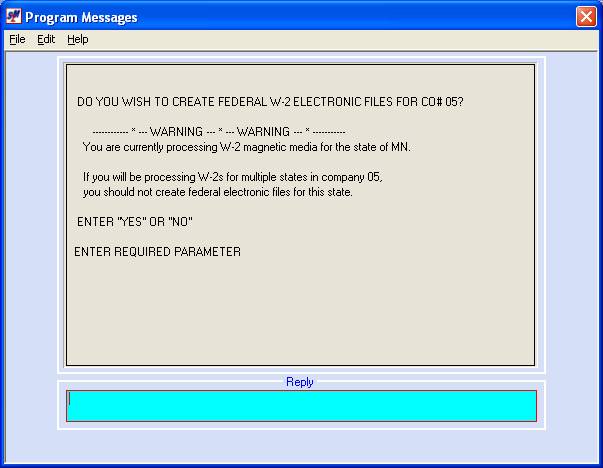

Federal W-2 file:

You will

need to create a federal file of W-2 data (to be transmitted electronically)

for each of your G/L companies for transmission to the Social Security

Administration.

Since all employee earnings are being reported to a

single state for this company, key YES. Press [Enter]

to continue.

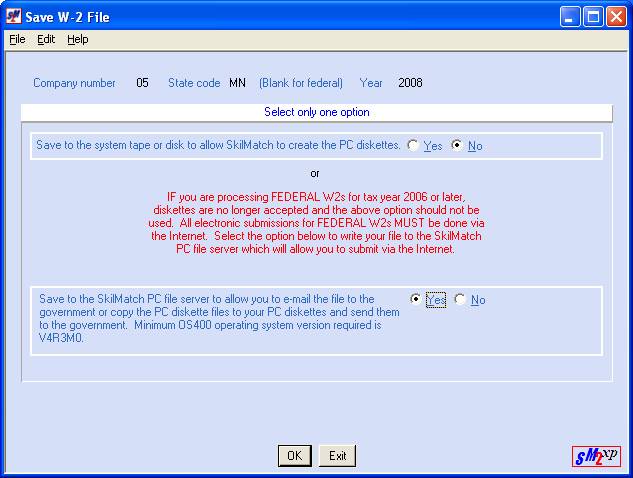

Since the federal government requires that the federal W2 data be submitted electronically, DO NOT choose to save to ‘system tape or disk’.

To create the federal W-2 file for

electronic submission, select:

Save to

the system tape or disk: NO

Save to

the SkilMatch PC file server: YES

To continue with this process, click [OK].

OR

To cancel and return to the menu, click [Exit].

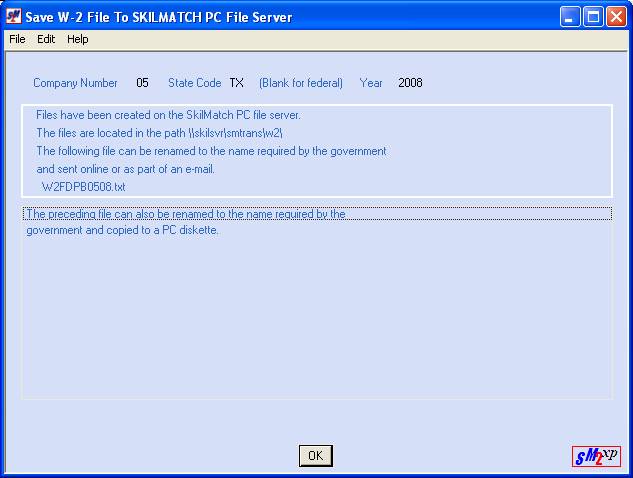

If you chose to continue, the screen will display.

We recommend that you move your cursor to the

top left corner of the screen, click the SM2 symbol and make a print of this

screen so that you have a copy of the ‘path’.

The file name is

W2FDPBxxyy.txt

(xx=general ledger company

number and yy=last two digits of the W-2 year being reported).

If the W-2 file is small enough that it can be

copied onto a SINGLE PC disk, then the screen will display as it is shown above

and only a single file will be created.

(Even though you cannot file by diskette, you will probably want to

create a diskette for your own archives.)

If the W-2 file would NOT fit onto a SINGLE PC

disk, then the system will create 3 or more files, and the system will display

additional verbiage:

The following file can also be renamed to

the name required

by

the government and sent online or as part of an e-mail.

W2FDPBxxyy.txt

The following files can also be renamed to

the names

required by the government and copied to PC diskettes.

W2FDPBxxyy01.txt

(xx=general ledger company number;

yy=year being reported;

01=diskette number 1)

W2FDPBxxyy02.txt

(xx=general ledger company number;

yy=year being reported;

01=diskette number 2)

The W2FDPBxxyy.txt is the complete file – ok for electronic submission, but is too large to fit on a single diskette.

The W2FDPBxxyy01.txt is the first portion of the file, and will fit on a diskette.

The W2FDPBxxyy02.txt is more of the file, and will fit on a diskette.

The system will create additional files, as necessary, until the entire file has been separated into sizes that will fit on diskettes. The files will be numbered sequentially.

(Even though you cannot file by diskette, you will

probably want to create diskettes for your own archives.)

Once you have made a print screen, click [OK] to continue. The screen will display.

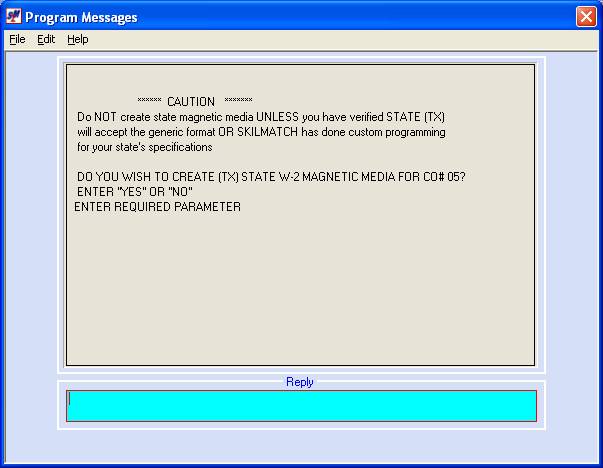

State W-2 Magnetic Media File:

As of 2014, the following states

do NOT require that you report W-2 data to the state, either because there is

no state tax, or because you have been reporting quarterly data. Verify current requirements.

These states include:

Alaska

California

Florida

Nevada

New

Hampshire

New

York

Oklahoma

South

Dakota

Tennessee

Texas

Washington

Wyoming

To create a state W-2 magnetic media file, click State mag media.

OR

To cancel W2 magnetic media for this state or if you plan to report on paper to this state, key NO and press [Enter]. You will return to menu.

OR

If your state is listed above, you should key NO and press [Enter]. You will receive a message confirming your decision and you will return to menu.

If you answered NO to State magnetic media, then you have completed the processing for this G/L company.

Remember, you must REPEAT this entire procedure for EACH G/L company that has employees with earnings this year. Click W-2 processing to repeat the instructions.

Once you have finished each G/L company, click W-2 processing to locate the instructions for printing W-2s, transmitting the federal file, and other additional W-2 chores.