00) and the $200.00 deduction becomes $166.65 (66.66% of $250.00).

Equal Amounts means

divide the available funds equally among all the deductions, not to exceed (for

any deduction) the original deduction amount if all amounts COULD be deducted.

Example: if a deduction of

$100.00 and a deduction of $200.00 (total $300) would be deducted if no

restrictions existed, but for “restricted reasons”, total deductions must not

exceed $250.00, then the $250.00 would be divided by 2 (2 deductions) or

$125.00 maximum for each deduction. One

deduction only needs $100.00 of its allocated $125.00, so the excess would go

toward the other deduction. Using EQUAL

AMOUNTS as the split, the $100.00 deduction becomes $100.00 and the $200.00

deduction becomes $150.00.

* This is an optional

entry field. Most deductions will have priority code 00.

* We recommend that

priority codes be assigned by tens (10, 20, etc.), allowing for insertion of

priorities higher or lower than this one, as well as reserving for room for

growth

Example: This deduction

might be a assigned a priority code of 50.

You can then assign a higher code of 55 to another deduction, or a lower

priority of 45 to another deduction.

“Priority” only comes into play

if the employee has multiple deductions and did not earn enough to withhold the

entire amount of all the deductions.

The “priority” code will rate the deduction by level of importance. The higher the priority the higher the

importance.

If the employee has multiple

deductions that are assigned the same priority code, then these will be

subjected to the SPLIT MULTI-DEDUCTION option selected above.

If this deduction is assigned a

priority code that is lower than other deductions, then the system will

withhold as much as possible of the higher priority deductions, before it

attempts to withhold those with a lower priority.

Enter a 2-digit number (00-99)

to indicate this deduction’s priority in relation to other deductions. (00=lowest, 99=highest). Be certain to leave room for higher

priority deductions! If you start with

90, you won’t be able to go much higher!

Example: An employee might have

child support garnishments that have been assigned the same priority. Garnishments with the highest priority

are processed first. Garnishments with

a lower priority might have be ignored by the system in order to prevent a

negative check calculation. You would

receive a report of these adjusted garnishments should the system be forced to

modify or ignore the amounts. However,

since NON-GARNISHMENT deductions are not adjusted automatically during check

calculation, these NON-GARNISHMENT deductions could result in the calculation

of a negative net check. If this occurs,

the system will issue a negative check message and report, and will require

manual intervention/adjustment before you can continue with payroll.

Other Deductions Used In Net Calculation:

* The deduction codes

entered in this field MUST have a higher priority than THIS deduction.

If you want other deductions to

figure into the calculation of the employee’s NET pay, key up to 5 deduction

codes. This will change the calculation

from the STANDARD calculation (described in the “Understanding Deductions”

section at the beginning of this document), to a customized calculation.

Maximum

Deduction $ Override: (N9.2)

* N9.2 means numeric

field, nine numbers long, two numbers to the right of the decimal. $150.00 is

keyed as 15000.

* Some maximums should NOT be set up in the distribution

file, but entered person-by-person (loans, for example).

If the distribution file for

this deduction code does NOT already have a pre-defined maximum deduction

amount, and you want to need to set a maximum for this employee, key the

maximum amount that should be withheld.

Any maximum set in the employee deduction file will OVERRIDE any

maximum in the distribution file.

You may prefer to set a maximum

in the distribution file (through Menu PBMANT, Item Payroll G/L Distributions)

rather than in the employee deduction file. For example: 401K maximum can be set up once in the distribution

file instead of being set up in each person's 4K deduction. Should the 401K maximum change, you could

make a single change that affects ALL employees by resetting the maximum in the

distribution file (through Menu

PBMANT, Item Payroll G/L Distributions) rather than having to reset

the maximum in each individual employee deduction record.

If this deduction code already

has a maximum deduction amount set up through Menu PBMANT, Item Payroll G/L

Distributions), and you want to override the

pre-defined maximum with a different amount, key the maximum that should be in

effect for this employee.

Maximum Net Check $ Amount: (N7.2)

* N7.2 means numeric

field, seven numbers long, two numbers to the right of the decimal. 150.00 is

entered as 15000.

* If you use this field,

you may NOT use the Minimum Net Amount

field, nor the AMOUNT/PERCENT/AMOUNT PER HOUR fields.

* This field can only be used for deduction codes that have been set up as garnishments through Menu PBMANT, Item Payroll G/L Distributions.

Before using this field, please

refer to the “Understanding Garnishments” section at the beginning of this

document for a review of the definition of NET PAY. This field can be used instead of the

AMOUNT/PERCENT/AMOUNT PER HOUR to determine a garnishment amount.

If you key an amount in this

field, then the system will calculate NET PAY for the employee paycheck; will

subtract the amount keyed in this field; and will use the remaining dollars as

the garnishment amount to withhold.

The employee’s eventual net

check can be affected by other deduction codes – this field affects the

calculation of just this one garnishment!

This information displays only;

changes are not allowed from this screen.

The amount displayed reflects the to-date dollars withheld for this

deduction for this employee. If you are

converting an employee who has existing to-date dollars, call SkilMatch for

further instructions.

Maximum Deduction $ In Distribution File:

This information displays only;

changes are not allowed from this screen.

This area displays the maximum deduction amount set up for this deduction

code through Menu PBMANT, Item Payroll G/L

Distributions.

This Is

A Garnishment/Child Support:

This information displays only;

changes are not allowed from this screen.

This area displays when the deduction is set up in the distribution file

(through Menu PBMANT, Item Payroll G/L

Distributions) as a garnishment or child support.

If this deduction is a garnishment,

you may set up Accounts Payable data for this deduction. Refer to Setting

up Accounts Payable Data for assistance.

If this is NOT a garnishment or

you do NOT wish to set up Accounts Payable data for this deduction, you may:

Proceed and add the displayed

deduction detail to the employee's file - click [OK].

Do NOT proceed; begin again -

click [Cancel]. You will return to the previous screen to

try again.

Do NOT proceed; return to the

“PayBill Library Master Files: Data Entry of …” menu, click [Exit].

If you wish to set up additional

deductions or change existing ones, follow the preceding steps.

When you have finished with this

option, click [Exit]. You will

be returned to the “PayBill Library Master Files: Data Entry of …” menu.

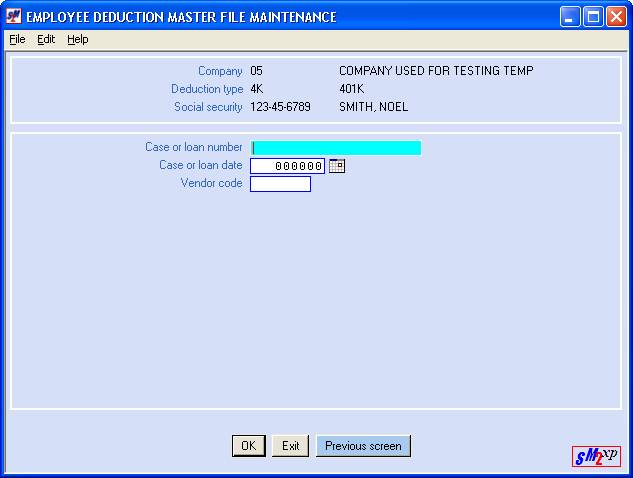

Setting up Accounts

Payable Data:

If this deduction is a

garnishment, then you are required to set up Accounts Payable. You should have created a vendor code and

file prior to creating this employee deduction.

The screen will display:

Enter up to 20 characters of the

case or loan number or some other description.

Enter a 6-digit case/loan date

or other deduction-type date. Format is

MMDDYY.

Vendor

Code:

Enter the 6-character A/P vendor code previously

created in the SkilMatch Accounts Payable.

WARNING: if

you interface with another A/P software package, then the SkilMatch vendor code

should be the EXACT match of the vendor code in the other A/P software package.

After keying the Vendor code,

you may:

Proceed and add the displayed

deduction detail to the employee's file - click [OK].

Do NOT proceed; return to the

previous screen, click [Previous Screen].

Do NOT proceed; return to the

“PayBill Library Master Files: Data Entry of …” menu, click [Exit].