Reporting to a SINGLE state:

Creating

federal file and state W-2 forms/file

You must process this option once per G/L Company.

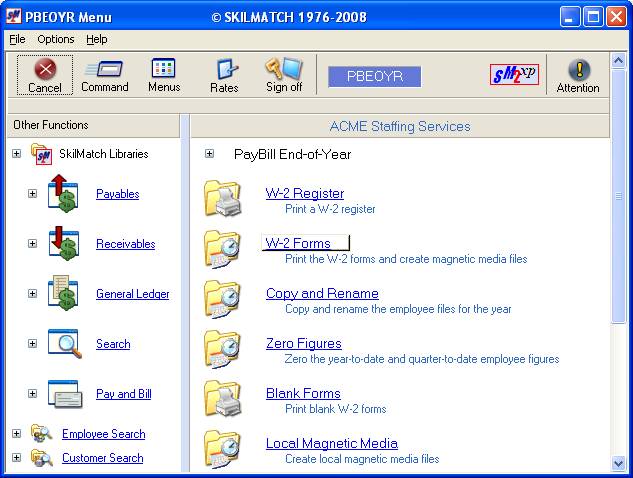

To

begin, select the [End-of-Year] menu in the Pay and Bill

library. The screen will display:

Select [W-2 Forms],

the screen will display:

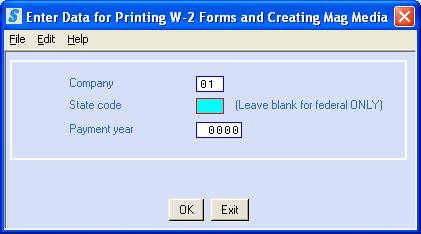

Company Number:

Defaults to 01.

To produce W-2 forms for another company, key the desired company

number.

State Code:

If the company number entered has earnings for only

one state, then key the state code.

Payment Year:

Enter the 4-digit year whose earnings you are

printing. (2013, 2014 etc.)

To continue, click [OK].

OR

To cancel and return to main menu without processing W-2 forms, click [Exit].

If you select [OK] to continue, there will be a short delay, then the screen will display:

Screen images and examples in document may not

reflect current law; always verify rates and figures with government officials

and/or accounting professional.

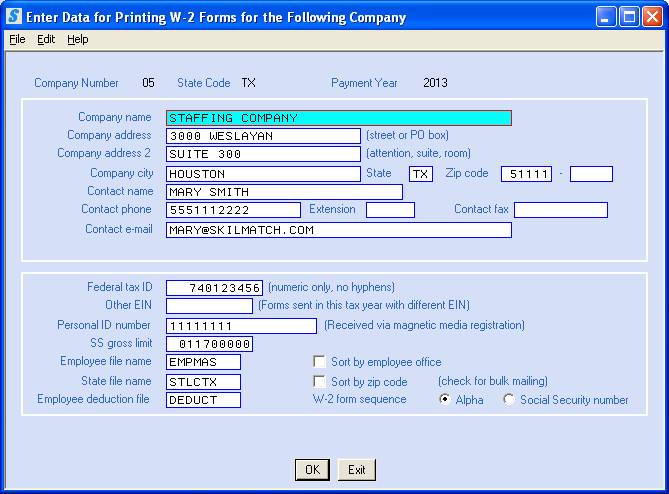

If you have processed this option

for this G/L Company/State/Year previously, then the system will display the

last selections you made. If you have

not processed this option previously, then many, but not all, of the areas will

be filled in for you, using data from the system set-up files.

Make necessary corrections to existing

data and enter the appropriate data in the remaining areas.

Remove any

special characters. SSA file

specifications prohibit them.

Company Name:

Will display as it appears in the payroll system requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy.

Make any necessary corrections,

or key the data if missing.

NOTE:

Make certain that there are no commas, hyphens, # signs, apostrophes,

etc. in your name.

Company Address (Street or PO Box):

Will display as it appears in the payroll system requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy.

Make any necessary corrections,

or key the data if missing.

NOTE:

Make certain that there are no commas, hyphens, # signs, apostrophes,

etc. in your address.

Company Address 2 (Attn, Suite, or Room):

Will display as it appears in the payroll system requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy.

Make any necessary corrections,

or key the data if missing.

NOTE:

Make certain that there are no commas, hyphens, # signs, apostrophes,

etc. in your address.

Company City:

Key the city for which you are processing this state report. Examine carefully for accuracy and make any necessary corrections.

NOTE: Make certain that there are no commas,

hyphens, # signs, apostrophes, etc. in your city.

State:

Key the state for your company address. Examine carefully for accuracy and make any necessary corrections.

Zip Code:

Key the zip for your company address. Examine carefully for accuracy and make any necessary corrections.

Contact Name:

Key up to 27 characters of name the social security administration should contact with questions about this data. Make any necessary corrections.

Contact Phone:

Key the business phone number belonging to the contact name. Make any necessary corrections.

Contact Ext:

Key the extension number, if applicable. Make any necessary corrections.

Contact Fax:

Key a fax number for the contact person, if desired. Make any necessary corrections.

Contact Email:

Key a valid email address for the contact person, if desired. The data will be retained from the last time this option was processed. Make any necessary corrections.

NOTE: If you select to notify via e-mail, you MUST

key a valid email address for the contact person.

Federal Tax ID:

Will display as it appears in the payroll system

requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy. Make any necessary corrections, or key the

data if missing.

NOTE: Make

certain there are no hyphens or letters in this field or your federal ID will

not be written to magnetic media correctly.

Other EIN:

If you have submitted forms for this same tax year

under a different EIN than the one entered in the Federal Tax ID area, key the

other EIN here.

Personal ID Number/User ID:

Key your User ID registered with the Federal

Government. The data will be retained

from the last time this option was processed.

Examine carefully for accuracy.

Make any necessary corrections, or key the data if missing.

This number had previously been referred to as the

PIN by the SSA Website.

NOTE: The federal

government requires that a User ID be included with W-2s being submitted on

magnetic media. You should already have

registered for this User ID with the SSA.

FICA Gross Limit:

Defaults to the FICA gross limit from the FICA tax

file (Menu PBMANT, Item FICA Tax Table).

NOTE:

If you print W-2s after you have begun a new payroll year and have

already changed the limit for the new year in the FICA tax table, you will need

to key last year's dollar limit here.

Any change made here does NOT affect Menu PBMANT, Item FICA Tax Table.

Employee File Name:

Examine carefully for accuracy. Make any necessary corrections.

The current year file name is EMPMAS.

OR

If you process this option AFTER processing

‘Copy and Rename’ and ‘Zero Figures’ you will need to change this file name to EMASxx

(where xx = the last 2 digits of the W-2 year).

State File Name:

Examine carefully for accuracy. Make any necessary corrections.

The current year file name is STLCTX.

OR

If you process this option AFTER processing

‘Copy and Rename’ and ‘Zero Figures’ you will need to change this file name to SLTXxx

(where xx = the last 2 digits of the W-2 year).

Employee Deduction File:

Examine carefully for accuracy. Make any necessary corrections.

The current year file name is DEDUCT.

OR

If you process this option AFTER processing

‘Copy and Rename’ and ‘Zero Figures’ you will need to change this file name to DEDUxx

(where xx = the last 2 digits of the W-2 year).

Sort By Employee Office:

Defaults to no.

OR

To sort the W-2s by the branch office code that

appears in the employee file, click once on the option to select (a checkmark

will appear next to the selection).

NOTE:

Sort by employee office only if you do NOT plan to use a bulk mailer,

and want each branch to mail/distribute their own W-2s.

Sort By Zip Code: (check for

bulk mailing)

Defaults to no.

OR

To sort the W-2s by employee zip code, click once

on the option to select (a checkmark will appear next to the selection).

NOTE: If you plan

to use a bulk-mailing permit, you should select to sort by zip code by clicking

once on the option to select (a checkmark will appear next to the selection).

W-2 Form Sequence:

The area defaults to sorting the W-2s in

alphabetical order. If you would rather

print the W-2s in social security number order, click the circle to move the dot

to this choice.

Before continuing, examine the screen carefully to make certain that

the correct data has been entered.

To continue, click [OK].

OR

To cancel and return to main menu without saving changes, click [Exit].

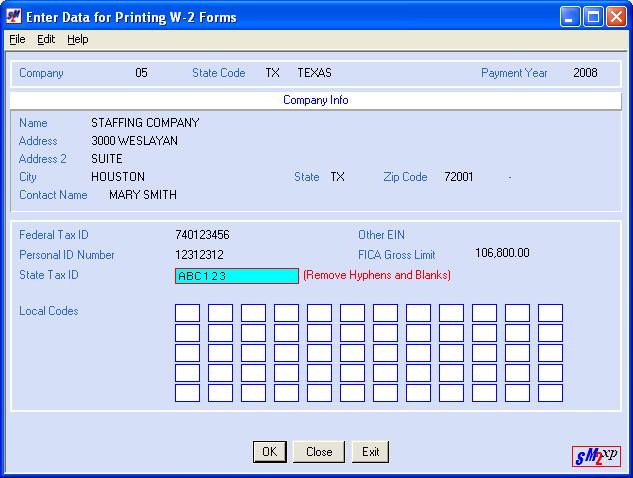

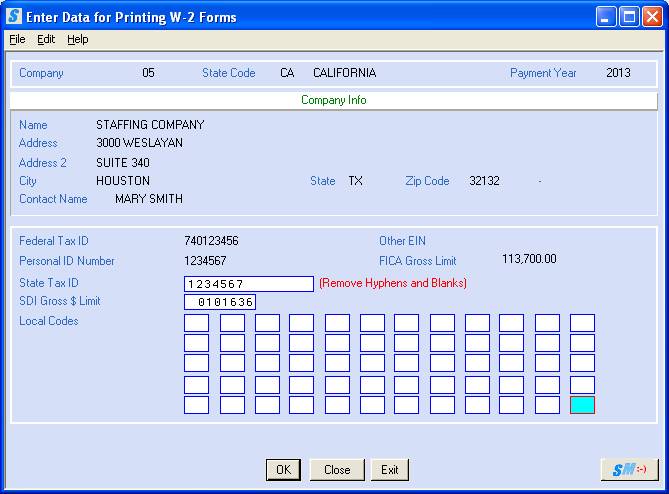

If you select [OK] to continue, since you are processing this option WITH a state code, the screen will display:

Screen images and examples in document may not

reflect current law; always verify rates and figures with government officials

and/or accounting professional.

State Tax ID:

Defaults to the state tax ID in the state file

(Menu PBMANT, Item State Information).

NOTE:

Make certain no hyphens or blanks are entered or this will result in

incorrectly written magnetic media.

SDI Gross $ Limit (see screen below):

THIS FIELD ONLY APPEARS IF SDI – STATE DISABILITY

INSURANCE - IS WITHHELD FOR THIS STATE.

If you withhold SDI for this state, the dollar

limit will display from the state file.

NOTE:

If you process this option after you the new payroll year has begun, and

have already changed the limit, you will need to key last year's dollar limit.

New York Filers, Note: If you do business in

New York, you will have a custom SDI program.

When processing this option, enter 9999999 for SDI Gross $ Limit. The dollars calculated by the custom program

will be used.

Screen images and examples in document may not

reflect current law; always verify rates and figures with government officials

and/or accounting professional.

Enter Local Codes:

If the state displayed above has local tax(es)

withheld, key the valid tax code(s). You may enter a grand total of 120 local

codes - 60 per screen. Enter up to 60

local tax codes on this screen.

If you enter tax codes in all 60 areas on this

screen and choose to continue, the screen will display additional local tax

code fields.

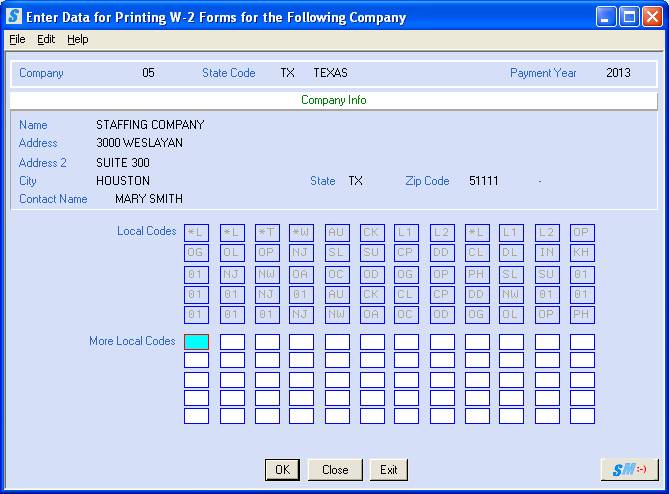

More Local Codes:

If you had more than 60 local codes to enter, enter

the remaining codes (up to an additional 60) on this screen.

NOTE: The system

will produce as many W-2s for an employee as required to print all local taxes

for that employee. If the employee has

more than one W-2 printed, there will be state tax printed only on the first

form, not on any of the subsequent forms.

To continue, click [OK].

OR

To return to the previous

screen, click [Close].

OR

To cancel and return to main menu without saving changes, click [Exit].

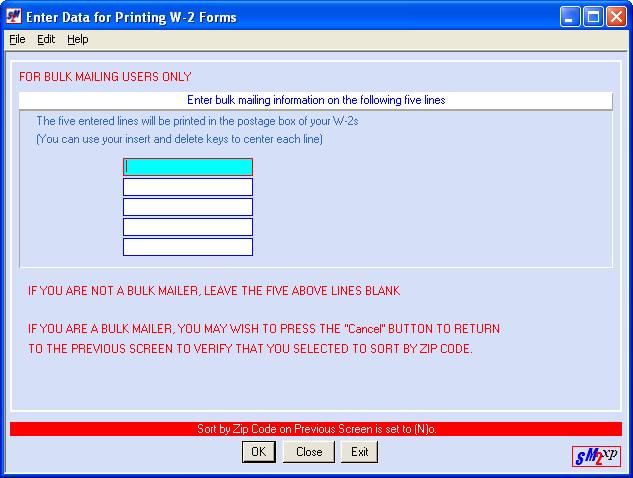

If you select [OK] to continue, the screen will display:

FOR BULK MAILING USERS ONLY

Note: If you are a bulk mailer, and

you wish to verify/change how you requested the sort sequence, click [Close]

to return to the previous screen to verify that you selected to sort by zip

code.

If you are not a bulk mailer, leave the five above lines blank.

OR

If you plan to use a bulk mail permit for mailing

W-2s, enter the bulk mailing information beginning on line 2 (the first line of

the self-mailer does not print adequately through the carbon). The data entered will be printed in the

postage box of your W-2s.

NOTE: You

can use your insert and delete keys to center each line.

To continue, click [OK].

OR

To return to the previous

screen, click [Close].

OR

To cancel and return to main menu without saving changes, click [Exit].

If you select [OK] to continue, your screen will remain ‘input inhibited’ while the print file is created.

If you do not have the

Create-a-Check W2 program, click Federal

W2 file to move to the next screen.

OR

If you use the Create-a-Check W2 program, click CAC

W-2 to move to the next screens.