GROSS PROFIT REPORTS

[CSR, OF, OT], Division,

Class, Customer

This report, named PB900I, prints gross profit amounts based on either the job order’s Customer Service representative (CSR), the Job Order filler (OF), or the Job Order Taker (OT). Within the CSR/OF/OT, the totals will sort by Job Order Division, then by Job Order Class code, then by customer code. Within customer, the employees sort by social security number, within SSN by job number, and within job by week-ending paid date. This report does NOT use the CSR/OF/OT that was on the job when the payroll/billing was processed – it looks at the job order for CURRENT data. This means if a change has been made to the job order since the payroll and billing took place, the report may not match historical totals.

The Gross Profit Report menu offers a variety of report choices. While each report will have the same bottom line total as any of the other reports, you may analyze your gross profit by viewing different methods of subtotals. Refer to this chart for assistance in selecting the right gross profit report for your needs:

|

|

|

Branch/ |

Job Br |

|

|

|

|

Related |

EQ/NE |

Low GP |

|

Gross Profit Report Title |

1 SS# |

Branches |

Em Br |

Report |

|

|

|

|

|

|

|

[CSR,OF,OT], Div, Class, Customer |

yes |

no |

no |

no |

|

Skill, Customer |

yes |

no |

no |

no |

|

Div, Class, Customer |

no |

no |

no |

no |

|

Sales Person, Customer |

no |

no |

no |

no |

|

Sales Person,

Div, Class, Customer |

no |

no |

no |

no |

|

Customer |

no |

no |

no |

yes |

|

Job Branch, Div,

Class, Customer |

yes |

yes |

yes |

no |

|

Job Branch Totals |

no |

yes |

no |

no |

|

Job Branch, [CSR,

OF, OT, IN], Customer |

yes |

yes |

no |

no |

|

Employee Branch,

Div, Class, Customer |

yes |

yes |

yes |

no |

|

Sales Person, Job

Branch, Customer |

no |

yes |

no |

no |

|

Source, Skill,

Customer |

no |

no |

no |

no |

|

Div, Class,

Skill, Customer |

no |

no |

no |

no |

|

Job Branch, Div,

Class, Skill, Customer |

yes |

yes |

yes |

no |

|

Customer,

Department |

no |

no |

no |

no |

|

Old/New Business

Report |

no |

no |

no |

no |

Column headings on the Gross Profit report include:

Company number

SL CD (Either the Order taker, Order filler, or CSR code)

JB DV (Job Division code)

GL CL (Job Class code)

Customer code

Customer name

Job number

Employee name

Week-ending worked

Pay rate

Bill rate

Markup

Hours billed

Dollars billed, including expenses billed

Payroll + reimbursed expenses + payroll burden cost

Burden %

GP per hour

GP dollar amount

GP percent

Subtotals are taken by Division, Class and Customer. A new page is started for each Order Taker or Filler or CSR (depending on choice).

EXPLANATION OF GROSS PROFIT REPORT CALCULATIONS

For an explanation of gross profit report calculations, click here.

HOW TO PROCESS THE GROSS PROFIT REPORT BY CSR/OF/OT, DIVISION, CLASS,

CUSTOMER

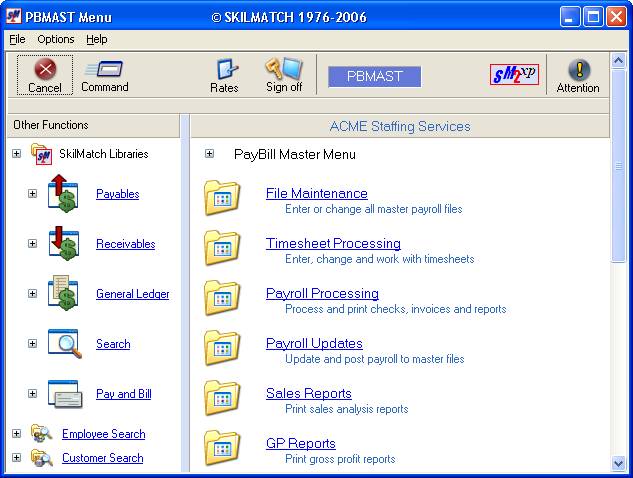

To begin, sign on to the Pay and Bill library. The screen will display:

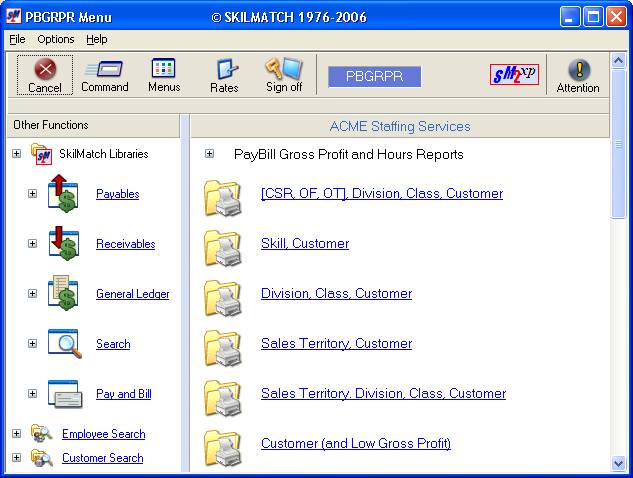

Select [GP Reports]. The screen will display:

Select [CSR/OF/OT, Div, Class, Customer].

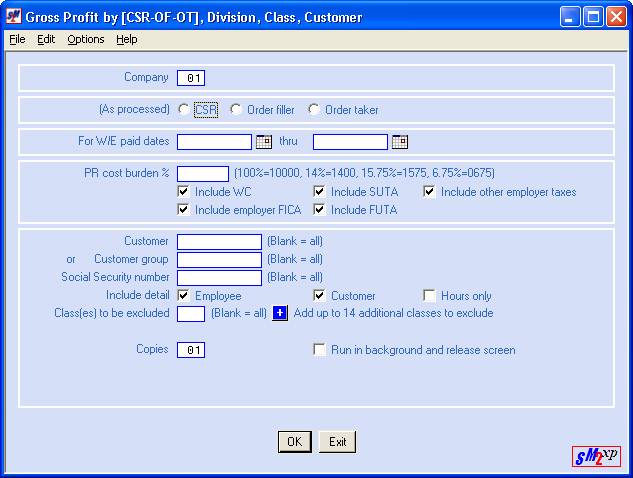

The screen will display:

Company Number:

Defaults to Company 01. If you wish to produce a report for another company, key the desired company number.

(AS PROCESSED) CSR/Order Filler/Order Taker:

Click

once on the circle to the left of either the CSR, Order filler or Order

taker. A black dot will display next to

your selection.

Note: regardless of which you choose, the system

looks to the job order, not history

files for these

codes. It uses the code that is

CURRENTLY in the job order.

Also,

if you have a different CSR on the customer than is on the job order, you

should be aware of the difference.

For W/E Paid Dates:

Key the beginning and ending week-ending paid dates to include on the report. Key the beginning date in the first date area, and the ending date in the last date area.

To print a report for just one week, use the same beginning and ending weekending dates.

Select a date

by clicking the ![]() button (prompt and select button) to the

right of dates throughout SkilMatch2. The

button (prompt and select button) to the

right of dates throughout SkilMatch2. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

P/R Cost Burden%:

Leave this area blank to include just the direct costs of payroll.

OR

You may add additional burden to the report by keying a percentage in this area. This percentage may include your costs for rent, staff salaries, applicant recruitment, applicant supplies (application forms, I-9 forms, W-4 forms), etc.

This is a 5-digit area, with three of the digits to the left of the decimal. You may key up to 999.99 percent. Examples: 50.00% is keyed as 5000, 8.0% is keyed 800, 15 ˝ % is keyed as 1550.

Include W/C, SUTA, FUTA, Employer FICA, other Employer Taxes:

The report will automatically include the burden dollars that were calculated when the payroll/billing was processed. This includes the employer portion of Social Security & Medicare (FICA), SUI, FUTA, and any other employer taxes in effect for this G/L Company.

If you prefer to exclude one of these costs from the GP calculated on this report, click once beside the cost to unselect (no checkmark will appear next to the selection).

Customer:

Leave this area blank to include all customers.

OR

Key a customer code to print a gross profit report for one specific customer.

OR

Customer Group:

Leave this area blank to include all customers.

OR

Key a customer group (six-characters) to print a gross profit report for all customers belonging to a specific customer group. (The first six characters of the customer code will be identical for customers belonging to a customer group.)

Social Security Number:

Leave this area blank to include all employees.

OR

Key a 9-digit social security number to print a gross profit report for one specific employee.

Include Detail: Employee, Customer, Hours Only

If you wish to print individual line items on each employee, and totals for each customer, leave both checkmarks displayed.

OR

If you do NOT wish to print individual line items for each employee, click once to unselect employee detail (box will be blank).

AND

If you also do NOT wish to print totals for each customer, click once to unselect customer totals (box will be blank).

(Unchecking both boxes will mean that the report will only include totals for each class, division, CSR/OF/OT, and G/L Company number.)

OR

To print only billing hours and the gross profit percentage, click once to select (a checkmark will appear next to the selection). No dollars will be printed.

Class(es) To Be Excluded:

You may choose to exclude up to 15 Job Order Class codes from the computation of this report (like the class for In-House temps or the class for Billed Drug Screens).

If you wish to include all classes, leave this area blank.

OR

If you wish to exclude one class, key the 1 or 2 character class code.

OR

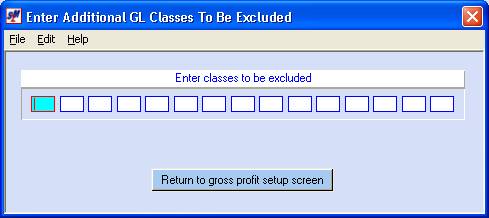

To exclude 2 or more Class

codes, click ![]() . The screen will display:

. The screen will display:

Key up to 15 Class codes to exclude from this report. When you have keyed the codes, click [Return to gross profit setup screen].

Copies:

Defaults to one copy. If you wish to print more than one copy, key the desired number (up to 99).

Run in background and release screen:

Leave this area blank to run interactively. (The report will process while your session remains input inhibited).

OR

If you have selected a large date range, and prefer to have your session available for use while the report process in the background, click once to select (a checkmark will appear next to the selection).

To process this report, click [OK].

To NOT process and return to the “PayBill Library Gross Profit and Hours by” menu, click [Exit].

EXPLANATION OF GROSS

PROFIT CALCULATIONS

Average Pay Rate:

Add together the pay rates and divide by the # of jobs.

(This is not a ‘weighted average’ - it is an average pay rate per job, not an average pay rate per hour)

Average Bill Rate:

Add together the bill rates and divide by the # of jobs.

(This is not a ‘weighted average’ - it is an average bill rate per job, not an average bill rate per hour)

Markup %:

Bill rate minus pay rate = difference

Difference divided by pay rate = markup decimal

Markup decimal x 100 = markup %

Billing Hours:

Total billing hours (includes adjustment hours, but adjustment hours with rates are not included)

Billing + Exp $:

Total billed dollars – this total includes expenses billed

(Expenses billed are also pulled out and displayed as an individual item on a separate line.)

Pay + Exp + Burd $:

Add together gross pay, reimbursed expenses, and burden (employer portion of SS & Medicare, FUTA, SUI, workers’ comp and other employer tax dollars)

Burden %:

Burden dollars divided by gross pay dollars (excluding reimbursed expenses)

(Burden $ = Gross pay $ (excluding reimbursed expenses) x Burden %)

Gross Profit Per Hour:

(Billing + Billed Expense $) minus (Gross Pay + Reimbursed Expenses + Burden $) = difference

Difference divided by Billing Hours

Gross Profit Amount:

(Billing + Billed Expense $) minus (Gross Pay + Reimbursed Expenses + Burden $) = gross profit amount

Gross Profit Percent:

(Billing + Billed Expense $) minus (Gross Pay + Reimbursed Expenses + Burden $) divided by Billed $ (excluding expenses)