ENTER RANGE (Of Cancelled Bank Checks)

During the Print

Checks option in payroll processing, paychecks are posted to the SkilMatch

check file when you respond to the question ‘Add checks to the bank

reconciliation file’? Paycheck data

accumulates in the check file, it does not automatically purge itself over

time. As a result, we recommend that

each month, when you receive your bank statement, you should reconcile the

cleared checks from the SkilMatch check file.

CHECKLIST: To process a complete Bank Reconciliation,

you must perform the following steps:

1) Mark checks as reconciled.

2) Print a

list of reconciled, deleted, and voided checks.

3) Verify

that the list is correct, and balance against your bank statement.

4) Update

the Bank reconciliation file – which gives you the option to remove the

reconciled checks.

There are 3

different methods available for marking checks as reconciled through

SkilMatch.

One option requires the purchase and installation of a custom

interface that will bring in a file of cleared check from your bank. This is the most efficient method of clearing

large groups of payroll checks. Contact

your SkilMatch sales rep for more information.

A second

option – no

interface program required - permits the ‘clearing’

of a range of check numbers. This

may be the second most efficient method of marking checks as reconciled. The system will ‘assume’ that the bank

cleared the check for the same amount as it was written from SkilMatch.

The final

choice – no

interface program required - requires you to mark each individual check as reconciled. You are required to key the amount of the

check by the bank, using the bank statement.

This method is more time consuming, but the system will notify you

immediately if the check amount cleared by the bank differs from the amount

written in SkilMatch.

If you prefer to clear individual check numbers,

rather than clearing a group of checks simultaneously, please refer to the

instructions for Enter Individual Checks.

The following instructions are for marking checks in

a range of check numbers.

NOTE:

Temporary payroll checks and staff payroll checks post to the same

internal check file. Staff, who do not

have authority to staff payroll, may gain access to staff paycheck data by

using this option if:

1) The staff member knows the bank

rec password,

2) The staff member knows the cash

account number for staff payroll, or

3) Temporary payroll and staff

payroll use the same cash account number

Correcting problems found

on Bank Rec Report

NOTE: Only one person can enter cleared checks for

a bank account number at a time.

THIS MENU OPTION IS PASSWORD PROTECTED. Be very careful about sharing the Bank Reconciliation

password with users!

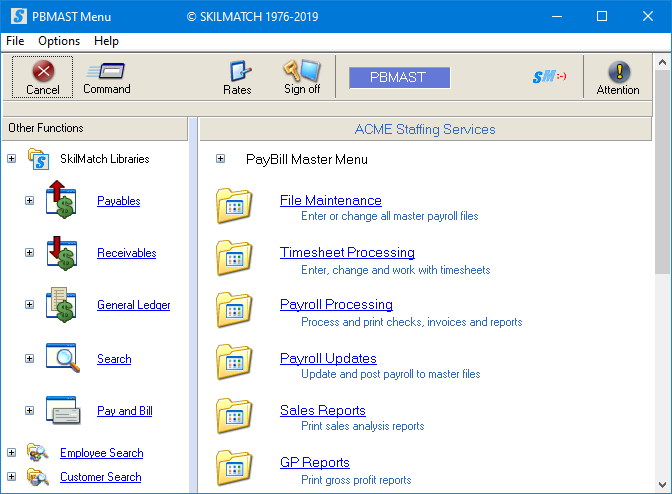

To begin, in the main menu in the Pay and Bill

library.

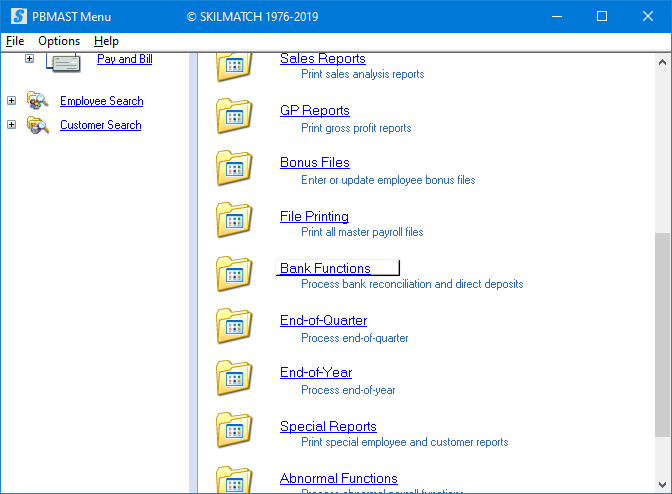

Next, scroll down or right click and select [Bank Functions].

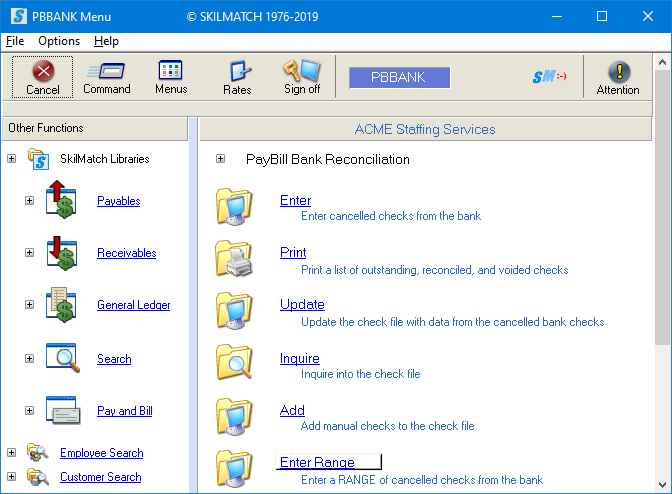

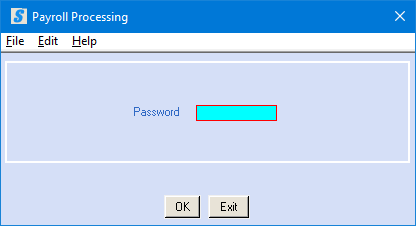

The screen will display:

Click [Enter Range], the screen

will display:

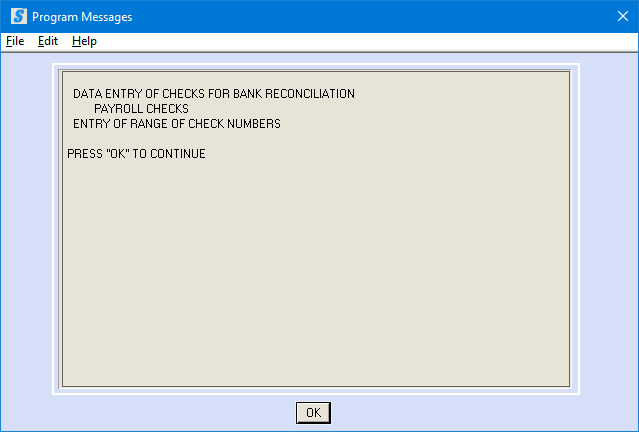

Click [OK] to continue, the screen will display:

Password:

Key the bank reconciliation password. If you do not know the password, see your

manager.

To continue, click [OK].

OR

To cancel and return to menu, click [Exit]. You will be returned to the “PayBill library,

Bank Functions menu”.

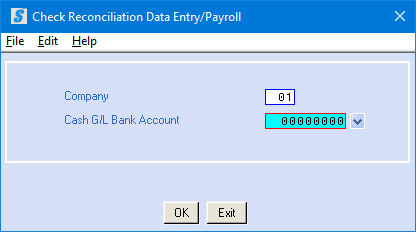

If click [OK] to continue, the screen will display:

Company Number:

Defaults to company 01. To reconcile checks for a different company,

key the desired company number.

Cash G/L Bank Account:

Key the bank

account number from which the checks were issued, click the ![]() button (prompt and select) to the right for a

valid list of bank accounts.

button (prompt and select) to the right for a

valid list of bank accounts.

To continue, click [OK].

OR

To cancel and return to menu, click [Exit]. You will be returned to the “PayBill library,

Bank Functions menu”.

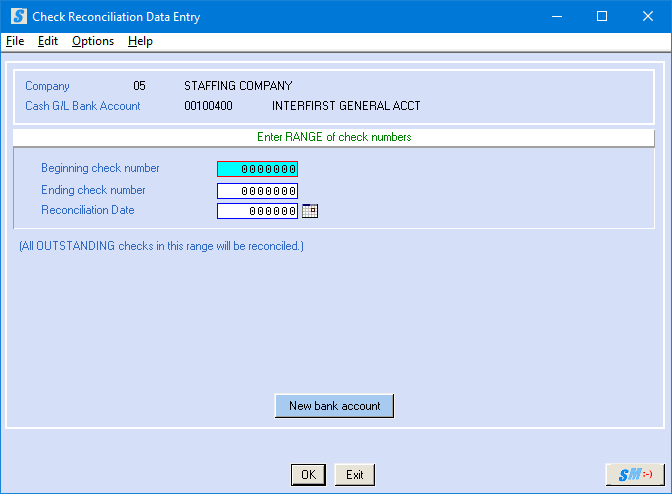

If click [OK] to continue, the screen will display:

Typically, your bank

statement will list the cleared checks in numerical order. There will be breaks in the sequence where

some checks have not yet been cashed. To

handle these breaks in sequence, you have 2 choices.

Using the following

example: A Bank statement includes

cleared check numbers 1-100, with the exception of Check numbers 23, 24, and

81.

You can enter the lowest

number (1) as the Beginning check, and the highest number (100) as the Ending

check, then you can use the Enter menu option go back and individually

delete the check numbers that have not cleared (23, 24, 81),

OR

You can enter multiple

ranges. The first range would have the

lowest number (1) as the Beginning check, and the last number before the break

in sequence as the Ending number (22).

The next range would pick up with the next cleared check number (25),

and go through the next break in sequence as the Ending number (80). Continue with as many additional ranges as

necessary (82-100) to reconcile all checks.

Beginning Check Number:

Key the first check number in the series of

consecutive numbers that have cleared the bank.

Ending Check Number:

Key the last check number in the series of

consecutive numbers that have cleared the bank.

Reconciliation Date:

Use the Bank Statement date

as the Reconciliation date. The date may

be keyed (without punctuation) or may be selected by clicking the ![]() button (prompt and select button) to the right

of dates. The

button (prompt and select button) to the right

of dates. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

If this is the first check range you are entering,

key or select the date. In subsequent

entries, this date will duplicate from the previous record. As long as the reconciliation date remains

the same, you will not need to key it in subsequent entries.

To mark these checks as Reconciled, click [OK]. You are ready to enter the next range of

check numbers to be reconciled. The

previous check number appears on the screen to help you keep your place when

entering check numbers. Key the next

check number over the one displayed.

OR

To cancel and return to menu, click [Exit]. You will be returned to the “PayBill library,

Bank Functions menu”.

If click [OK] to continue, you can continue to follow

the preceding steps until all the cleared checks for this bank account number

have been entered.

When you have finished entering checks to be

reconciled, click [Exit] to return to the “PayBill library,

Bank Functions menu”. There is no report

created by this option (see menu option “Print”).

New Bank Account:

If you have checks to enter for a different bank

account, rather than clicking [Exit], click [New Bank Account].

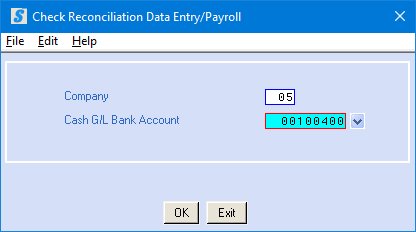

The screen will display:

The screen will show the prior Company Number and

Cash G/L Bank Account that was being updated, enter the new bank account

information and proceed as before.

Company Number:

To reconcile checks for a different company, key the

desired company number.

Cash G/L Bank Account:

Key the bank

account number from which the checks were issued, click the ![]() button (prompt and select) to the right for a

valid list of bank accounts.

button (prompt and select) to the right for a

valid list of bank accounts.

To continue, click [OK] and proceed with entry

as before.

OR

To cancel and return to menu, click [Exit]. You will be returned to the “PayBill library,

Bank Functions menu”.

When you have finished entering checks to be

reconciled, click [Exit] to return to the “PayBill library,

Bank Functions menu”. There is no report

created by this option (see menu option “Print”).

You should verify the accuracy of your data entry by

processing PayBill Bank Functions, Item Print and inspecting the report.

Check left out of previous entry:

If you neglected to mark a check as reconciled, simply

use the menu option “Enter” to go back into the check file

to mark the check as reconciled, or use the steps above to clear another range

of checks.

Check marked as reconciled by accident:

If the reconciled total on the report does not match

the bank statement because a check was coded as reconciled by mistake, go back

into menu option “Enter”. Re-enter the Check

number and Check amount, select the

Deleted code, and key a Reconciliation date. This does NOT delete the check from the

SkilMatch check file, but it does delete it from the reconciled column, and

puts it back as OUTSTANDING.

Check reconciled with incorrect amount:

If the reconciled total on the report does not match

the bank statement because a check was coded as reconciled, but the wrong

amount was keyed, go back into menu option “Enter”. Re-enter the Check number, the correct Check amount, select the

Reconciled code, and key a Reconciliation date.

This will correct the amount.

Check number does not exist in SkilMatch:

This is a symptom of a much larger problem. Since check numbers are added to Bank Reconciliation

as a part of some other process, it is possible that the other process did not

complete correctly. You will need to

research and find out if bank reconciliation is the only place where a failure

occurred.

IMPORTANT: If a check number has cleared your bank, but

is not in the SkilMatch check file, it may be that an entire process was skipped. Example:

If an advance check was written to an employee, and cashed by the

employee, but the advance check was never processed in SkilMatch as either an

Advance check, or as a Prepaid check, then the employee’s earnings are not

accurate, the G/L accounts are not accurate, payroll taxes have not been paid,

etc.

OR

Perhaps

an advance check was written, but a mistake was made when the check number was

keyed, so that the number in SkilMatch does not match the number cleared by the

bank – but the amount is correct.

If you make corrections, you should print another Bank Reconciliation report to once again verify

accuracy of the report.

Remember that entry of reconciled checks is only the

first step in the Bank reconciliation process!

Please continue the process by proceeding to PayBill Bank Functions, Item Print.