END-OF-QUARTER

TOTALS

PRINT

EMPLOYEE MASTER FILE TOTALS

This option prints two reports for each general ledger company on your system.

(a) PB800 - federal gross and tax totals (one page per general ledger company number)

(b) PB810 - state/local gross and tax totals for each state and locality (a new page per general ledger company number).

Reports can be run for (1) current quarter (2) prior year and (3) prior

quarter/year. The PB800/PB810 report

will include the file names used during the creation of the EOQ reports. This will allow users and support staff to

identify the files used when processing the report.

Note: Files names for current quarter

will display as EMPMAS, STLCTX, SRSUTA.

Files names for prior

year will display as EMASxx, SLTXxx, SUTAxx (xx=year, i.e. 2015 will

display as EMAS15, etc…)

Files names for prior quarter will display as

PEMPqyy, PSTLqyy, Pdedqyy (q=quarter/yy=year, i.e. 3rd quarter 2015 will

display as PEMP315, etc…)

Check the State report to see

which states and which local taxes have quarter-to-date (QTD) dollars. QTD closing has to be processed for those

states with QTD dollars.

The QTD totals on the federal

and state reports should match the total of all payroll journals for the

current quarter. If they do not

match, call your SkilMatch support staff before proceeding.

The gross wages on this report do NOT take FUTA, SUTA, FICA or MEDICARE limits into consideration. The gross wages are a grand total of wages paid that were SUBJECT to taxation (i.e. only exempt dollars are subtracted).

The gross wages on this report DO reflect pre-tax deductions (like 401K). So if grosses do not match, they should be off the exact amount of pre-tax deductions. If not, call your SkilMatch support staff before proceeding.

HOW TO

BALANCE PAYROLLS TO END OF QUARTER

At the beginning of each quarter:

Prepare a spreadsheet or worksheet with the following column headings:

W/E DATE

TOTAL GROSS

FICA TAX

MEDICARE TAX

WITHHOLDING TAX

STATE TAX (one for each state, if you have state tax)

LOCAL TAX (one for each locality, if you have local tax)

SDI TAX (if you have SDI)

Once Per Payroll:

(1) Locate your final (not preliminary) Payroll Journal for this payroll (the final journal will have check numbers). Enter the totals from the Payroll Journal onto your worksheet under the appropriate column headings. Keep a running total for each column.

(2) From library PayBill/menu End of Quarter, select [End-of-Quarter Totals] (see details below).

(3) Once you have your End of Quarter totals, compare the QTD amounts with the totals on your own spreadsheet/worksheet.

(4) If they are the same, then you are in balance.

(5) Look at your End of Quarter totals again. Are all of the Federal grosses (total gross, FIT gross, Medicare gross, FICA gross, FUTA gross) identical?

(6) If you have only one state, do the state gross, SUTA gross, and SDI gross (if you have SDI) match the TOTAL GROSS? If you have more than one state, then at the end of the quarter only you should add the totals of all state grosses and match the grand total to the TOTAL gross.

If you have only one locality, does the local gross match the TOTAL gross?

(7) If you have more than one local tax, then at the end of the quarter only you should add the totals of all local grosses and match the grand total to the TOTAL gross.

Pre-Tax Deductions:

If any of your grosses do not match, and you have pre-tax deductions, then you should print 2 additional reports:

(1) Menu PBLIST, Item Payroll Deduction Code Employee Detail to get pre-tax totals to add back to the tax grosses that are exempt

(2) Menu PBEOYR, Item W-2 Register to verify that detail appears acceptable.

The combining of the pre-tax dollars and the grosses should bring you back into balance with the TOTAL GROSS.

No Pre-Tax Deduction:

If any federal grosses do not

match the TOTAL GROSS, then you may have someone exempt from FICA or

Medicare. Verify that this is not a

problem to you. If someone has been

made exempt incorrectly, you will need help from SkilMatch in fixing this

problem. Don't wait - it won't go

away by itself.

HOW TO PRINT END-OF-QUARTER TOTALS (totals from Employee Master File)

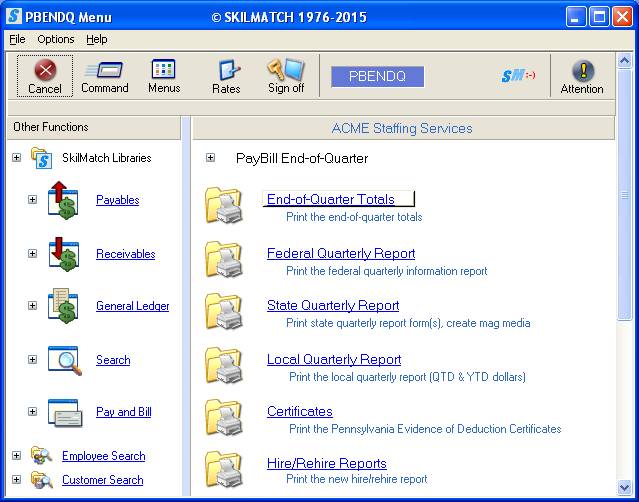

To begin, select the [End-of-Quarter] menu in the Pay and Bill library, the screen will display:

Click [End-of-Quarter Totals], the screen will display:

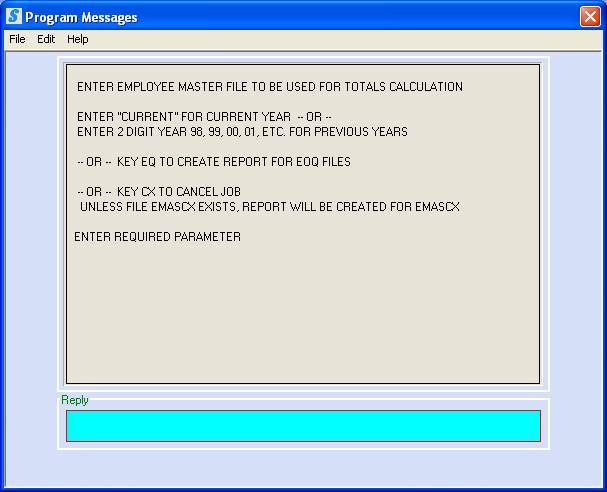

To produce the quarterly totals report for the CURRENT QUARTER (not yet zeroed and closed), key CURRENT and press <Enter>.

OR

To produce 4th quarter/EOY totals report for PRIOR YEAR, key two-digit prior year (15 = year 2015) and press <Enter>.

OR

To produce the quarterly totals report for a PRIOR QUARTER (already zeroed and closed), key EQ and press <Enter>.

OR

To cancel processing quarterly totals report and return to main menu, key CX and press <Enter>.

Note: If the file EMASCX exists (an EOQ file that

contains the CX as a “year” or file), then a report will be created, based on

the information in the “CX” file.

Contact SkilMatch if this occurs.

If you keyed CURRENT,

two EOQ Totals reports (PB800/PB810) may be found in your printer output queue.

Verify file names used during the creation of the EOQ reports.

OR

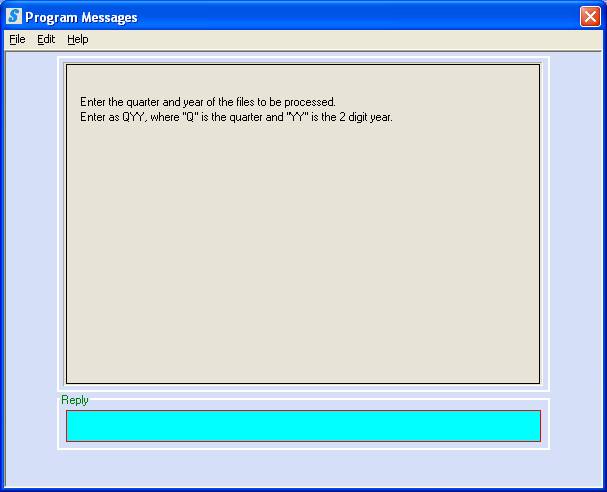

If you keyed EQ to run report for previous quarter/year, the screen will display:

Key Quarter and Year as QYY (i.e. 1st quarter 2016, is 116) for which to run report and press <Enter>.

When reports are complete

will be returned to the main menu, two EOQ totals reports (PB800/PB810) may be

found in your printer output queue.

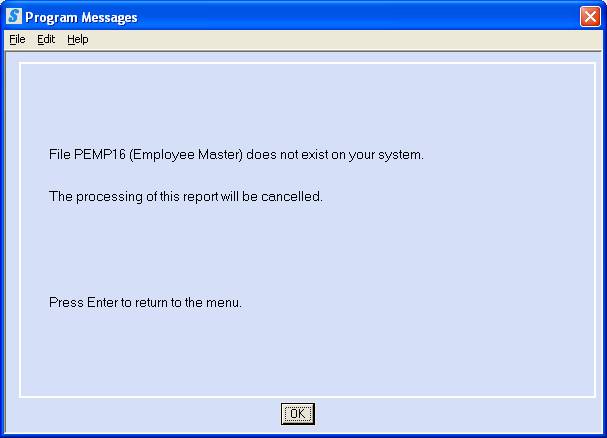

NOTE: If the EOQ quarter/year file is not currently on your system, you will receive the following message.

Identify the files you were

attempting to access to confirm correct, (i.e. example below shows file PEMP16

= 2016). If not correct file year,

reprocess your report with the correct quarter/year. If the prior EOQ/EOY files were stored to tape, the file must

first be restored from tape before the reports can be run, call SkilMatch for

assistance. There may be billable

support for restoring files for reports.