EMPLOYEES

In SkilMatch, the basic difference between an ‘employee’ and an ‘applicant’ is the extra name and address fields and the tax data fields that are a part of an ‘employee’ record. A person may be added first as an ‘applicant’ and later upgraded to an ‘employee’ by simply going into the Employees menu option and adding the necessary tax information. The ‘applicant’ file contains the data used by the various search programs; the ‘employee’ file contains the taxing data necessary for payroll processing.

If you prefer to enter a person as an ‘applicant’ (without tax data), please refer to document Menu File Maintenance, Item Applicants

NOTE: Applicants cannot be placed on job orders.

The Employees menu option allows you to add a new employee to the system and make changes to existing employee records. You are restricted to adding and/or changing employee files that belong to the company number(s) to which you have been authorized.

NOTE: The feature ![]() “prompt and select” button throughout employee

entry allows users to access a list of

codes available for designated field. A

blank field is required for a full list of valid code options. If this field already contains a

character(s), the system will search by that character(s) and will give you a

sorted list based on the text in the field.

“prompt and select” button throughout employee

entry allows users to access a list of

codes available for designated field. A

blank field is required for a full list of valid code options. If this field already contains a

character(s), the system will search by that character(s) and will give you a

sorted list based on the text in the field.

NEW FOR 2020

W4: SkilMatch programming installed to enable NEW 2020 W4 compliance, allowing employees to calculate more accurate

withholdings. The NEW 2020 W4 allows

employees new tax setup options starting January 1, 2020 that will affect the

employee withholding during tax calculations.

Employees

are now able to elect the following new options on their W4 Form and will need

to be entered into their employee file:

1) Employees can now select new “Head of household” as a filing status

in Step 1 (Married and Single

options are still available).

2) Employees can check W4 Box 2 tax withholding for houses

with 2 jobs total in Step 2.

3) Employees can “Claim dependents” dollars in Step 3 to assist with withholding

calculations.

4) Employees can list “Other income” dollars in Step 4a to assist with withholding

calculations.

5) Employees can list “Deductions” in Step 4b to assist with withholding calculations.

NOTE: Employee “Extra

withholding” in Step 4c will use

the EXISTING Special FIT and FIT $ or % fields.

NOTE:

The NEW 2020 W4 no longer allows

option for employees to claim dependents for filing. This

is now handled on the 2020 W4 in Step 3 using dependent amount for tax

calculation.

If an

employee’s 2020 W4 fields (2, 3, 4a, 4b) contain data, the Dependents field in

employee file MUST BE 0 (zero

dependents). If data is entered in the Dependents

field during W4 entry, and data is also entered

in new

fields 2, 3, 4a and/or 4b, an error message will prevent you from proceeding

with entry.

WARNING:

You can NOT pay an employee

in 2019 with NEW 2020 W4 tax

setup. You will receive a warning

message during entry in employee file (entry of tax information allowed in

2019), but if you attempt to create a timesheet in a 2019 payroll the batch will

NOT pass edit.

REVIEW IRS WEBSITE

FOR FULL DETAILS: Visit this IRS website to understand

implementation, compliance responsibilities, logic and rules for the NEW 2020

W4 form for your current and future employees.

2020 W4 form: https://www.irs.gov/pub/irs-pdf/fw4.pdf

The following is a list of the different features described in this documentation:

How to Enter or Change an Employee

Last Name, First

Address

City, State, Zip

Area Code/Phone

Branch

Division

Status

Category

Home Location

Interviewer

Counselor

Interview Date

1, 2, 3, 4

Minimum $

Source

Education

Birth date

Parsed name fields

Spouse

Email address

Alternate

Emergency

Cell

Pager

Customized fields

Next date/code

Last date/code

EIN or SS#

2020 W4 Box 2

2020 W4 Step 3

2020 W4 Step 4a

2020 W4 Step 4b

Status

Dependents

Special FIT

FIT $ or %

SUTA

State

Local(s)

SDI

NA?

Today, Future, No Change

Available Date

HOW TO

ENTER OR CHANGE AN EMPLOYEE

Change:

Making changes to existing employee files is very similar to adding new files. When you enter an existing social security number, rather than displaying a blank data entry screen, the system will display the person's current file.

With the employee file displayed, advance (tab or point and click) to the fields you wish to change. BE VERY CAREFUL NOT TO BLANK OUT FIELDS AS YOU MOVE THROUGH THEM.

When making changes to an employee file, you must click [Continue] or [Finish] to retain the changes made to the employee file. If you exit the employee file by clicking [Back], [Close], or [Exit] your changes will NOT be retained. If you select an option to exit without saving changes, a warning message will display.

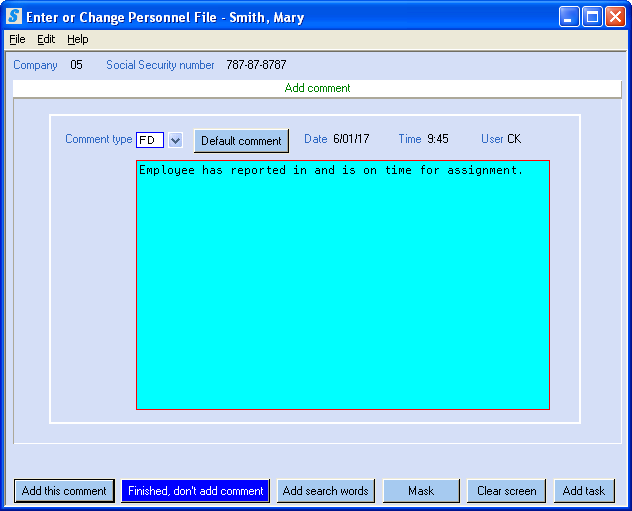

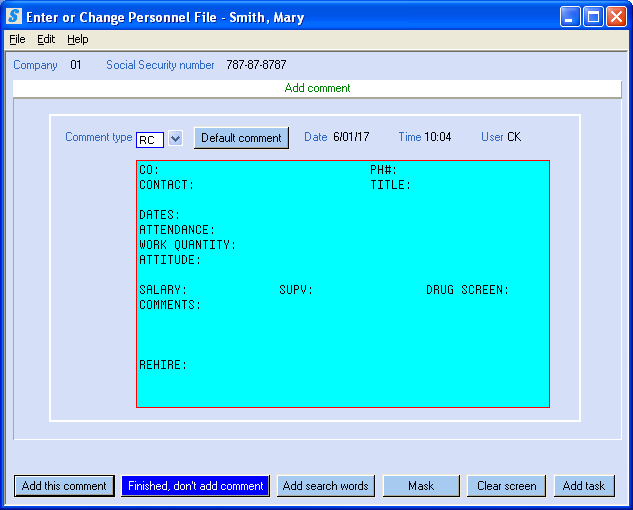

(The

system keeps track of all permanent data entry changes in an employee

file: Every time the file is changed

through data entry, a comment is written to the person’s Activity Comment

screen. It is dated and timed, shows the

user making the change, and shows what the information was before and after the

change. These comments are designated as

“changes to file” comments and have a comment type of “#*”).

Delete:

Deleting an employee file is NOT allowed. Instead, you should use the social security number merge feature to transfer data from an incorrect number to one that is accurate. The system will not allow you to delete/remove a person in social security merge who has earnings in the current year.

If a person has been paid under the wrong social security number, or, if a person is in the system multiple times (with 2 or more social security numbers), you should process a social security number merge to merge the data from the incorrect social security number file into a file using the correct social security number. (Please refer to online documentation, Library Pay and Bill, Menu End-of-Year, Item Go to Social Security Merge Processing).

NOTE: Employees with a status of ‘D’ (Do not

use) or ‘F’ (File and Forget) cannot be added to Job orders. We recommend you change employees to one of

these status codes to prevent them accidentally being paid.

NOTE: Only one person may access an employee file

at a time for purposes of making changes.

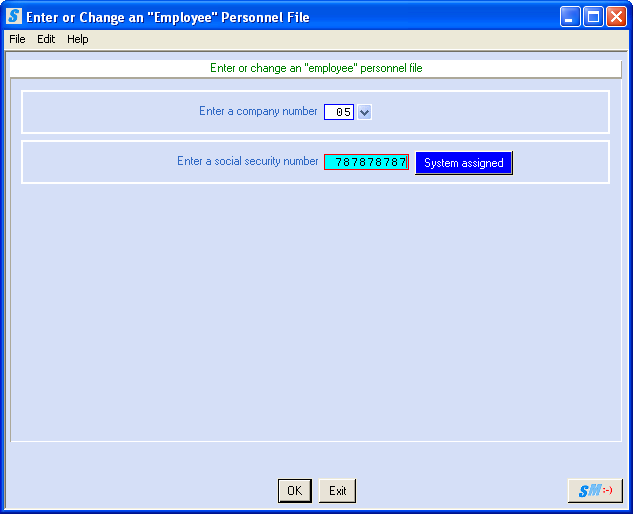

Add/Change:

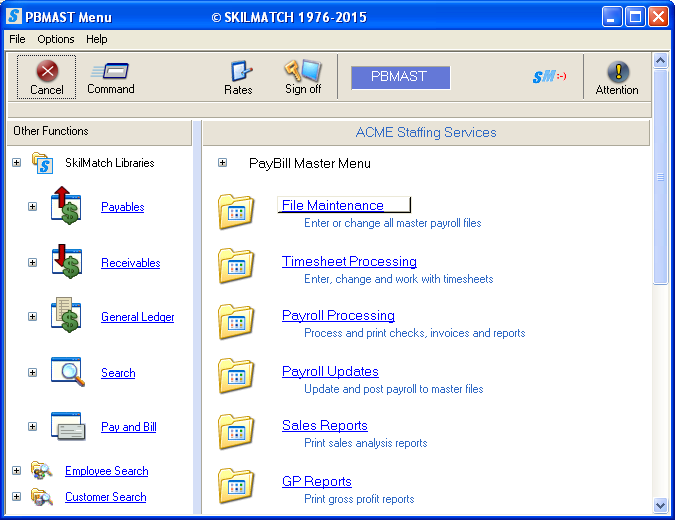

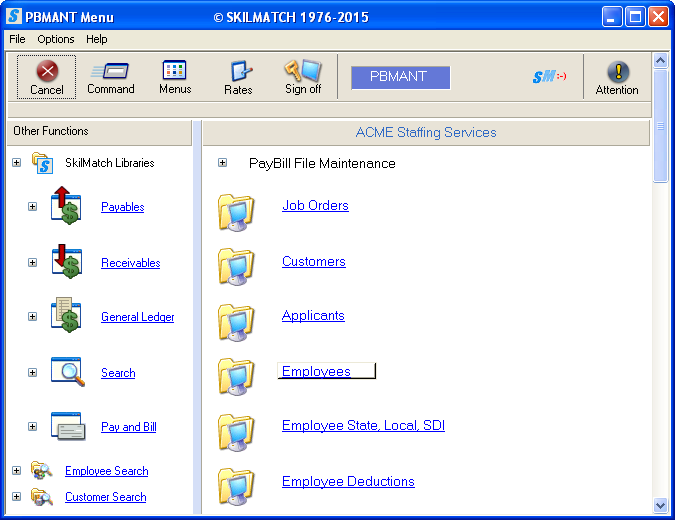

To begin, select the [File Maintenance] menu in the Pay and Bill library.

Select [Employees].

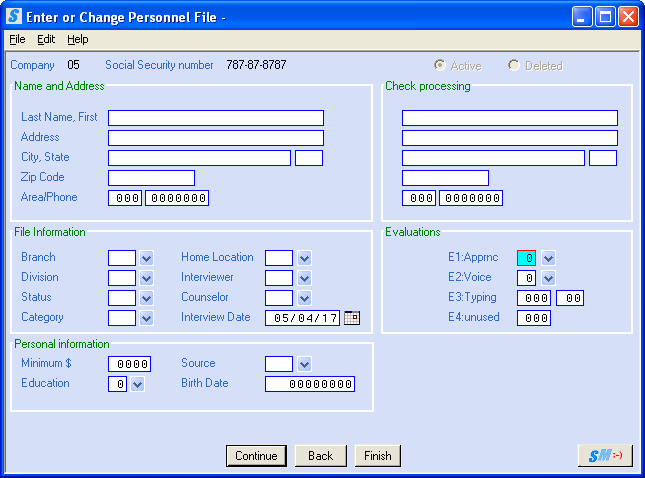

The screen will display:

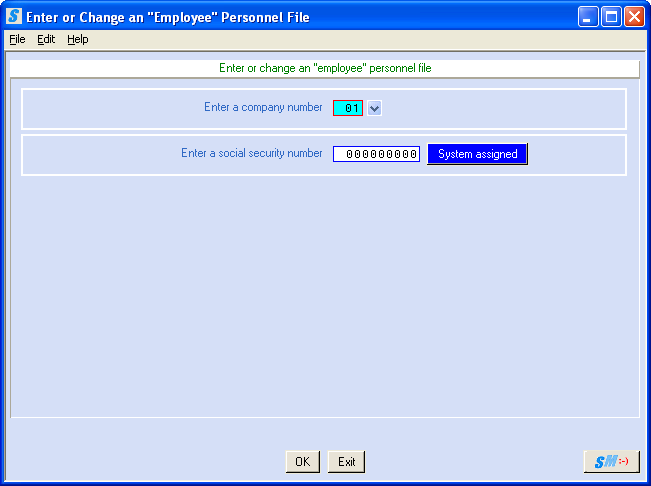

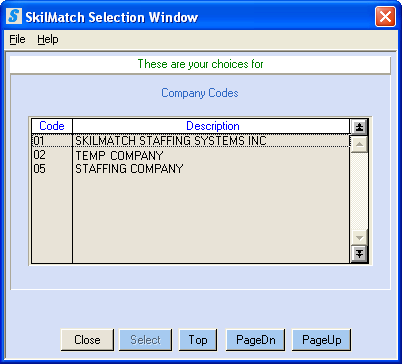

Enter A Company Number:

The system will default to Company 01. To enter/change an employee file in another company, key the desired Company Number.

OR

Starting with a blank field, select a Company

Number by clicking the ![]() button (prompt and select) to choose from a

full list of valid Company Numbers.

button (prompt and select) to choose from a

full list of valid Company Numbers.

NOTE: The feature ![]() “prompt and select” button throughout employee

entry allows users to access a list of

codes available for designated field. A

blank field is required for a full list of valid code options. If this field already contains a character(s),

the system will search by that character(s) and will give you a sorted list

based on the text in the field.

“prompt and select” button throughout employee

entry allows users to access a list of

codes available for designated field. A

blank field is required for a full list of valid code options. If this field already contains a character(s),

the system will search by that character(s) and will give you a sorted list

based on the text in the field.

The screen will display:

When you see the company code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the company code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

NOTE: You are restricted to adding and/or changing

employee files that belong to the company number(s) to which you have been

authorized.

Enter A Social Security Number:

Key the social security number of the person you wish to add/change. Remember, only one person can work with an employee file at a time. If someone is making a change to the person’s file, you will be denied access to the file until the other person is finished.

NOTE: If you are adding a

special employee file for "Open order", “Cancelled order”, “Unfilled

order”, etc… the social security number

must be less than 10,000 (000-00-9999 or lower).

NOTE: If you are adding a

special employee file for anything other than "Open order",

“Cancelled order”, “Unfilled order” (like non-employees or vendors who are

being paid through the payroll, or non-employees who have images-like

timesheets or maps attached to their file), the social security number must be

between 10,000 and 99,999. (000-01-0000

through 000-09-9999)

System Assigned:

Auto-creation of ‘social security numbers’ – You may now have the system assign a ‘social security number’ (SSN) to an applicant or employee file. While this feature is intended for use in the new Applicant Tracking System (ATS), and the new SkilMatch interface ATS.connect, it can also be used outside ATS in your real database of employees.

WARNING: This feature

is designed for Applicant Tracking System (ATS/ATS.connect)

interface and is NOT recommended for a real payroll company. You would not want to discover at the end of

a year that you have been paying an employee with an “assigned” number rather

than a real social security number (SSN).

A social security merge will need to be processed if a system assigned

number is used and an employee needs to be changed to a valid SSN.

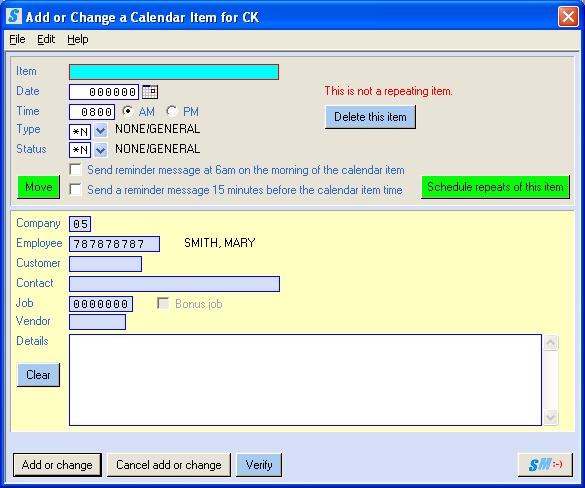

During data entry, instead of keying a real SSN, click the [System Assigned] button. If the company number displayed has been set up to allow this feature, or is an ATS or ATS.connect company, then the system will assign a unique number greater than 10000.

NOTE: If you want to use the “system assigned” SSN feature in a regular payroll company, it must be activated in the Payroll System Requirements file.

To cancel and return to the main menu, click [Exit].

OR

To proceed with entering/changing the employee file, click [OK].

If the social security number is already on file and if you are allowed to make file “changes” from this option, the system will display the file that belongs to the social security number entered.

OR

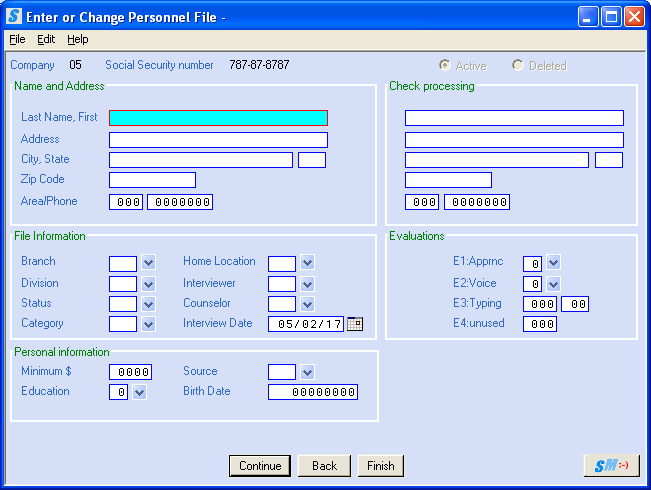

If the social security number is not on file, the screen will display a new blank employee file to be completed:

Active/Deleted:

This area is grayed out.

You are not allowed to delete an employee file. If the social security has been entered

incorrectly, this record can be ‘merged’ over to a correct social security

number.

NOTE:

If this is a NEW file and you see the social security number has been

keyed “incorrectly” for a new employee, click [Back] to exit without saving the file

and repeat the above steps with the correct social security number. At anytime during the creation of this

employee file, you can exit without saving the information keyed. However, once you select [Finish], the data will be saved to the new employee file and the only

way to change employee data to correct SSN is through a SS merge.

(REQUIRED) Key up to 25 characters of the last name and the name the person prefers to be called.

(William may prefer to be called Bill, Margaret may prefer Peggy, or the person may go by their middle name – James Douglas may go by Doug). This name will be used for search purposes, and will print on some reports, but will not be used for printing payroll checks, customer invoices, SUTA or W-2 reporting.

To follow postal regulations, DO NOT TYPE PERIODS in a person’s name.

Key the name using the following format:

Last name (comma) (space) first name

OR

Last name (comma) (space) nickname

Examples:

Smith, William

Smith, Bill

If the person has a family name, key the designation AFTER the First Name, otherwise the name will not alphabetize correctly on reports:

Smith, Bill Jr (Omit punctuation)

Smith, Bill III (Omit punctuation)

If there is another space keyed after the FIRST name, then the system will consider this a MIDDLE name.

Example:

Smith, Mary Jane (Smith is the LAST NAME, Mary is the FIRST NAME, and JANE is the MIDDLE NAME)

Address (left side):

Key the person’s residential address (where the person lives). The address entered will be used for dispatching. To follow postal regulations, OMIT PUNCTUATION AND USE STANDARD POSTAL ABBREVIATIONS in an address.

City (left side):

Key the person’s city of residence. The city entered will be used for dispatching. To follow postal regulations, OMIT PUNCTUATION AND USE STANDARD POSTAL ABBREVIATIONS in an address.

(If you are entering several employee files, one after the other, the city used for the previous entry will be displayed. You may leave the city as shown, or key the correct city.)

State (left side):

Key the person’s state of residence. The state entered will be used for dispatching. To follow postal regulations, key the proper state abbreviation and OMIT PUNCTUATION.

(If you are entering several employee files, one after the other, the state used for the previous entry will be displayed. You may leave the state as shown, or key the correct state.)

Zip Code (left side):

Key the residential address zip code. The zip code entered will be used for dispatching. To follow postal regulations, use the 9-digit zip code if known (entered without punctuation).

Area Code (left side):

Key the area code of the person’s primary phone number.

(If you are entering several employee files, one after the other, the area code used for the previous entry will be displayed. You may leave the area code as shown, or key the correct area code.)

Phone (left side):

Key the person’s primary phone number. Omit punctuation (do not insert a dash).

Last Name, First (right side/check processing):

The name keyed in this area should match the name on the employee’s social security card. This name will print on paychecks, W-2s and customer invoices.

OR

If this name is exactly the same as the name keyed in the left-side name area, leave this area blank and the system will copy the left-side name into this area for you.

Address (right side/check processing):

If paychecks and W-2s are to be mailed to the same address keyed in the left-side address area, leave this area blank and the system will copy the left-side address to this area for you.

OR

Key the person’s mailing address. To follow postal regulations, OMIT PUNCTUATION AND USE STANDARD POSTAL ABBREVIATIONS in an address.

City (right side/check processing):

If paychecks and W-2s are to be mailed to the same city keyed in the left-side city area, leave this area blank and the system will copy the left-side city to this area for you.

OR

Key the mailing address city. To follow postal regulations, OMIT PUNCTUATION AND USE STANDARD POSTAL ABBREVIATIONS in an address.

State (right side/check processing):

If paychecks and W-2s are to be mailed to the same as the state keyed in the left-side state area, leave this area blank and the system will copy the left-side state to this area for you.

OR

Key the mailing address state.

Zip Code (right side/check processing):

If paychecks and W-2s are to be mailed to the zip code keyed in the left-side zip code area, leave this area blank and the system will copy the left-side zip code to this area for you.

OR

Key the mailing address zip code. The zip code entered will appear on paychecks and W-2s. To follow postal regulations, use the 9-digit zip code if known (entered without punctuation).

Area Code (right side):

Phone (right side):

The area code and phone number keyed on the right side generally go with the address on the right side. If both the left and right side addresses are identical, then you may use this as a second phone number. (Remember that the next screen of data entry has designated fields for alternate, emergency, cell and pager phone numbers.)

OR

If the area code of the person’s secondary phone number is exactly the same as the area code keyed in the left-side area code area, leave this area blank and the system will copy the left-side area code to this area for you.

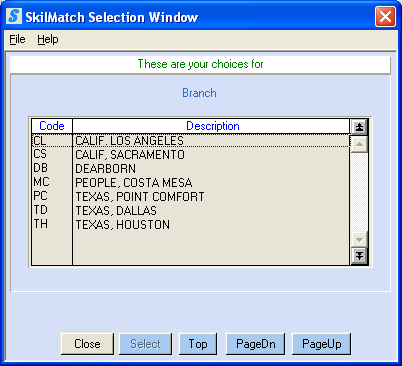

(REQUIRED) Key the Branch office where this person registered.

(If you are entering several employee files, one after the other, the Branch office used for the previous entry will be displayed. You may leave the Branch office as shown, or key the correct Branch office.)

OR

Starting with a blank field, select a Branch by

clicking the ![]() button (prompt and select) to choose from a

full list of valid Branch codes.

button (prompt and select) to choose from a

full list of valid Branch codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

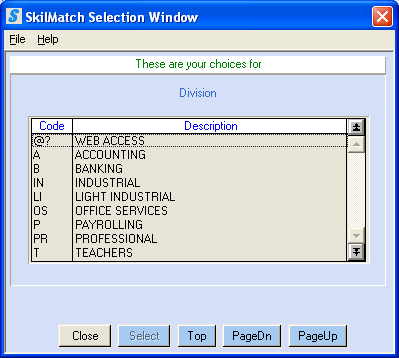

Division:

(REQUIRED) The Division, if used according to SkilMatch standards, reflects the type of position a person is seeking (office clerical, industrial, technical, etc.).

Key a valid Division code.

OR

Starting with a blank field, select a Division code

by clicking the ![]() button (prompt and select) to choose from a

full list of valid Division codes.

button (prompt and select) to choose from a

full list of valid Division codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

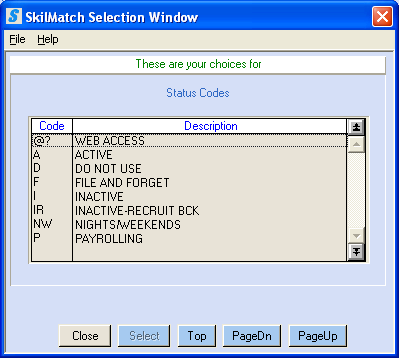

Status:

(REQUIRED) The Status, if used according to SkilMatch standards, should reflect the job-seeking status of a person (active, inactive, do not use, and more). This is NOT the area in which to track day-to-day availability.

NOTE: Employees with a status of ‘D’ (Do not

use) or ‘F’ (File and Forget) cannot be added to Job orders.

Key a valid Status code.

OR

Starting with a blank field, select a Status code

by clicking the ![]() button (prompt and select) to choose from a

full list of valid Status codes.

button (prompt and select) to choose from a

full list of valid Status codes.

The screen will display.

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

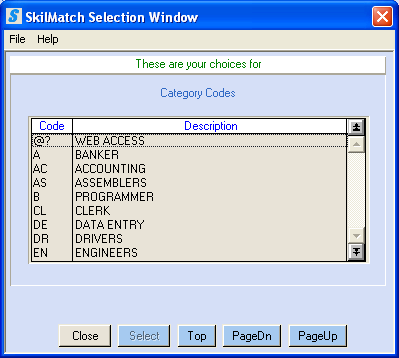

Category:

(REQUIRED) The Category, if used according to SkilMatch standards, should reflect the general kind of position a person is seeking (secretarial, accounting, skilled labor, unskilled labor, etc.).

Key a valid Category code.

OR

Starting with a blank field, select a Category code

by clicking the ![]() button (prompt and select) to choose from a

full list of valid Category codes.

button (prompt and select) to choose from a

full list of valid Category codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

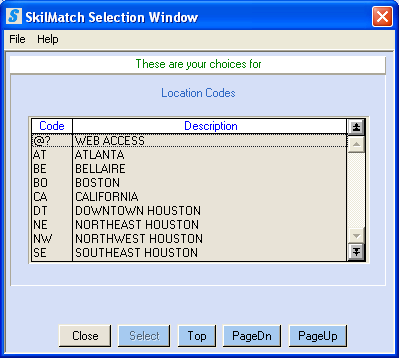

Home Location:

(REQUIRED) The Home location, if used according to SkilMatch standards, should reflect the area where the person lives (not were they are willing to work). The information entered will assist you in filling orders by allowing you to search for people who live in a specific area.

Key a valid Home Location code

OR

Starting with a blank field, select a Home Location

code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Home Location codes.

button (prompt and select) to choose from a

full list of valid Home Location codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

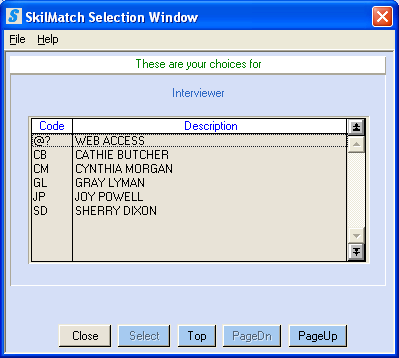

Interviewer:

(REQUIRED) The Interviewer, if used according to SkilMatch standards, should reflect the staff person who conducted the interview. The information entered will be used in some reports (interviewer summary report, gross profit reports sorted by interviewer, etc.).

Key a valid Interviewer code.

OR

Starting with a blank field, select an Interviewer

code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Interviewer codes.

button (prompt and select) to choose from a

full list of valid Interviewer codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Counselor:

If your organization assigns a Counselor to each employee, then you will use this area. Generally a Counselor is assigned only if you have staff that do direct hire placements only. If your employees are not assigned to work with specific staff member, then the Counselor should reflect the staff member who “is responsible” for the person. This information is for display purposes only. It will not be used in any search nor will it be used in reports (unless this information is used in custom reports).

Key a valid Counselor code.

OR

Starting with a blank field, select a Counselor

code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Counselor codes.

button (prompt and select) to choose from a

full list of valid Counselor codes.

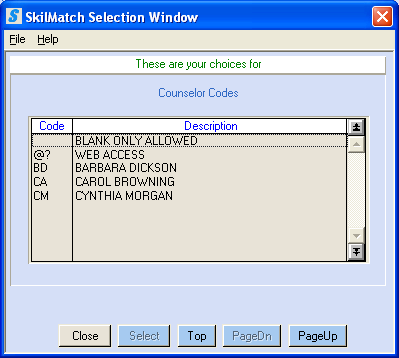

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Interview

Date:

The interview date, if used according to SkilMatch standards, should reflect the date the person was interviewed or the person’s application date (your organization should define this for you). The information entered may be used in reports (interviewer summary report, etc.).

The interview date will default to today’s date.

OR

The date may be keyed in MMDDYY format (without punctuation).

OR

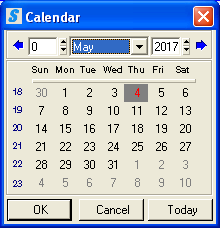

Select date by

clicking the ![]() button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

There are 4 areas for evaluation of employees. Each of the E1-E4 headings can be customized by your organization to better define what is being evaluated. These headings are created on the Codes menu, User Defined Headings.

Sample data entry screen with customized

Evaluation headings:

E1: Eval 1

(i.e. Apprnc – Appearance):

(Your organization may have selected a customized heading to display rather than “Eval 1/Apprnc”)

Evaluation 1 is an optional area that, if used, is “user defined”. Your organization defines what is being evaluated, and what your selections will be. Examples might be image (appearance), quality of speaking voice, attitude, overall internal grading score, and more.

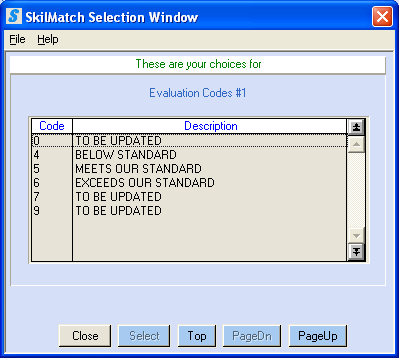

Key a valid Evaluation code.

OR

Starting with a blank field, select an Evaluation

code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Evaluation 1 codes.

button (prompt and select) to choose from a

full list of valid Evaluation 1 codes.

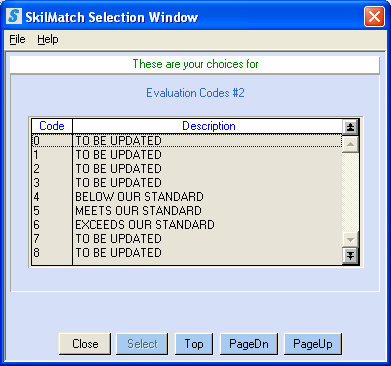

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

E2: Eval 2

(i.e. Voice):

(Your organization may have selected a customized heading to display rather than “Eval 2”)

Evaluation 2 is an optional area that, if used, is “user defined”. Your organization defines what is being evaluated, and what your selections will be. Examples might be image (appearance), quality of speaking voice, attitude, overall internal grading score, and more.

Key a valid Evaluation code

OR

Starting with a blank field, select an Evaluation

code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Evaluation 2 codes.

button (prompt and select) to choose from a

full list of valid Evaluation 2 codes.

The screen will display:

E3: Eval 3

(i.e. Typing):

(Your organization may have selected a customized heading to display rather than “Eval 3”)

Evaluation 3 is an optional area that, if used, is “user defined”. Your organization defines what is being evaluated. Evaluation 3 has two areas – one holds 3 numbers (0-999) and the second area holds 2 numbers (0-99). It is typically used for typing score with number of errors or years of experience/years in specialty. Your organization should define the use of this area and valid options for you.

Key an Evaluation 3 figure.

E4: Eval 4

(i.e. unused):

(Your organization may have selected a customized heading to display rather than “Eval 4”)

Evaluation 4 is an optional area that, if used, is “user defined”. Your organization defines what is being evaluated. If this area is being used, you may select from 0 to 999. Your organization should define the use of this area and valid options for you.

Key an Evaluation 4 figure.

Minimum $, if used according to SkilMatch standards, should reflect the lowest pay amount a person is willing to accept. The information entered will assist you in filling orders by allowing you to search for people who have salary requirements less than a specific amount or within a specific range. This area may reflect an hourly, monthly, or annual rate; however, it is important that the compensation reflected in this area be consistent throughout your company. Your organization should define this for you.

Key the minimum compensation required by this person. Do not key a decimal point, but do key zeroes to hold decimal places. (Example: $10.00 keyed as 1000; $15.50 keyed as 1550).

Source:

(REQUIRED) The Source, if used according to SkilMatch standards, should reflect how this person became aware of your organization. The information entered may be used in reports (sources summary report, advertising sources report).

Key a valid Source code

OR

Starting with a blank field, select a Source code

by clicking the ![]() button (prompt and select) to choose from a full

list of valid Source codes.

button (prompt and select) to choose from a full

list of valid Source codes.

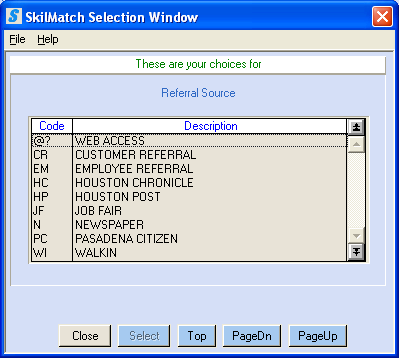

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Education:

The education level should reflect the highest level of education attained by the person. The information entered will assist you in filling orders by allowing you to search for people who have education levels at or above a specific level.

Key a valid Education code

OR

Starting with a blank field, select an Education

code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Education codes.

button (prompt and select) to choose from a

full list of valid Education codes.

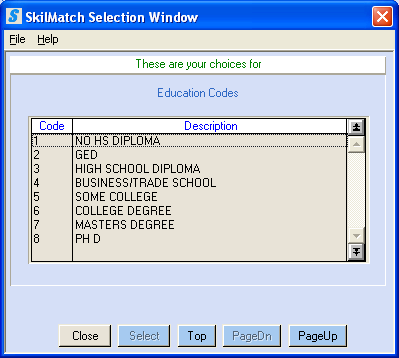

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Birth Date:

You may key all zeroes for the birth year if you do not wish to enter the actual year. When an employee file is displayed in Search, the birth year does not display. You do not have access to discriminatory information (age) when making hiring decisions.

The information entered may be used in reports. (The birthday report may be used to send birthday greetings to current employees or to send birthday greetings as a re-recruiting tool to previous employees. The employee list report can be used to identify 401K qualifiers, among other things).

The birth date must be keyed in MMDDYYYY format (without punctuation).

To proceed with data entry of this employee, click [Continue].

OR

To cancel without saving changes and return to main menu, click [Back]. A warning message will display, all information keyed to this point will NOT be saved.

OR

If this is an existing file being changed (not a new file), and the desired changes were made on this screen, you may click [Finish] to update the file with the change(s) and exit from this employee file.

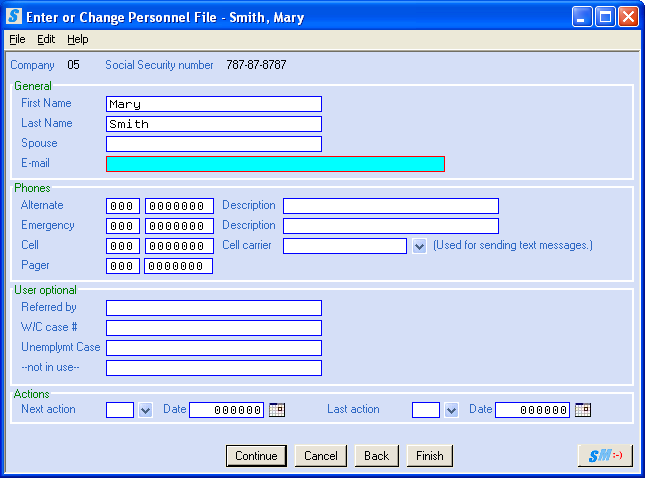

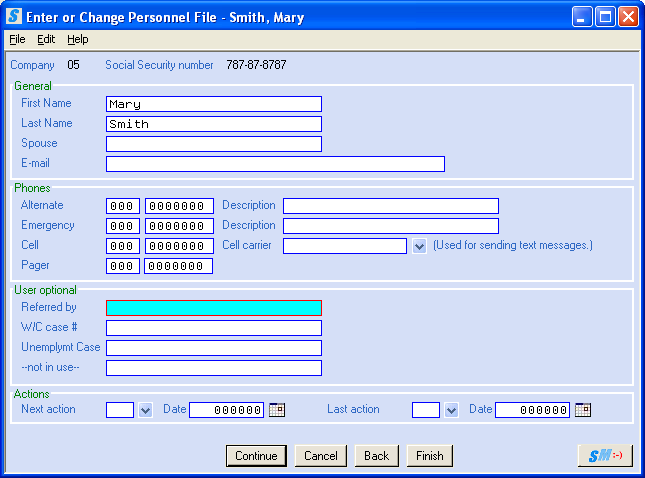

If you select [Continue], the screen will display:

Explanation of First name and Last name:

When the person is first added, the system will automatically ‘parse’ the Last name and First name that was keyed on the LEFT side of the previous screen. It will disregard any middle name. If you decide to modify the parsed Last name or First name, these changes will be retained until a change is made to the left-side Name on the first page of the Employee file.

The system looks at placement of the comma and various spaces to determine which characters make up the Last name, the First name, and the middle name (if any). Example: SMITH, MARY ANN (Smith is the LAST name, Mary is the FIRST name, Ann is the MIDDLE name)

All characters to the left of the comma are considered the LAST NAME, regardless of any additional spaces.

Example: SMITH JONES, MARY ANN (Smith Jones is the LAST name, Mary is the FIRST name, Ann is the MIDDLE name)

Characters immediately following the comma/space, and up to another space, are considered the employee’s FIRST NAME.

Example: SMITH, MARY ANN (Smith is the LAST name, Mary is the FIRST name, and Ann is the MIDDLE name)

If there is another space, then the system will consider the remaining characters to be a MIDDLE NAME.

Example: SMITH, MARY ANN (Smith is the LAST name, Mary is the FIRST name, Ann is the MIDDLE name)

First Name:

The system will display the portion of the left-hand FIRST NAME area (keyed on first screen) that is after the comma/space. The left-hand name is automatically parsed (separated) into individual first and last names for mail merges and mailing labels. If you do want to use the name as it displays, you may change the First name. In the example above, the person may prefer to be called Mary Ann. The system will have disregarded the ANN as a middle name, so you must manually change the area to read Mary Ann. This name may also be in upper/lower case depending on the selection made in the Payroll System Requirements file.

Last Name:

The system will display the portion of the left-hand LAST NAME area (keyed on first screen) that is before the comma/space. The left-hand name is automatically parsed (separated) into individual first and last names for mail merges and mailing labels. This name may also be in upper/lower case depending on the selection in the Payroll System Requirements file.

Spouse:

If desired, you may keep the name of the employee’s spouse in this area. You may key up to 25 letters or numbers of the name.

E-mail:

If desired, key the employee’s email address. This field is case-sensitive. If you display the email address while in the Name search, and if your system uses Outlook Express, then the system will open Outlook for you and the employee’s email address will have been brought over.

NOTE: Email can be included in reports and it is extremely useful to record this information if it is available.

NOTE-EOY Processing: The employee’s email is used in the distribution of Affordable Care Act Form 1095C. It will save you time and cost to include the employee’s email in their file.

Complete, if desired, the following phone number information about the employee.

Alternate/Description:

If desired,

key an alternate phone number for the employee.

Key the area code, then press <TAB> to

move to the 7-digit phone number field.

Do not key dashes or slashes in the phone number.

AND

Press <TAB> to key a description of this phone number (like Mrs. Jones, mother; or Betty

Smith, friend).

Emergency/Description:

If desired,

key an emergency phone number for the employee.

Key the area code, then press <TAB> to

move to the 7-digit phone number field.

Do not key dashes or slashes in the phone number.

AND

Press <TAB> to key a description of this phone number (like Mrs. Jones, mother; or Betty

Smith, friend).

Cell:

If desired, key the employee’s cell phone number. Key the area code, then press <TAB> to move to the 7-digit phone number field. Do not key dashes or slashes in the phone number.

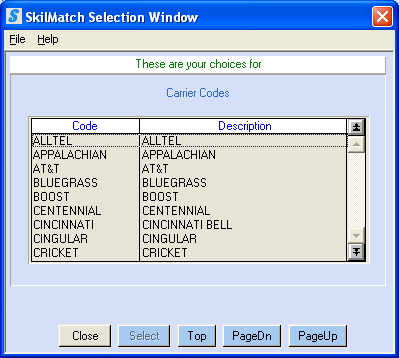

Cell Carrier:

This option is used for the Text

Messaging Interface.

You must select from a full list

of valid cell carriers by clicking the ![]() button (prompt and select) to the right.

button (prompt and select) to the right.

REVIEW CAREFULLY, this function working properly depends on accurate information keyed into cell and cell carrier fields.

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Pager:

If desired, key the employee’s pager number. Key the area code, then press <TAB> to move to the 7-digit phone number field. Do not key dashes or slashes in the phone number.

USER

OPTIONAL (Applicant Optional 1-4)

Your organization may have selected customized headings to

display rather than “Appl User 1 – Appl User 4” that better describe the use of

the areas. These headings are created on

the menu Codes, item User Defined Headings.

NOTE: If your company has purchased the PSO (Pay Stub Online) and/or iWebTime interface and it is active on your system, the interface will use one of the User Optional fields to store the employee password that allows employees’ access to their records online. The field that contains the code SMWEBTMPW will be followed by a space and then the employee’s current password (i.e. SMWEBTMPW SAMPLEPW). The password is ONLY the SAMPLEPW portion.

Sample screen with customized User Optional headings:

Appl User 1 (i.e. Referred by):

(Your organization may have selected a customized heading to display rather than “Appl User 1”)

Appl User 1, if used, means your organization has defined the use of this area and the information to be keyed in this area. Key up to 25 letters or numbers associated with the heading. (For example, if the heading reads REFERRED BY, then you should key the name of the person who referred the employee)

Appl User 2 (i.e. W/C case #):

(Your organization may have selected a customized heading to display rather than “Appl User 2”)

Appl User 2, if used, means your organization has defined the use of this area and the information to be keyed in this area. Key up to 25 letters or numbers associated with the heading. (See example listed in Appl User 1)

Appl User 3 (i.e. Unemplymt Case):

(Your organization may have selected a customized heading to display rather than “Appl User 3”)

Appl User 3, if used, means your organization has defined the use of this area and the information to be keyed in this area. Key up to 25 letters or numbers associated with the heading. (See example listed in Appl User 1)

Appl User 4 (i.e. -not in use-):

(Your organization may have selected a customized heading to display rather than “Appl User 4”)

Appl User 4, if used, means your organization has defined the use of this area and the information to be keyed in this area. Key up to 25 letters or numbers associated with the heading. (See example listed in Appl User 1)

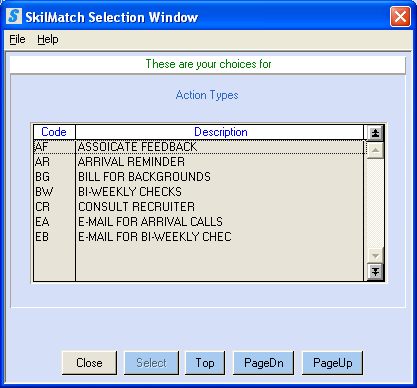

Use the Last

and Next action dates and types to produce the Action

report (Library Search, Menu Employee Reports), or for visual reminders to take some type of action

with an applicant (Action report, AP708).

Next Action/Date - Last Action/Date:

If the date areas are left with all zeros (no date selected), then the code areas may be left blank also, even if “blank” is not a valid selection.

Key a valid Action code.

OR

Starting with a blank field, select an Action code

by clicking the ![]() button (prompt and select) to choose from a

full list of valid Action codes.

button (prompt and select) to choose from a

full list of valid Action codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Date:

The date may be keyed in MMDDYY format (without punctuation).

OR

Select date by

clicking the ![]() button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

To proceed with data entry of this employee, click [Continue].

OR

To cancel without saving changes and return to main menu, click [Cancel]. All information keyed to this point will NOT be saved; you will receive a warning message.

OR

To view the previous screen before continuing, click [Back]. You will move to the previous screen while retaining the information keyed on this screen.

OR

If this is an existing file being changed (not a new file), and the desired changes were made on this screen, you may click [Finish] to update the file with the change(s) and exit from this employee file.

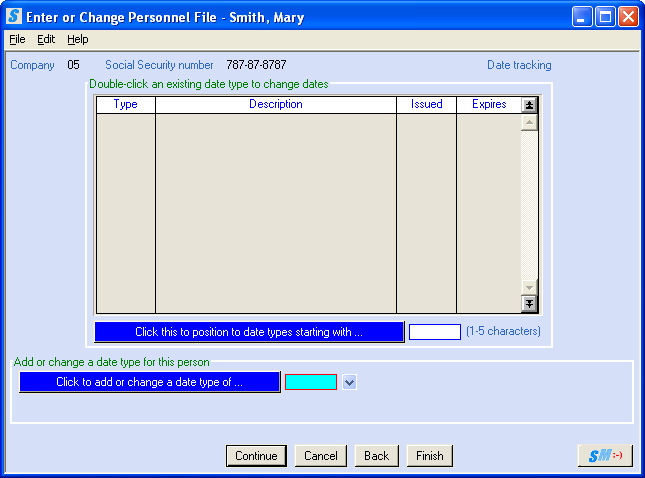

If you select [Continue], the screen will display:

You can use the system to track a variety of dates associated with an applicant/employee. The top section of this screen will display the dates that have been added to this employee’s file. The types of dates your organization tracks are pre-defined by management and added to the system though the Library Pay and Bill, Menu Maintenance, Item Date Tracking.

NOTE: The system allows you to run a report (SR341P)

on Date Tracking in Search library, Employee Reports Menu,

item Date Tracking.

If the employee has more dates than there is room to display, you may move forward to the date type by keying 1-5 characters of the date type code you are looking for and clicking the blue button [Click this to position to date types starting with….] under the current list of date type and descriptions.

ADD OR CHANGE DATE TYPE FOR THIS PERSON

Click to Add or Change Date Type of…:

To add or change a Date Type for this employee, key a valid Date Type.

OR

Starting with a blank field,

select a Date Type by clicking the ![]() button (prompt and select) to choose from a

full list of valid Date Type codes.

button (prompt and select) to choose from a

full list of valid Date Type codes.

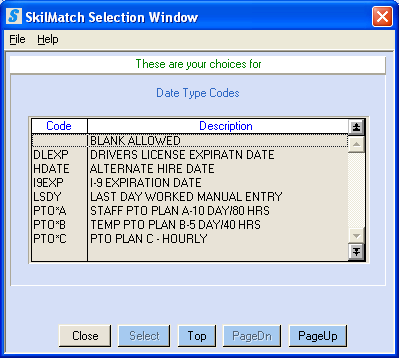

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

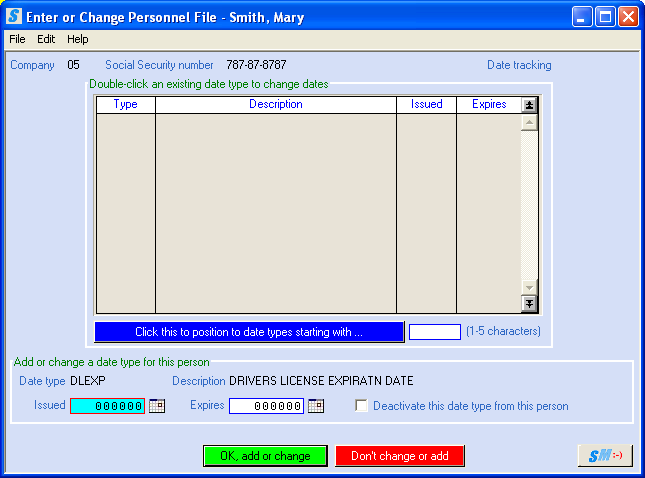

Once the Date Type is selected, the screen will display:

The system will display the date type and description you selected. The cursor is positioned at ISSUED.

Issued (date):

Many of the dates that are tracked on applicant/employees deal with licenses or certificates that are good for a designated time period. Other date types do not have a beginning and ending date, just a day of occurrence. Use the ISSUED date area to track either the date of issue, or date of occurrence.

The date may be keyed in MMDDYY format (without punctuation).

OR

Select date by

clicking the ![]() button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

Expires (date):

If this date type has an expiration date, use this area to track this date. If this date type does not have an expiration date, leave this area blank.

The date may be keyed in MMDDYY format (without punctuation).

OR

Select date by

clicking the ![]() button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

Deactivate this date type from this person:

If you no longer want to track this date type for this employee, check this box. This date type will no longer display in the employee’s file.

To cancel change or add for this date type, click [Don’t change or add]. You will go back to the Date Tracking screen.

OR

To add a new date type or to keep the changes made to this date type, click [OK, add or change]. Your add/change will be saved and you will be returned to the Date tracking screen.

REPEAT these steps to add or changed additional date types as necessary.

When you have finished adding or changing date types, choose one the options below:

To proceed with data entry of this employee, click [Continue].

OR

To cancel without saving changes and return to main menu, click [Cancel]. All information keyed to this point will NOT be saved; you will receive a warning message.

OR

To view the previous screen before continuing, click [Back]. You will move to the previous screen while retaining the information keyed on this screen.

OR

If this is an existing file being changed (not a new file), and the desired changes were made on this screen, you may click [Finish] to update the file with the change(s) and exit from this employee file.

If you chose to continue, the system will look to see whether or not Benefit Tracking is active for your organization. Benefit Tracking must be activated on the third screen of that company’s Payroll System Requirements File, located in the Pay and Bill library, File Maintenance menu, Payroll System Requirements option.

OR

If it is not active, the next screen to display will be the tax maintenance screen. Click here to move forward to the tax screen.

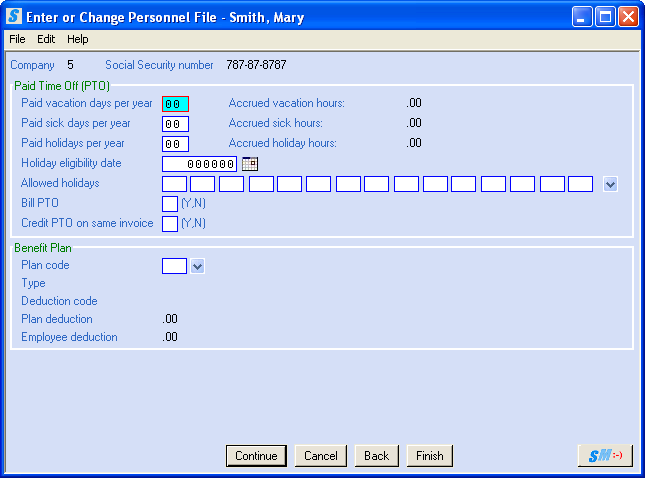

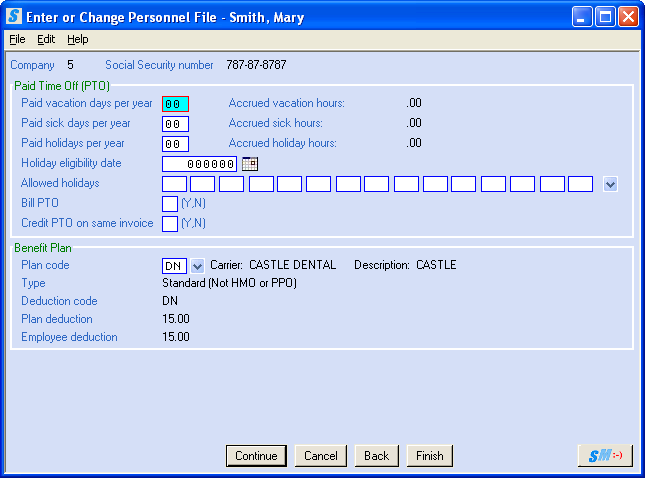

If benefit tracking is active, the following screen will display:

PAID TIME OFF

(PTO)

The system will display the number of days allowed to the employee and the number of hours accumulated toward the various paid time off benefits.

SkilMatch has added Paid Time Off (PTO) that accrues to

both the temp and staff payroll programs.

This is a totally separate function from the SkilMatch Bonus

programs. The PTO programs differ from

the Bonus programs in the following ways:

1) You predefine the exact holidays that you will pay.

2)

You designate,

by employee, the number of holidays, sick days, and vacation days to be paid

each year.

3)

This program

can automatically bill the customer, and optionally credit the customer the

same amount.

4)

Employees will accrue holiday, sick time and vacation time for each hour

worked, and calculation example below.

(The current SM bonus plan

determined eligibility based on ‘one-hour-worked-equals one-hour accumulated’.)

The accrual of PTO hours is based on the number of

PTO days allowed to an employee, the employee’s pay cycle code, the number of

hours worked in the pay cycle, and an annual work year of 2080 hours. Also, the system takes into account the paybill

history hours and looks at the total hours for a WE worked week. When an employee reaches their limit for a

pay cycle (i.e. 40 hours weekly, or 80 hours biweekly, 86.67 semi-monthly,

etc…), the system stops accruing PTO hours.

ACCRUAL

EXAMPLE:

This is for an employee paid Semi-Monthly getting 15 days of vacation

per year.

Hours per Year 52

weeks x 40 hours = 2080 hrs/yr

Vacation Hours Paid per Year 15

days X 8 hours = 120 vac hrs/yr

Worked Hours per Year 2080

hrs/yr – 120 vac hrs/yr = 1960 wk hrs/yr

Vacation Hours Accrued per Worked

Hour 120

/ 1960 = .06122 (rounds to 5 dec.)

Regular Hours for Semi Monthly

Employee 2080 hrs/yr DIV 24 pay periods = 86.67 hrs

Maximum # of Vacation Hrs that can

accrue per period 86.67 X .06122 = 5.3059 hrs

The PTO Programs are already installed and activate

on all customers’ systems. No additional

programming assistance is needed from SkilMatch.

Paid vacation days per year:

Key the number of days that the employee is eligible to be paid for vacation days. Key a number from 01-99.

Paid sick days per year:

Key the number of days that the employee is eligible to be paid for sick days. Key a number from 01-99.

Special Programming:

San Francisco (2007) - If you are subject to the San Francisco Paid Sick Leave act, you should key a 91 into this area.

(Please refer to the specific San Francisco Sick Leave instructions.)

California, Massachusetts and Oregon (2016) - special programs must be installed on your system for proper accrual, contact SkilMatch for assistance. (Please refer to the specific CA, MA, OR instructions for this option.)

Paid holidays per year:

Key the number of days that the employee is eligible to be paid for holidays. Key a number from 01-99.

Holiday eligibility date:

Key the first day the employee is eligible to receive a PTO holiday. The date may be keyed in MMDDYY format (without punctuation).

OR

Select date by

clicking the ![]() button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

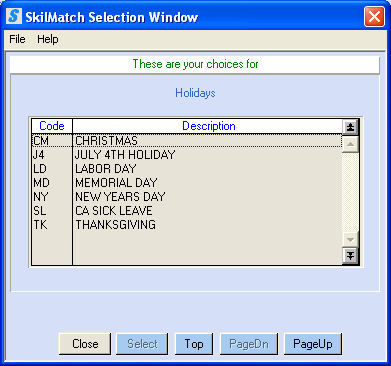

Allowed Holidays:

A set of codes representing valid holidays has been pre-defined for your organization (using the PayBill Library, File Maintenance Menu, Item Valid Holidays). Add the codes that this employee will be eligible to receive as a paid holiday.

Key a valid Holiday code.

OR

Starting with a blank field, select a Holiday code

by clicking the ![]() button (prompt and select) to choose from a

full list of valid Holiday codes.

button (prompt and select) to choose from a

full list of valid Holiday codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Repeat until you have added all the appropriate Holiday codes.

Bill PTO (Y, N):

If you want the system to automatically bill the

customer for the PTO hours being paid, key Y. During payroll, if you pay PTO

hours, and if the employee’s Benefit screen indicated that the PTO should be

billed, then you will not have to key in billing information. The system will add the billing info to the

timecard for you.

OR

Key N (No) if you do not want the customer to be billed.

If the Benefits screen is active, an error message will display if this field is left blank. A Y (Yes) or N (No) must be keyed in this field.

Credit PTO on same invoice:

If you answered Y (Yes) to bill the PTO, and if you want the system to also automatically create a credit for that same billing, key Y. During payroll, if you are paying PTO hours, you will not have to enter credit information. The system will add a timecard to the merged timesheet file for the credit. Should you delete the pay timecard from the merged file, then the system will automatically delete the credit timecard as well.

Answering Y (Yes) to both the Bill PTO and Credit PTO will, in effect, demonstrate to the customer that you are indeed paying the benefit to the employee, but without ultimately billing the customer, since both the billing and the credit will appear on the same invoice.

OR

Key N (No) if you do not want the customer to be credited for the PTO hours.

If the Benefits screen is active, an error message will display if this field is left blank. A Y (Yes) or N (No) must be keyed in this field.

BENEFIT PLAN

If you are creating a new employee file, the benefit screen will be blank.

OR

If a plan already exists for this employee, then the details of the plan will be displayed for the plan code, including the associated deduction code and amount.

Example:

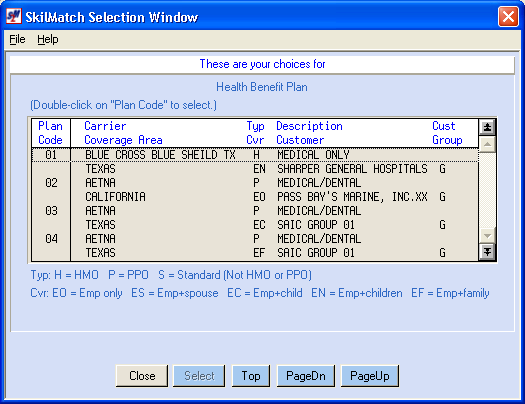

Plan code:

A set of codes representing the Health Benefit plans offered by your organization has been pre-defined (using the Pay and Bill Library, File Maintenance Menu, Item Health Benefit Plans).

If this employee will participate one of the Health Benefit plans, key a valid Health Benefit code of the plan.

OR

Starting with a blank field, select a Health

Benefit code by clicking the ![]() button (prompt and select) to choose from a

full list of valid Health Benefit codes.

button (prompt and select) to choose from a

full list of valid Health Benefit codes.

NOTE: When a health benefit code is selected and

saved in an employee file, a deduction records is “auto created by the system”

for the employee, to be withheld during payroll. This deduction can be accessed in Pay and

Bill Library, File Maintenance Menu, Item Employee Deductions. If you remove a plan code from an employee

file, the system will warn you that the deduction record for this employee will

be changed to a “9” frequency code so that it will no longer be withheld during

payroll.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

After you have selected a Health plan for the employee (if appropriate), select from the following:

To proceed with data entry of this employee, click [Continue].

OR

To cancel without saving changes and return to main menu, click [Cancel]. All information keyed to this point will NOT be saved; you will receive a warning message.

OR

To view the previous screen before continuing, click [Back]. You will move to the previous screen while retaining the information keyed on this screen.

OR

If this is an existing file being changed (not a new file), and the desired changes were made on this screen, you may click [Finish] to update the file with the change(s) and exit from this applicant file.

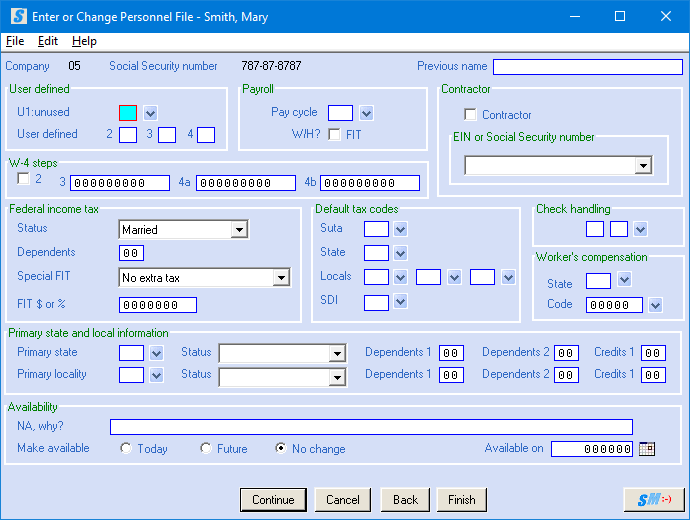

If you select [Continue], the screen will display:

Previous Name:

This area can be used to record a person’s previous name (which may prove helpful when checking prior employment history). Position your cursor in this area with “point and click” or “shift + tab”. Key the desired information as directed by your organization.

(Your organization may have selected a customized heading to display rather than “U1:User 1”)

If used, your organization has defined the use of and the information to be keyed in this area. Your organization should define the use of this area for you.

NOTE: When an employee file is displayed in Search,

User 1 is the only User Defined code displayed.

Even though it does display, this information is not “searchable”

criteria and is not included in any SkilMatch reports. As a result, this area is rarely used.

Key a valid User 1 code.

OR

Starting with a blank field, select a User 1 code

by clicking the ![]() button (prompt and select) to choose from a

full list of valid User Defined 1 codes.

button (prompt and select) to choose from a

full list of valid User Defined 1 codes.

User Defined 2

– User Defined 4:

NOTE: When an employee file is displayed in Search,

User Defined 2, 3 and 4 will NOT be displayed.

This information is not “searchable” criteria and is not included in any

SkilMatch reports.

Since these areas are NOT selection criteria on any SkilMatch search option, your organization may be using them to store sensitive EEOC information. Please obtain information about the use of these areas from your management.

The system will not validate the entries, so be very careful to key the one-character codes selected by your management.

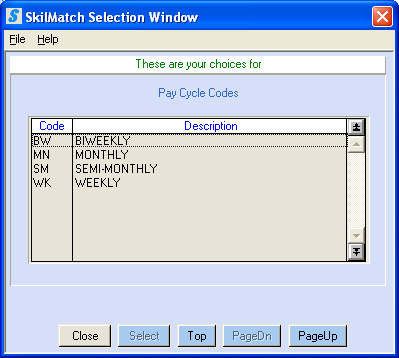

During the tax calculation part of a payroll process, an employee’s wages are “annualized”. If this G/L company has only one valid pay cycle, then the system will add the code to the employee automatically. If this G/L company has 2 or more valid pay cycle codes, then you must select a code to indicate how frequently an employee is paid (weekly, bi-weekly, monthly, etc).

Key the appropriate Pay Cycle for this person.

OR

Starting with

a blank field, select a Pay Cycle by clicking the ![]() button (prompt and select) to choose from a

full list of valid Pay Cycle codes.

button (prompt and select) to choose from a

full list of valid Pay Cycle codes.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

Defaults to Yes (checked). If this person is to have federal income tax withheld, leave the checkmark displayed.

OR

If this person is exempt from FIT, click “Withhold FIT” once to remove the checkmark.

If this person is an independent contractor and responsible for paying his/her own taxes, and you wish to pay this person through payroll, click “Contractor” once. A checkmark indicates this person is a contractor and tells the system not to withhold taxes for this person. The system will NOT withhold any federal, state or local taxes, nor will it calculate FUTA or SUTA on any payroll processed. (Contractors will receive a 1099 rather than a W2)

OR

If this person is NOT an independent contractor, but an employee of your company, leave “Contractor” unchecked.

EIN or SS#:

IF you marked this person as a Contractor, then you must indicate the number entered in the social security number area is an Employee Identification Number (EIN) or a social security number.

Select EIN or Social

Security Number by clicking the ![]() button (prompt and select) to the right of the

field.

button (prompt and select) to the right of the

field.

NEW January 2020, W4 Steps 2, 3,

4a, 4b:

NOTE: If you are entering the

tax information for new 2020 W4 tax setup (fields 2, 3, 4a, 4b), you can NOT

have a figure in the Dependents field. NEW 2020 W4 replaces dependent option with Step 3 “Claim

Dependents” figure.

WARNING:

You can NOT pay an employee

in 2019 with 2020 W4 tax setup. You will

receive a warning message during entry in employee file (entry of tax

information allowed in 2019), but if you attempt to create a timesheet in a

2019 payroll the batch will NOT pass

edit.

2 / W-4 Form Step 2:

NEW 2020

W4. Select this option if employee checks the “Step 2 box” on the 2020 W4 form, a check

mark will appear in box 2.

NOTE: Select again if you want to unselect the option, the check mark will be removed.

NOTE: Step 2 box checked “Y” requires Dependents to be 0, warning

message will display.

3 / W-4 Form Step 3:

NEW 2020

W4. Key amount employee entered on Step 3 on the 2020 W4 form. NOTE:

Step 3 entry

requires Dependents to be 0, warning message will display.

Field has total of 9 digits, two spaces to the

right of the decimal, example: $100.00

keyed as 10000.

4a / W-4 Form Step 4a:

NEW 2020

W4. Key amount employee entered on Step 4a on the 2020 W4 form. NOTE:

Step 4a entry

requires Dependents to be 0, warning message will display.

Field has total of 9 digits, two spaces to the

right of the decimal, example: $100.00

keyed as 10000.

4b / W-4 Form Step 4b:

NEW 2020

W4. Key amount employee entered on Step 4b on the 2020 W4 form. NOTE:

Step 4b entry

requires Dependents to be 0, warning message will display.

Field has total of 9 digits, two spaces to the

right of the decimal, example: $100.00

keyed as 10000.

FIT Status:

NOTE: It is not necessary to complete

this area for contractors.

NEW 2020

W4. FIT now allows filing status of Head of household

starting in 2020.

Starting with

a blank field, select a status from the drop-down box by clicking the ![]() button (prompt and select) to the right of the

FIT Status. Select from Married, Single

and Head of household.

button (prompt and select) to the right of the

FIT Status. Select from Married, Single

and Head of household.

WARNING:

You can NOT pay an employee

in 2019 with 2020 W4 tax setup. You will

receive an error message during entry in employee file (entry of tax

information allowed in 2019), but if you attempt to create a timesheet in a

2019 payroll the batch will NOT pass

edit.

FIT Dependents:

Key the number of federal dependents the person claimed on the W-4. Employees with W4 forms for 2019 and before may continue to use dependents for tax calculations.

NEW 2020

W4 no longer allows

option for employees to claim dependents for filing. This

is now handled on the 2020 W4 in Step 3 using dependent amount for tax

calculation. If an employee’s 2020

W4 fields (2, 3, 4a, 4b) contain data, the Dependents field in employee file MUST BE 0 (zero dependents). If data is entered in the Dependents field

during W4 entry, and data is also entered in new fields 2, 3, 4a and/or 4b, an

error message will prevent you from proceeding with entry.

Special FIT:

NEW 2020

W4. Employee “Extra withholding” in Step 4c will use this existing Special

FIT field and the FIT $ or %

field.

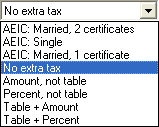

The screen will default to “No extra tax”. This option will withhold federal taxes based on the federal taxes tables only. No need to change unless employee requests custom FIT withholdings.

OR

If an employee is requesting a

custom withholding and dictating the amount or percentage of federal income tax

they prefer to have withheld, you can use this special FIT option to accomplish

custom withholding. To modify the way

federal income taxes are calculated for this employee you may select from the

options in the drop-down box by clicking the ![]() button (prompt and select) to the right. NOTE:

“Table” refers to the federal tax tables.

button (prompt and select) to the right. NOTE:

“Table” refers to the federal tax tables.

Drop down options:

AEIC options refer to Automatic Earned Income Credit payments; the opportunity to receive AEIC through payroll expired on December 31, 2010 and is no

longer available in SkilMatch. Do not select any of the first three options used for AEIC in this field. Employees must apply for AEIC when they file their

federal tax returns.

No extra tax: “No extra tax” is the default and indicates that system will use the federal tax tables ONLY with no extra withholding.

Amount, not table: If you select this option, the amount keyed into the following FIT $ or % field will be withheld for federal taxes (taxes not calculated

using the federal tax table).

Percent, not table: If you select this option, the percentage keyed into the following FIT $ or % field will be used to calculate federal taxes (taxes not

calculated using the federal tax table).

Table + Amount: If you select this option, they system will withhold the amount the federal tax table calculates as “taxes owed” PLUS and the

additional amount specified by the employee. The additional tax amount needs to be keyed into the following FIT $ or % field.

Table + Percent: If you select this option, they system will withhold the amount the federal tax table calculates as “taxes owed” PLUS and an

additional percentage of income. The additional percentage amount needs to be keyed into the following FIT $ or % field.

FIT $ or %:

NEW 2020

W4. Employee “Extra withholding” in Step 4c will use this existing FIT

$ or % field (and Special FIT field above).

This option works WITH the “Special FIT” above. If you selected a Special FIT, then key the corresponding dollar amount or percent.

DO

NOT KEY A DECIMAL POINT, BUT DO KEY ZEROES TO HOLD DECIMAL PLACES.

Example: $10.00 keyed as 1000 (field has total of 7 digits, two spaces to the right of the decimal)

5.50% keyed as 550

Default Tax Codes: Suta State

Locals SDI:

If your organization does business in one state only, and if your employees are not subject to local taxes based on where they live, leave these default tax areas BLANK. Tax codes will have been added to the Payroll System Requirements file that will be used for all employees.

OR

Key or select default Tax codes only if this employee is subject to tax codes that are different from the Payroll System Requirements file, or if local taxes are determined by where an employee lives (rather than where they work).

OR

Starting with

a blank field, select a valid Tax code from the drop-down boxes by clicking the

![]() button (prompt and select) to the right of the

tax type.

button (prompt and select) to the right of the

tax type.

NOTE: If you make a selection into any one of these

areas, then you should make selections into ALL the areas appropriate for the

employee. The system will automatically

add selections from ALL the default areas to every job order to which the

person is assigned, and will override any default that may have been set up for

the company.

NOTE: If a person is currently on assignment and

you make a change to the person’s default tax line, you must also make the same

change to ALL active job orders for this person. THE SYSTEM

DOES NOT AUTOMATICALLY CHANGE THE JOB ORDERS.

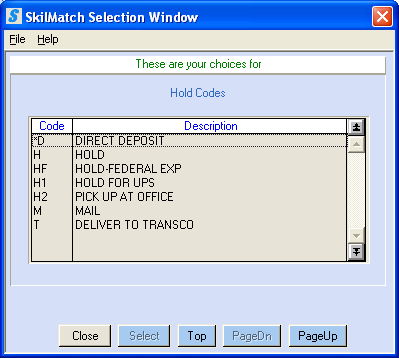

If you add a Check Handling code to the employee’s file, then the code will be added automatically to the employee’s timecard during timecard data entry.

If you do not add a Check Handling code to the employee’s file, then you will have to add one manually to the timecard during the data entry process. The Check Handling code will print on the face of the paycheck.

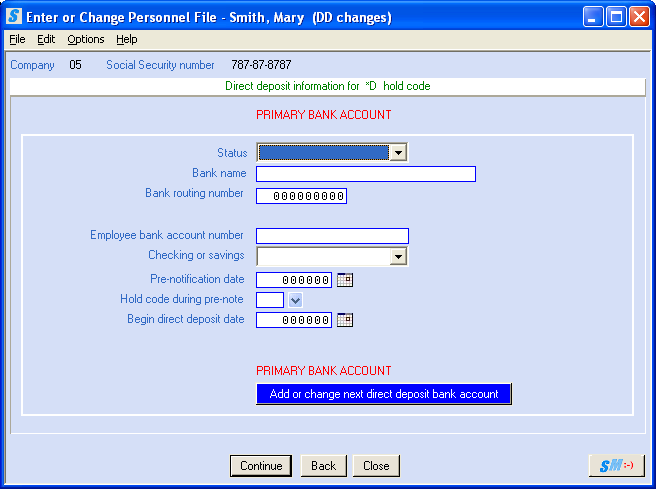

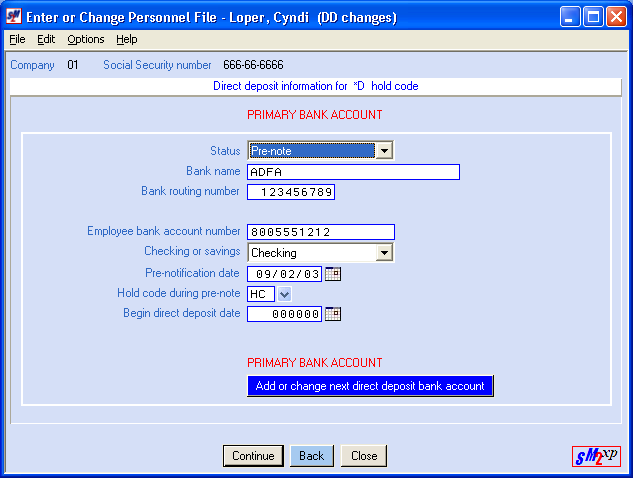

NOTE: Leave this area blank if this person’s

paycheck will NOT ALWAYS be handled the same way.

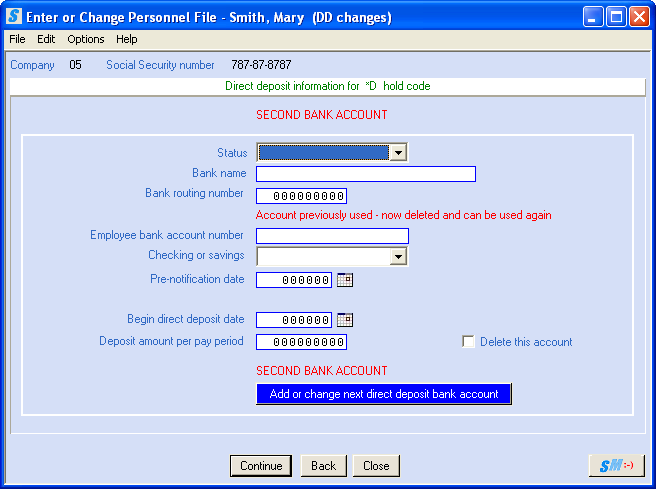

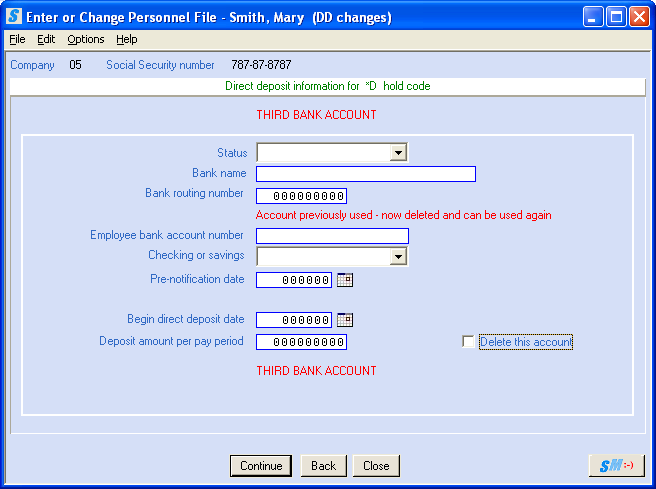

Select *D as the Check handling code if this employee is participating in Direct Deposit. If this employee later drops out of the plan, you will replace the *D with any other valid hold code. If *D is selected, then an additional screen of data entry will display once you click [Continue].

Depending on the choice made on the Payroll Constant file, paychecks may be sorted into groups by Check Handling code before being printed. The groups will then print in order by Check Handling code.

Key a valid Check handling code if you want this employee's paychecks to be handled the same way each time (mailed, delivered, held for pick up, etc).

OR

Starting with

a blank field, select a paycheck hold code by clicking the ![]() button (prompt and select) to the right.

button (prompt and select) to the right.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

NOTE: If you make a change to the Check Handling

code in the employee file AFTER a timecard has been entered for the

employee, the change will NOT have an effect the timecards. The new Check Handling code will not be used

until the next new timesheet is entered.

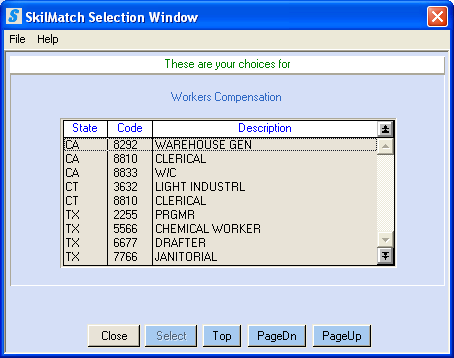

Worker’s Compensation State/Code:

These fields are generally left blank since worker’s comp is typically based on the type of work being performed on a job order, and an employee may be assigned to different types of work.

OR

If your payroll system requirements file allows it, and if this person is only to perform work under one specific workers' compensation code, then key the appropriate W/C state.

OR

Starting with

a blank field, select a workers compensation state/code by clicking the ![]() button (prompt and select) to the right. If you key a state code before clicking the

button (prompt and select) to the right. If you key a state code before clicking the ![]() button, then your selection will be limited to

the codes that are valid for that state.

If you leave both the state code and w/c code blank, then the selection

will include all codes for all states.

button, then your selection will be limited to

the codes that are valid for that state.

If you leave both the state code and w/c code blank, then the selection

will include all codes for all states.

OR

If this person is a contractor, key the special workers’ compensation state/code that has been designed specifically for contractors.

NOTE: If a W/C state/code

is entered, the combination will automatically be added to any NEW job order to

which the employee is assigned and will override any default W/C that may have

been set up for the customer. However,

if the employee’s designated W/C state and code are not on the list of approved

W/C codes in the customer file, the job order will have a terminal error until

you either remove the W/C from the employee file, or add it as valid to the

customer’s file.

NOTE: If a person is currently on assignment and you

make a change to the default W/C state/code in the employee file, you must also

make the same change to ALL active job orders for this person, if

necessary. THE SYSTEM WILL NOT AUTOMATICALLY UPDATE

EXISTING JOB ORDERS.

The screen will display:

When you see the code you wish to use, either <DOUBLE-CLICK> on the description, or highlight and click [Select]. If you do not see the code and the [PageDn] button is not grayed out, then click [PageDn] to view more. When you get to the end, [Top] will start the selections over again. If you page down past a screen of selections, and wish to go back a screen, then click [PageUp]. To not select a code, click [Close].

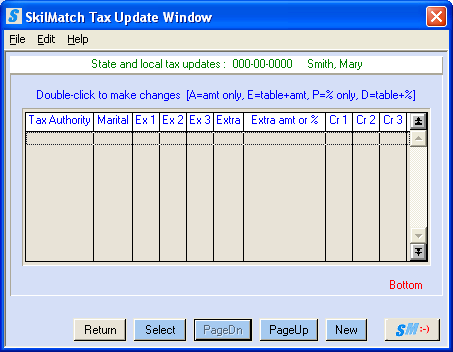

PRIMARY STATE AND LOCAL

INFORMATION

(This area will display blank even if a state or local record

was created during a previous data entry process.)

NEW 2020 W4. New programming no longer automatically creates State and Local tax buckets to match Federal withholding. Due to changes in the 2020 W4 filing status (addition of Head of household status) and dependent processing changes (dependent count no longer used in tax calculation), the system will no longer use the Federal filing status and dependents as the DEFAULT State and Local tax filing status and dependents. NOW, if NO SETUP is done for State and Local filing status during employee entry, the system will NOW default to SINGLE with 0 for State and Local tax withholding. A warning message reminding you of this will display during timesheet entry. If you do not want SINGLE with 0 for State and Local withholding, you must make the change in employee entry and then re-edit your timesheet batch.

ALWAYS

FIRST - Display the current state

record (or records) for this employee by clicking the ![]() button (prompt and select) to the right of

Primary State. You may add a new state

record or change an existing state record.

button (prompt and select) to the right of

Primary State. You may add a new state

record or change an existing state record.

If you add or change a state record through the ![]() button (prompt and select) you will notice

that there are more options available than appear on the Employee data entry screen.

Please refer to document Menu

File Maintenance, Item Employee State, Local, SDI for an

explanation of the additional options.

button (prompt and select) you will notice

that there are more options available than appear on the Employee data entry screen.

Please refer to document Menu

File Maintenance, Item Employee State, Local, SDI for an

explanation of the additional options.

The system will use any information keyed into this area to

create a new or to update an existing State or Local record for the

employee. The State record tracks not

only state income tax data, but state unemployment, and disability insurance

data as well. You must create a primary state for EACH employee

(not contractors), even if your state does not have a state income tax!

You may create or update a Primary State or a Primary

Locality by either keying the data in the areas on the screen, but we highly

recommend using the ![]() button (prompt and select),

button (prompt and select),

If no state tax records have been created, the screen will

display:

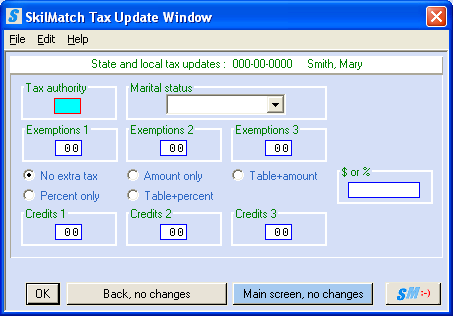

Select [New] to add a tax file, the screen will display:

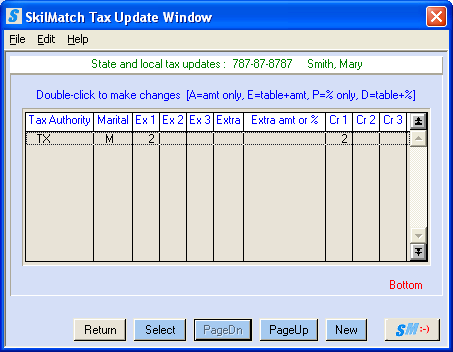

OR, if a state tax records had been previously created, the

screen will display:

Highlight and click [Select]

on a tax authority that is

already setup to update/change.

Status:

Please

verify with your accounting department how the Marital Status is used for your

state – there are special considerations for some states, including but not

limited to AZ, CT, and MD.

Click the ![]() button (prompt and select) to the right and

select from married, single, head of household, or exempt.

button (prompt and select) to the right and

select from married, single, head of household, or exempt.

NEW 2020 W4. New programming no longer automatically creates State and Local tax buckets to match Federal withholding. Due to changes in the 2020 W4 filing status (addition of Head of household status) and dependent processing changes (dependent count no longer used in tax calculation), the system will no longer use the Federal filing status and dependents as the DEFAULT State and Local tax filing status and dependents. NOW, if NO SETUP is done for State and Local filing status during employee entry, the system will NOW default to SINGLE with 0 for State and Local tax withholding. A warning message reminding you of this will display during timesheet entry. If you do not want SINGLE with 0 for State and Local withholding, you must make the change in employee entry and then re-edit your timesheet batch.

Please

verify with your accounting department how the Dependent areas are used for

each state – there are special considerations for some states, including but

not limited to AZ, CA and CT.

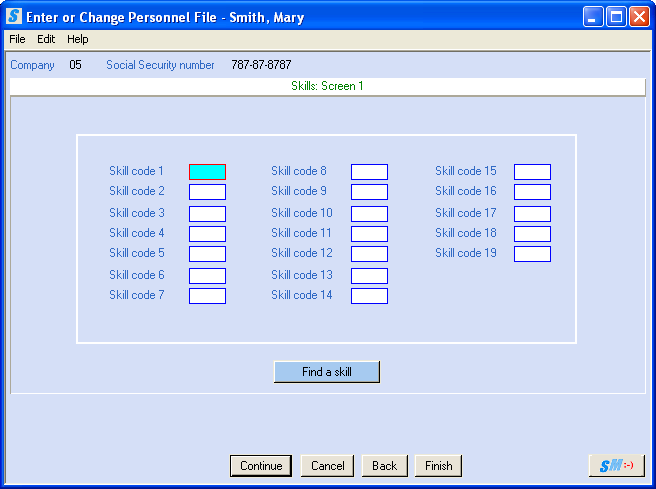

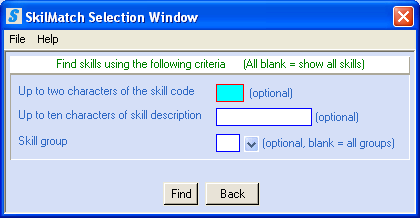

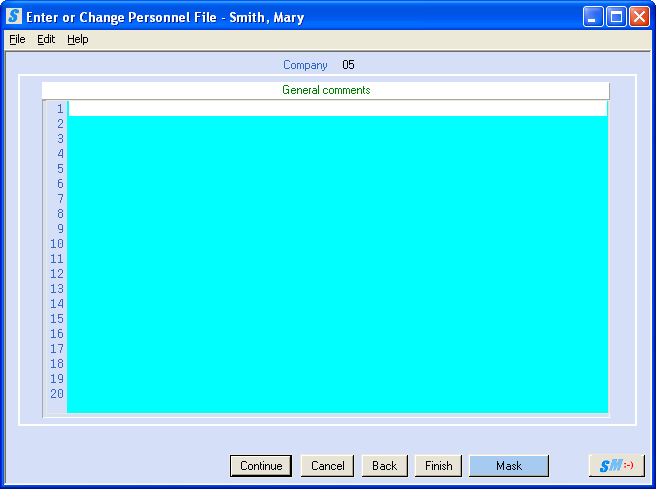

(If you view the employee’s State or Local records, Dependents 1 from the employee record matches the Exemptions area, and Dependents 2 from the employee record matches the Additional Exemptions 1 area. The State/Local record has an additional area named Additional Exemptions 2 area that is not accessible through the employee data entry screen.)