Creating State W-2 files and Optional State Magnetic

Media files:

You will need to create a set of state W-2s for each combination of G/L company/state with earnings. Please repeat these instructions for each combination.

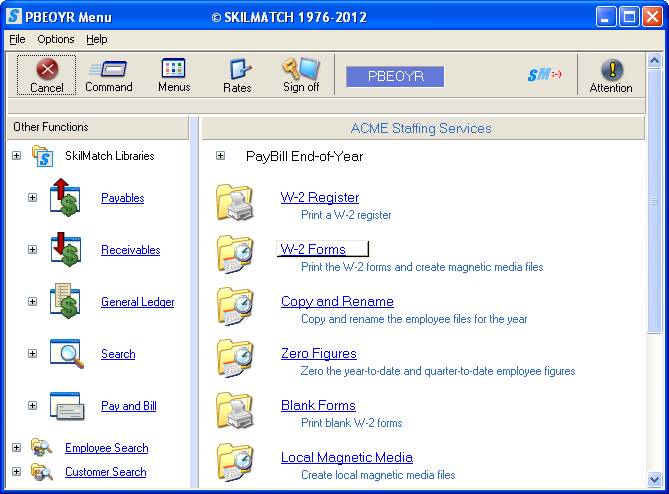

To begin,

select the [End-of-Year] menu in

the Pay and Bill library. The screen

will display:

Select [W-2 Forms].

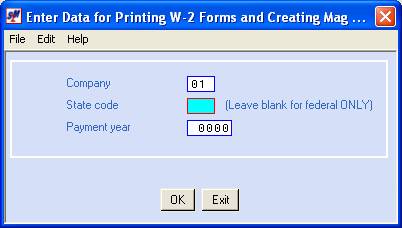

Screen will display:

Company Number:

The system defaults to company 01. If you wish to produce W-2 forms for another

company, key the desired company number.

State Code:

Key the state code.

Payment Year:

Enter the 4-digit year whose earnings you are

printing. (2013, 2014, etc.)

To continue, click [OK].

OR

To cancel and return to main menu, click [Exit].

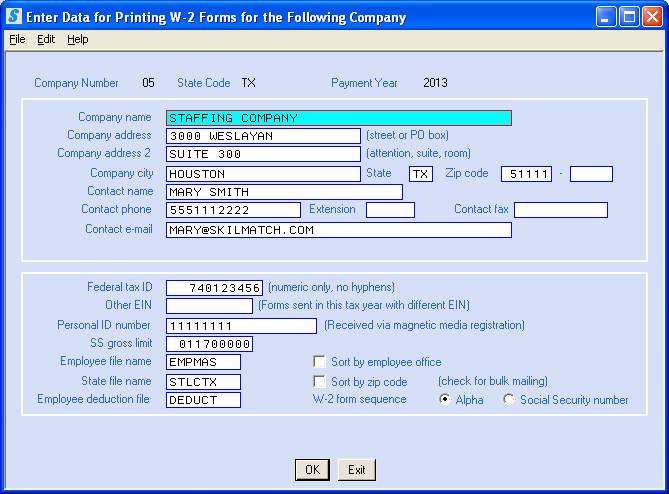

If you select [OK]

to continue, there will be a short delay, then the screen will display:

Screen images and examples in document may not reflect current law; always verify rates and figures with government officials and/or accounting professional.

If you have processed this option

for this G/L Company/State/Year previously, then the system will display the

last selections you made. If you have

not processed this option previously, then many, but not all, of the areas will

be filled in for you, using data from the system set-up files.

Make necessary corrections to

existing data and enter the appropriate data in the remaining areas.

Remove any special characters. SSA file specifications prohibit them.

Company Name:

Will display as it appears in the payroll system requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy.

Make any necessary corrections

or key the data if missing.

Note: Make certain that there are no commas, hyphens, # signs,

apostrophes, etc. in your name.

Company Address (Street or

PO Box):

Will display as it appears in the payroll system requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy.

Make any necessary corrections

or key the data if missing.

Note: Make certain that there are no commas, hyphens, # signs,

apostrophes, etc. in your name.

Company Address 2 (Attn,

Suite, or Room):

Will display as it appears in the payroll system requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy.

Make any necessary corrections

or key the data if missing.

Note: Make certain that there are no commas, hyphens, # signs,

apostrophes, etc. in your name.

Company City:

Key the city for your company address. Examine carefully for accuracy and make any necessary corrections.

State:

Key the state for your company address. Examine carefully for accuracy and make any necessary corrections.

Zip Code:

Key the zip for your company address. Examine carefully for accuracy and make any necessary corrections.

Contact Name:

Key up to 27 characters of name the social security administration should contact with questions about this data. Examine carefully for accuracy and make any necessary corrections.

Contact Phone:

Key the business phone number belonging to the contact name. Examine carefully for accuracy and make any necessary corrections.

Contact Ext:

Key the extension number, if applicable. Examine carefully for accuracy and make any necessary corrections.

Contact Fax:

Key a fax number for the contact person, if desired. Examine carefully for accuracy and make any necessary corrections.

Contact Email:

Key a valid email address for the contact person, if desired. Examine carefully for accuracy and make any necessary corrections.

Note: If you

select to notify via e-mail, you MUST key a valid email address for the contact

person.

Federal Tax ID:

Will display as it appears in the payroll system

requirements file (Menu Maintenance, Item Payroll System Requirements). Examine carefully for accuracy. Make any necessary corrections or key the

data if missing.

Note: Make certain there are no hyphens or letters in this field or your federal ID will not be written to magnetic media correctly.

Other EIN:

If you have submitted forms for this same tax year

under a different EIN than the one entered in the Federal Tax ID area, key the

other EIN here.

Personal ID Number/User ID:

Key your User ID registered with the Federal

Government. Examine carefully for

accuracy. Make any necessary

corrections or key the data if missing.

This number had previously been referred to as the

PIN by the SSA Website.

Note: The federal

government requires that a User ID be included with W-2s being submitted on

magnetic media. You should already have

registered for this User ID with the SSA.

FICA Gross Limit:

Defaults to the FICA gross limit from the FICA tax

file (Menu PBMANT, Item FICA Tax Table).

Note: If you print W-2s after you have begun a new payroll year and

have already changed the limit for the new year in the FICA tax table, you will

need to key last year's dollar limit here.

Any change made here does NOT affect Menu PBMANT, Item FICA Tax Table.

Employee File Name:

Examine carefully for accuracy and make any necessary corrections.

The current year file name is EMPMAS.

OR

If you process this option AFTER processing

‘Copy and Rename’ and ‘Zero Figures’ you will need to change this file name to EMASxx

(where xx = the last 2 digits of the W-2 year).

State File Name:

Examine carefully for accuracy and make any necessary corrections.

The current year file name is STLCTX.

OR

If you process this option AFTER processing

‘Copy and Rename’ and ‘Zero Figures’ you will need to change this file name to SLTXxx

(where xx = the last 2 digits of the W-2 year).

Employee Deduction File:

Examine carefully for accuracy and make any necessary corrections.

The current year file name is DEDUCT.

OR

If you process this option AFTER processing

‘Copy and Rename’ and ‘Zero Figures’ you will need to change this file name to DEDUxx

(where xx = the last 2 digits of the W-2 year).

Sort By Employee Office:

Defaults to no.

OR

To sort the W-2s by the branch office code that

appears in the employee file, click once on the option to select (a checkmark

will appear next to the selection).

Note:

Sort by employee office only if you do NOT plan to use a bulk mailer,

and want each branch to mail/distribute their own W-2s.

Sort By Zip Code: (check for bulk mailing)

Defaults to no.

OR

To sort the W-2s by employee zip code, click once

on the option to select (a checkmark will appear next to the selection).

Note: If you plan to use

a bulk-mailing permit, you should select to sort by zip code by clicking once

on the option to select (a checkmark will appear next to the selection).

W-2 Form Sequence:

The area defaults to sorting the W-2s in

alphabetical order. If you would rather

print the W-2s in social security number order, click the circle to move the

dot to this choice.

Before continuing, examine the screen carefully to make certain that

the correct data has been entered.

To continue with this report, click [OK].

OR

To cancel and return to main menu without saving changes, click [Exit].

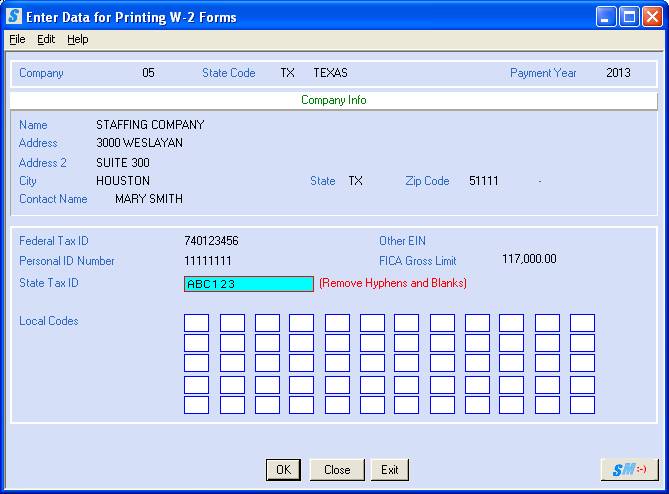

If you select [OK]

to continue, since you are processing this option WITH a state code, the

screen will display:

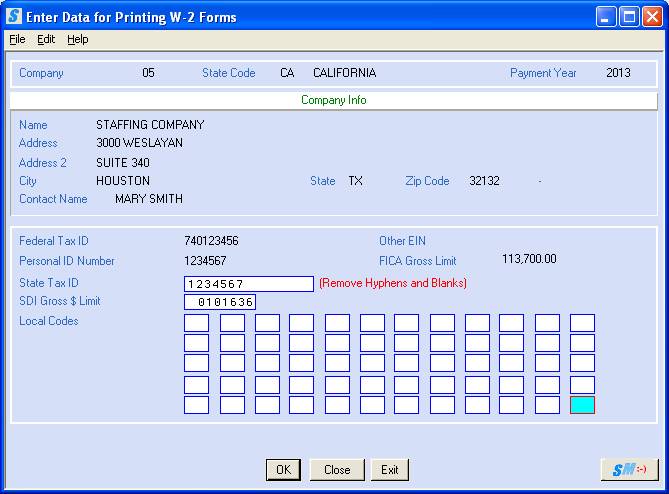

Screen images and examples in document may not reflect current law; always verify rates and figures with government officials and/or accounting professional.

State Tax ID:

Defaults to the state tax ID in the state file (Menu PBMANT, Item State Information). Examine carefully for accuracy and make any necessary corrections.

Note: Make

certain no hyphens or blanks are entered or this will result in incorrectly

written magnetic media.

SDI Gross $ Limit (see screen below):

THIS FIELD ONLY APPEARS IF SDI – STATE DISABILITY

INSURANCE - IS WITHHELD FOR THIS STATE.

If you withhold SDI for this state, the dollar

limit will display from the state file.

NOTE: If you process

this option after you the new payroll year has begun, and have already changed

the limit, you will need to key last year's dollar limit.

New York Filers, Note: If you do business in

New York, you will have a custom SDI program.

When processing this option, enter 9999999 for SDI Gross $ Limit. The dollars calculated by the custom program

will be used.

Screen images and examples in document may not reflect current law; always verify rates and figures with government officials and/or accounting professional.

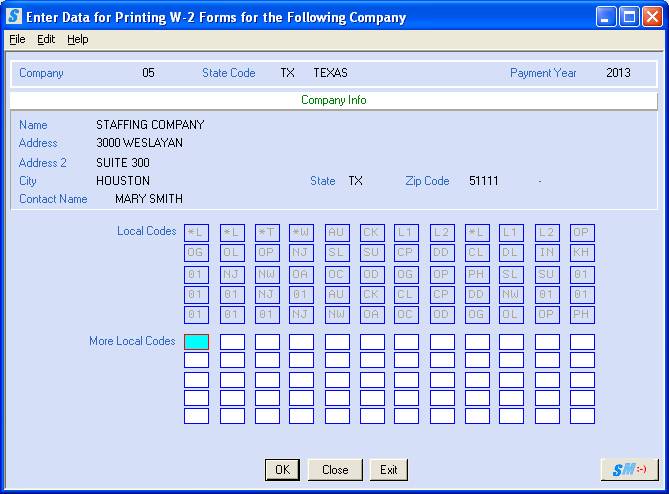

Enter Local Codes:

If the state displayed above has local tax(es)

withheld, key the valid tax code(s). You may enter a grand total of 120 local

codes - 60 per screen. Enter up to 60

local tax codes on this screen.

If you enter tax codes in all 60 areas on this

screen and choose to continue, the screen will display additional local tax

code fields.

More Local Codes:

If you had more than 60 local codes to enter, enter

the remaining codes (up to an additional 60) on this screen.

Note: The system

will produce as many W-2s for an employee as required to print all local taxes

for that employee. If the employee has

more than one W-2 printed, there will be state tax printed only on the first

form, not on any of the subsequent forms.

To continue, click [OK].

OR

To return to the previous screen,

click [Close].

OR

To cancel and return to main menu without saving changes, click [Exit].

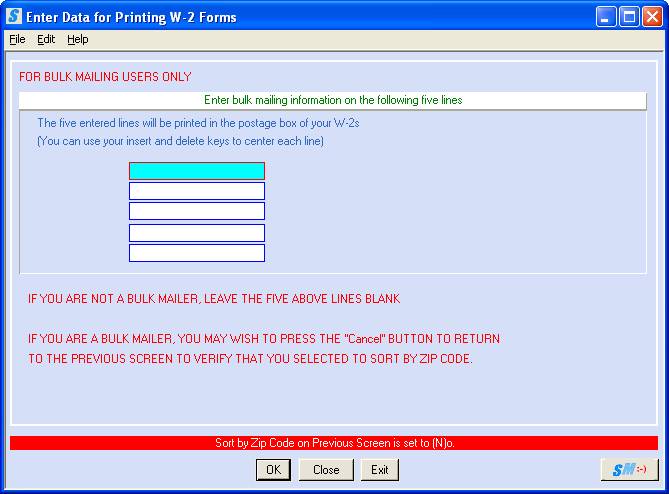

If you select [OK]

to continue, there will be a short delay, the screen will display:

FOR BULK

MAILING USERS ONLY

Note: If you are a bulk mailer, and you wish to verify/change how you

requested the sort sequence, click [Close] to return to the previous screen to

verify that you selected to sort by zip code.

If you are not a bulk mailer, leave the five

above lines blank.

OR

If you plan to use a bulk mail permit for mailing

W-2s, enter the bulk mailing information beginning on line 2 (the first line of

the self-mailer does not print adequately through the carbon). The data entered will be printed in the

postage box of your W-2s.

Note: You can use your insert and delete keys to center each line.

To continue, click [OK].

OR

To return to the previous

screen, click [Close].

OR

To cancel and return to main menu without saving changes, click [Exit].

If you select [OK] to continue, the screen will remain ‘input inhibited’ while the print file is created.

If you do not have the

Create-a-Check W2 program, click mag media to move

forward to the next screen.

Create-A-Check

W-2 users:

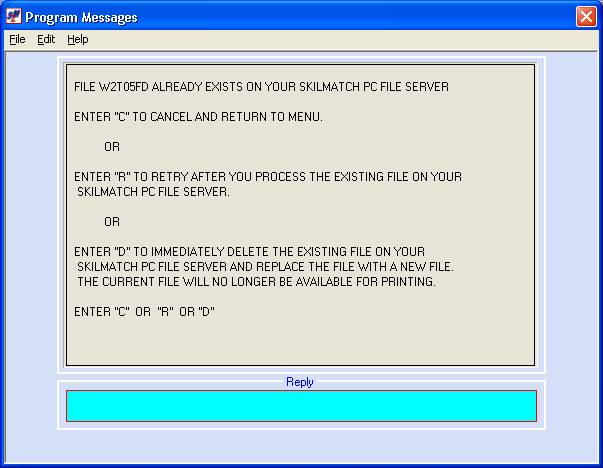

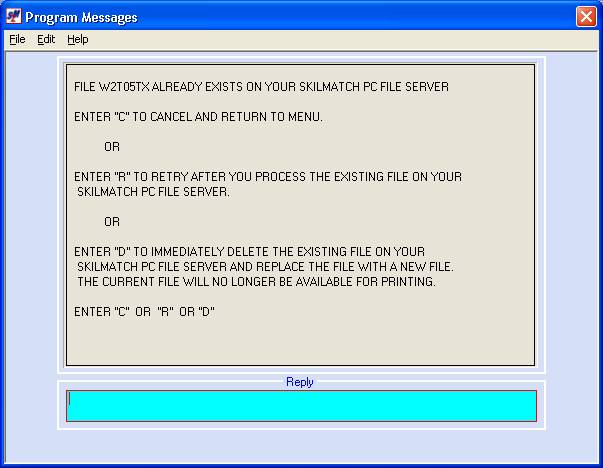

The system SHOULD NOT display the following screens. If you see one of these screens, then (1) you use Create-a-check W2s, (2) you have processed this option at least once for this company and state this year or in a previous year, and (3) you did not print the CAC W2s.

OR

If you received one of the screens displayed above, then you cannot continue until the existing W-2 file has been printed, or deleted, or renamed.

If you are already aware of this print file, and do not want to use the W-2s from this file, key ‘D’ and press [Enter].

OR

If you were not aware of this existing file, and do not wish to continue at this time, key ‘C’ and press [Enter]. You will return to menu. Investigate the existing file and take action to print the file, or rename the file or delete the file before attempting this option again.

OR

If you need to print the existing W-2s, but do not want to cancel ant start this process over again, you can let this message stay on your screen while you go to Windows Explorer and print the file. Return to this session afterwards, and respond with ‘R’. The system will verify that the W-2 file has been printed or no longer exists, and this option will continue.

If you are an SM/E customer, click SM/E to move to

your next screen.

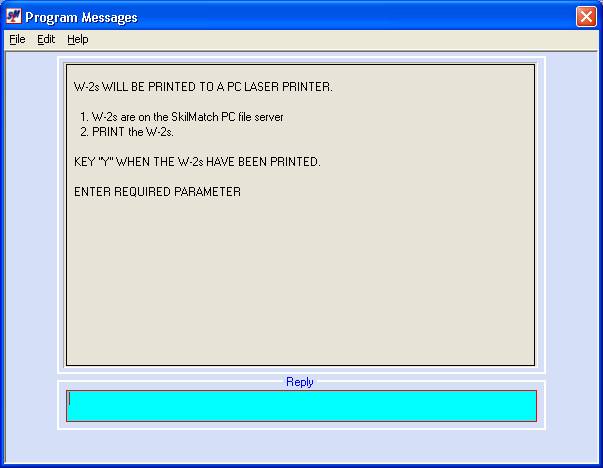

If your organization

owns the server, then the next screen should display:

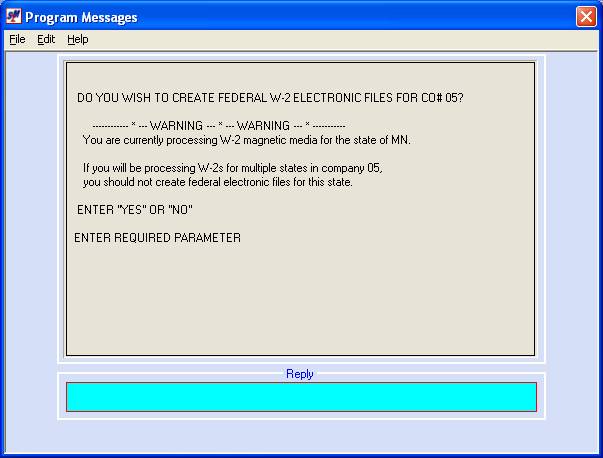

Despite

what the screen says, do not print the W-2s at this time. Go ahead and key Y and press [Enter]

to continue with processing.

You should wait until the SkilMatch technical department has modified the W-2 CAC software with the NEW YEAR changes.

Also, remember to update the YEAR in your CAC file before you print W-2’s.

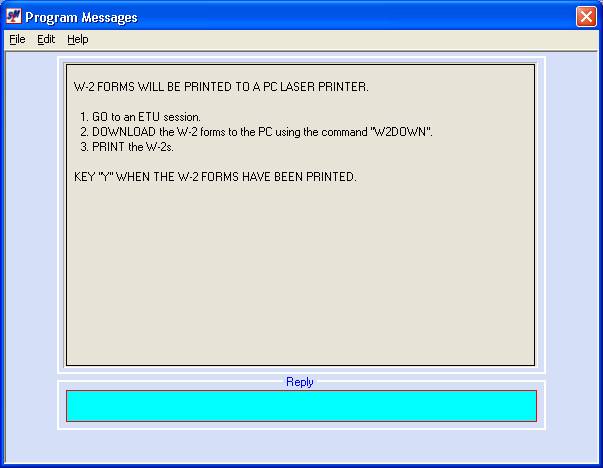

If you are a SkilMatch/E customer, then the next screen will

display:

Despite

what the screen says, do not stop and print the W-2s at this time. Go ahead and key Y and press [Enter] to

continue with processing. You should

wait until the SkilMatch technical department has modified the W-2 CAC software

with the NEW YEAR changes.

Once you

have responded Y, the program will move on to electronic file creation.

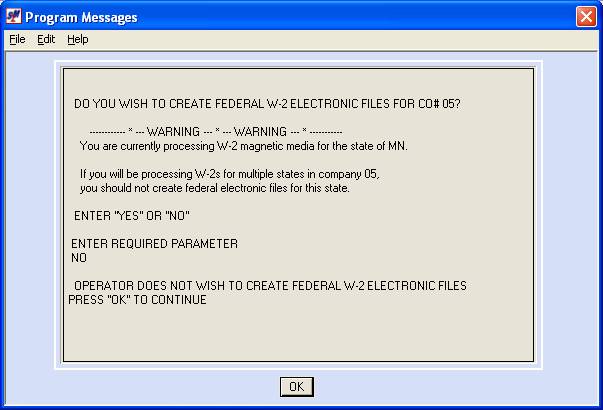

Since employee earnings are being reported to a multiple states for this company, you will NOT want to create a federal file with a state code.

Key NO and press [Enter] to continue.

The next

screen will confirm your choice to NOT create a federal file:

Click [OK] to continue, the screen

will display:

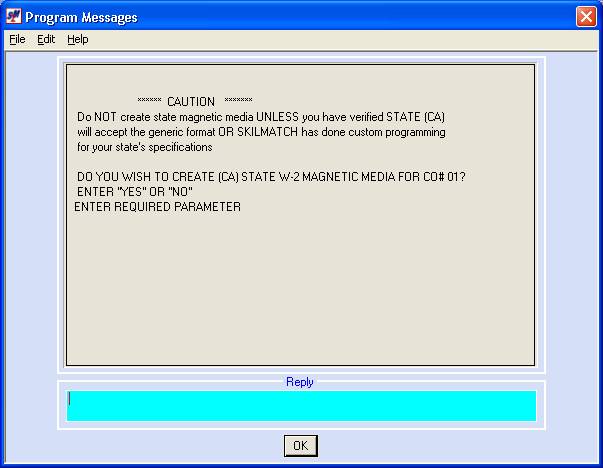

As of 2014, the following states

do NOT require that you report W-2 data to the state, either because there is

no state tax, or because you have been reporting quarterly data. Verify current requirements.

These states include:

Alaska

California

Florida

Nevada

New

Hampshire

Oklahoma

South

Dakota

Tennessee

Texas

Washington

Wyoming

Should your state require that you report W-2 data on

magnetic media, you need to know what format the state uses. Also, some states use a ‘generic’ format,

and others require a ‘customized’ format.

If there is an asterisk to the right of the state name, then the state has its own custom format. We have written a custom program for that state, unless noted otherwise. The following is a list of the requirements we are aware of at this time.

Note: We received one request to modify state

formats for reporting year 2014 – Maryland.

Alabama* MMREF

Arizona MMREF

Arkansas MMREF

Colorado MMREF

Connecticut* MMREF

Delaware MMREF

Georgia* MMREF

Hawaii (Unknown)

Illinois* MMREF

Indiana* MMREF

Iowa MMREF

Kansas MMREF

Kentucky MMREF

Louisiana MMREF

Maryland* MMREF

Massachusetts* MMREF

Michigan MMREF

Minnesota MMREF

Missouri MMREF

Montana MMREF

New

Hampshire MMREF

New

Jersey* MMREF

North

Carolina MMREF

Ohio* MMREF

Oregon* MMREF

Pennsylvania* MMREF

South

Carolina MMREF

Utah MMREF

Vermont MMREF

Virginia MMREF

West Virginia MMREF

*Indicates non-generic MMREF state format. Each of you has these custom programs on

your system.

Note: SkilMatch charges a conversion fee for each diskette produced.

Do not send diskettes to SkilMatch for the state conversion. SkilMatch will provide the necessary diskette(s).

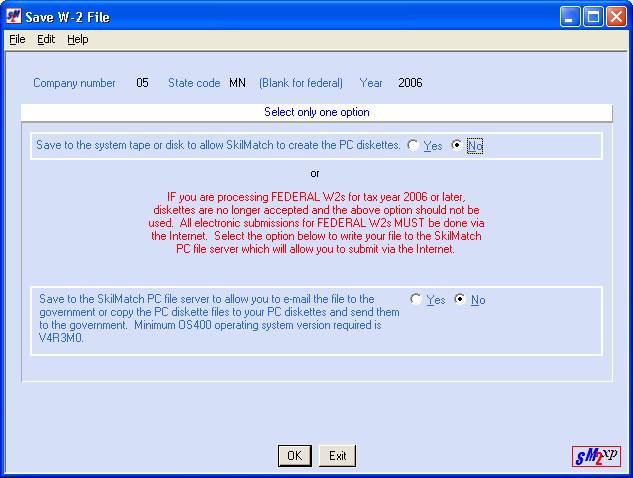

If you answered YES to create a magnetic media file for this state, the next screen will display:

If you are allowed to transmit the state W-2 file to the state government electronically using the Internet, or if you want to create your own state MMREF diskettes, click save to PC File server.

OR

If you need SkilMatch to produce PC diskettes, click diskettes.