ENTER INVOICES

This option is used for entering vendor invoice data and prepaid check

information. This option produces an

Accounts Payable Journal Proof (APINV2).

Through this option you may:

(1) Enter invoices (not yet

paid) and expense them.

(2) Enter invoices (already paid), enter the

prepaid check data, and expense them.

(3) Enter invoices (paid or not yet paid) and

create the vendor file if it doesn’t already exist.

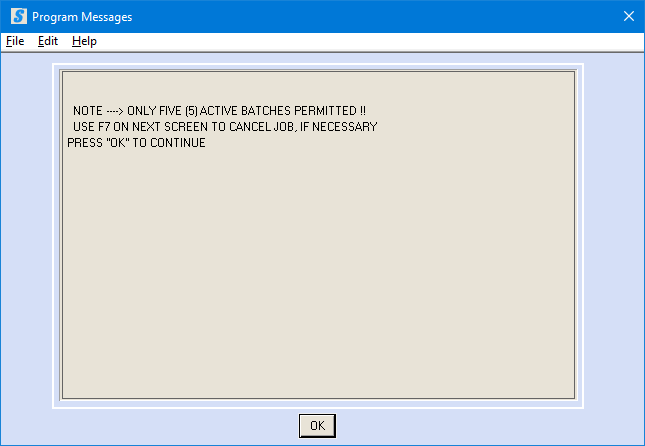

Only

five active batches are permitted at a time.

A batch is a group of vendor invoices that share some basic criteria

such as general ledger company and accounting period.

While the system will allow you to enter up to 99 invoices in a batch, SkilMatch does not recommend that you enter more than 25. The reason for this lower number is the procedure required to make a change to an invoice. You cannot simply key a "key/sequence" number and go straight to the invoice, you must "page" through all invoices (starting with the last invoice in the batch) to get to an invoice for a change. Imagine if your error is on invoice number 1!

The following is a list of the different features described in this documentation:

How To Create/Select A Batch for Accounts Payable Invoices

How To Page Through Accounts Payable Invoices/Distributions Previously Entered

HOW TO CREATE/SELECT A BATCH FOR ACCOUNTS PAYABLE

INVOICES

Before beginning, SkilMatch recommends you:

(1) Separate invoices into batches by general ledger company number and fiscal period (all entries in a batch should be for the same general ledger company number and fiscal period).

(2) Write on each invoice the vendor code and fiscal period.

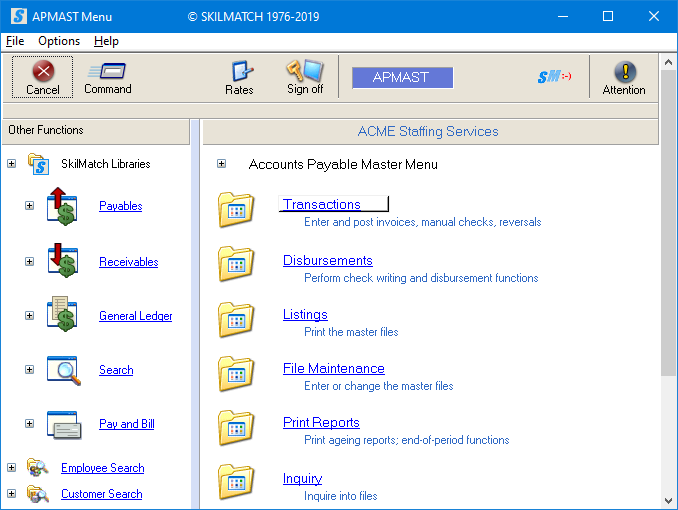

To begin, select the [Transactions] menu in the Payables library:

The screen will display:

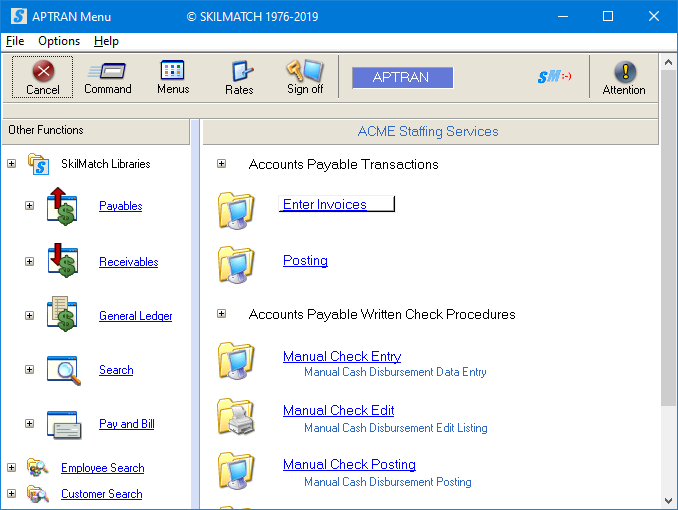

Click [Enter Invoices], the screen will display:

Click [OK] to continue, the screen will display:

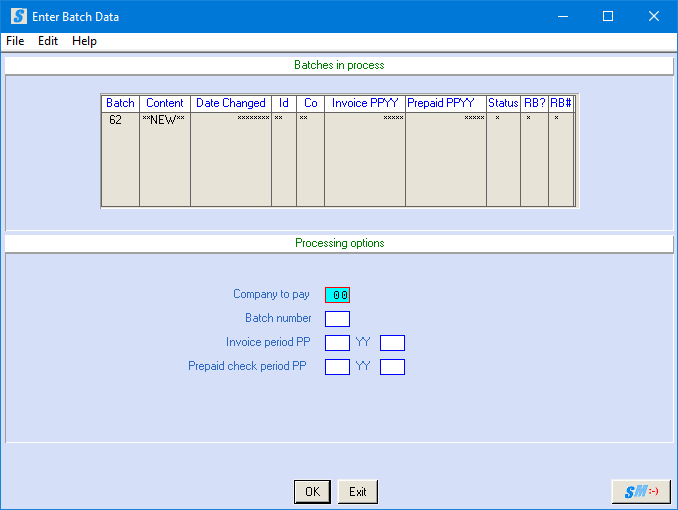

NOTE: The batch detail of your screen will NOT display the same data as above. Your screen will display the batch available on your system.

The top of the screen will show the active batch numbers, the number of invoices in each active batch, the date the batch was last changed, which workstation is using the batch, the general ledger company number, invoice fiscal period/year, the prepaid check fiscal period/year, the status of the batch, whether the batch was copied from a saved "recurring” batch, and the "recurring" batch number.

Batch Status:

(1) Status ‘U’ (in use). If the STS column shows a ‘U’, you cannot select this batch; it is in USE.

(2) Status ‘A’

(available). If the STS column shows

"blank" or ‘A’, you may select this batch; it is AVAILABLE.

(3) Status ‘P’ (passed

edit). If the STS column shows ‘P’, the

invoices in this batch have passed all editing and can be POSTED.

The bottom of the screen

establishes the batch information for the invoices you are about to enter.

Company To

Pay:

Key the number of the general ledger company to pay.

NOTE: Do not enter invoices for multiple general ledger

companies in the same, single batch.

Batch Number:

To create new batch, key the batch number indicated on the line marked as

"*NEW*".

OR

To update an existing batch, key the number of an existing batch that you

wish to add or update records.

OR

To delete an existing batch, key the number of the batch you wish to

delete.

NOTE: Only 5

active batches allowed at one time. Only

99 invoices allowed in one batch.

Invoice

Period, PP:

Key the 2-digit month of the fiscal accounting period, (i.e. 01=first

period or 01=January).

NOTE: If you key a period that has been closed

(through Menu AP File Maintenance, Item System File), you will receive a

message, “Invoice period is closed”, no posting is allowed to a closed period.

Invoice Year,

YY:

Key the 2-digit year of the fiscal accounting period, (i.e. 2023=23).

NOTE: If you key a period that has been closed

(through Menu AP File Maintenance, Item System File), you will receive a

message, “Invoice period is closed”, no posting is allowed to a closed period.

Prepaid Check

Period, PP:

Key the 2-digit accounting period for the prepaid checks, (i.e. 01=first

period or 01=January)

NOTE: If you key a period that has been closed

(through Menu AP File Maintenance, Item System File), you will receive a

message, “Invoice period is closed”, no posting is allowed to a closed period.

Prepaid Check

Year, YY:

Key the 2-digit prepaid check year, (i.e. 2023=23).

NOTE: If you key a period that has been closed

(through Menu AP File Maintenance, Item System File), you will receive a

message, “Invoice period is closed”, no posting is allowed to a closed period.

To continue, click [OK].

OR

To cancel and return to menu, click [Exit].

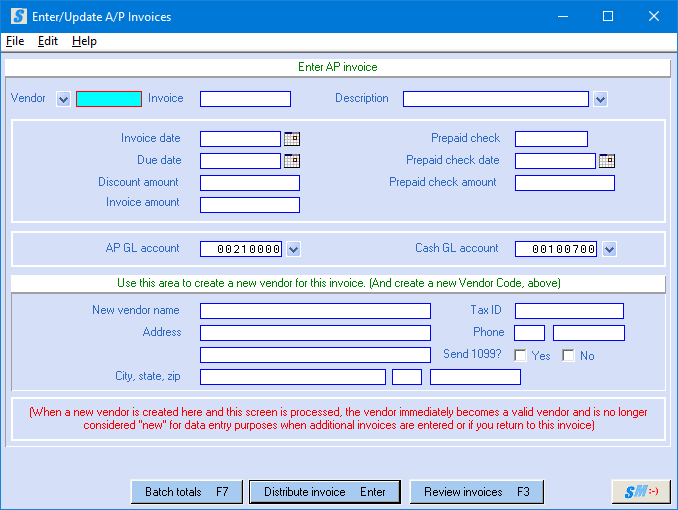

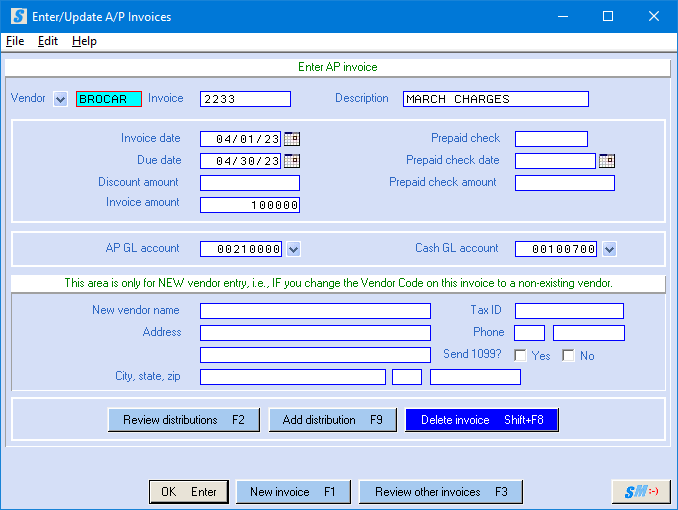

If you click [OK] to continue, the screen will display:

Vendor:

(REQUIRED) Key the vendor code. You may use up to 6 characters.

NOTE: If this is a NEW vendor, and you have not

already setup a vendor file in A/P file maintenance, you may enter the invoice

and the vendor information at the same time by assigning a 6-character vendor

code in this area, and keying the vendor name and address in the miscellaneous

vendor area. A vendor file will be

created using the 6-character vendor code.

Invoice:

(REQUIRED) Key the invoice number. You may use up to 9 characters.

NOTE: You may NOT use the same invoice number on

any other invoice belonging to the same vendor within the same general ledger

company. You may re-use an invoice

number from an invoice that has been reversed.

Description:

(OPTIONAL, BUT RECOMMENDED) Key

a description of the invoice. You may

use up to 20 characters.

OR

Select a description by clicking

the ![]() button (prompt and select button) to the right

of the description.

button (prompt and select button) to the right

of the description.

NOTE: This description will print on the check

stub.

Invoice Date:

(REQUIRED) The vendor invoice date may be keyed in MMDDYY format (without punctuation)

OR

You may select

date by clicking the ![]() button (prompt and select) to the right of

dates and a calendar from which you may click on a date to select, and then

click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar from which you may click on a date to select, and then

click [OK] to bring the calendar date

into the date field.

Due Date:

(OPTIONAL, BUT RECOMMENDED) The due date may be keyed in MMDDYY format (without punctuation).

OR

You may select

date by clicking the ![]() button (prompt and select) to the right of

dates and a calendar from which you may click on a date to select, and then

click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar from which you may click on a date to select, and then

click [OK] to bring the calendar date

into the date field.

OR

Leave field blank and current day’s date will be used.

NOTE: This date is used for running reports, and

for selecting checks by due date.

Discount

Amount:

(OPTIONAL) Key the amount of the discount, if one is to be taken.

NOTE: This is NOT contingent on being paid by a

certain date. If the invoice is entered

with a discount, then the discount will be deducted from the check amount

during processing, regardless of the date it is paid. You will have to remove the discount from the

invoice if you do not wish to take the discount when the invoice is paid.

Invoice

Amount:

(REQUIRED) Key the amount of the invoice. Do not use a decimal point. Use zeroes to

hold spaces.

Example: $25.00 is keyed as 2500.

NOTE: This will

probably be all you will need to enter on this screen.

If one of these three conditions apply, continue with entry on this screen,

following the instructions below:

(1) This check was prepaid.

(2) The default account numbers are not correct

for this invoice.

(3) There is no vendor account set up for the

vendor code used above, and you need to enter the vendor name & address.

If none of the three conditions apply, you may click [Distribute

invoice] to continue.

Refer to instructions for distribution screen

below.

If this entry

is a PREPAID CHECK, follow these instructions:

If you have already written a manual check paying this invoice, key the

check number.

Prepaid Check

Date:

If you have already written a manual check paying this invoice, key the

prepaid check date.

OR

You may select

date by clicking the ![]() button (prompt and select) to the right of

dates and a calendar from which you may click on a date to select, and then

click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar from which you may click on a date to select, and then

click [OK] to bring the calendar date

into the date field.

Prepaid Check

Amount:

If you have already written a manual check paying this invoice, key the

amount of the prepaid check.

AP GL Account:

The default A/P liability general ledger account number will

automatically appear in this field. If

you wish to use a different account number for this invoice, key the account

number that applies to this entry.

OR

Select A/P G/L account by clicking

the ![]() button (prompt and select button) to the right

of the account field.

button (prompt and select button) to the right

of the account field.

Cash GL

Account:

The default cash general ledger account number will automatically appear

in this field. If you wish to use a

different cash account for this invoice, key the account number that applies to

this entry.

OR

Select Cash G/L account by

clicking the ![]() button (prompt and select button) to the right

of the account field.

button (prompt and select button) to the right

of the account field.

If this entry

is a NEW VENDOR, follow these instructions:

If you

are entering an invoice and/or prepaid check information on a vendor who does

not have a vendor file in the system, and you assigned a NEW vendor code, then

complete the following vendor information.

A vendor account is being created during the entry of this invoice.

New Vendor

Name:

If this is a NEW vendor code, key the vendor name.

Address:

If this is a NEW vendor, key the vendor mailing address.

City:

If this is a NEW vendor, key the vendor city.

State:

If this is a NEW vendor, key the vendor state.

Zip:

If this is a NEW vendor, key the vendor zip code.

Tax ID:

If this is a NEW vendor, key the vendor Federal Tax ID/Social Security Number.

Phone:

If this is a NEW vendor, key the vendor phone number.

Send 1099:

If you want this vendor to receive a 1099 at the end of the year, click Yes on this option to select (a checkmark will appear next to the

selection).

OR

If this vendor does not require a 1099, click No on this option to select

(a checkmark will appear next to the selection).

To complete this invoice entry and continue with distribution of expense

of this invoice, click [Distribute

invoice] or press < Enter>.

OR

CAUTION selecting Batch totals, data entered will NOT be saved: To review batch totals, click [Batch totals] or press <

F7>. NOTE: Any data entered on this screen will NOT be

saved.

OR

CAUTION selecting Review invoices, data entered will NOT be saved: To review invoices, click [Review invoices] or press <

F3>. NOTE: Any data entered on this screen will NOT be

saved.

OR

To cancel without saving changes and return to main menu, click [Batch totals]. NOTE: Any data entered on this screen will NOT be

saved. On the batch totals screen, click

[Close

Batch].

If you select [Distribute

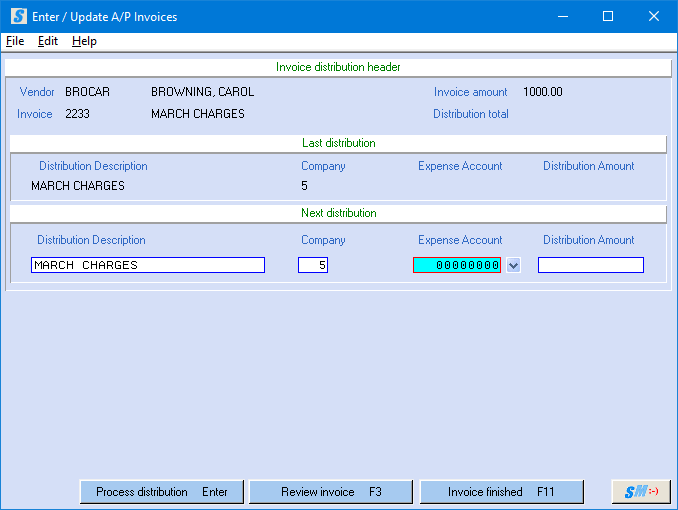

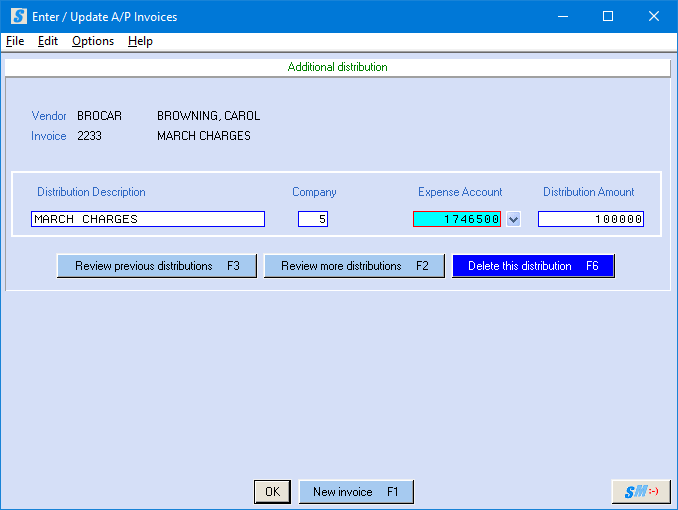

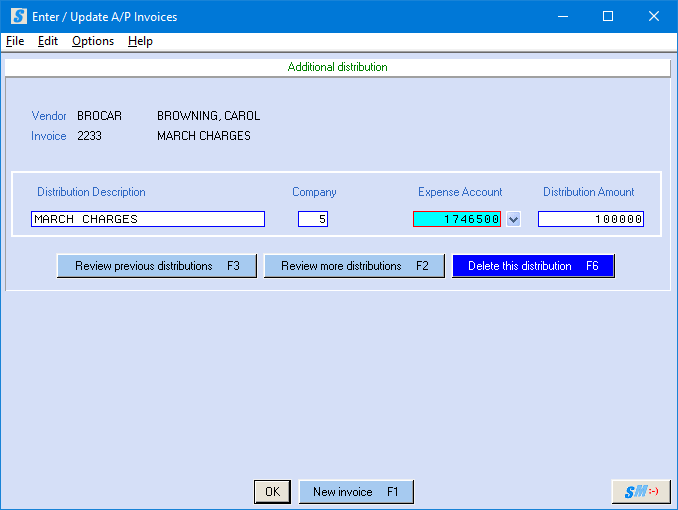

invoice] (or press <Enter>) to continue, the screen will display:

This screen provides the opportunity to distribute the expense of the

invoice to the appropriate account(s).

It can be distributed to one expense account or multiple expense

account(s).

Distribution

Description:

Defaults to the description entered on the previous screen for this

invoice.

OR

To use a different description, you may change the data in this area.

Example: the description on the

invoice is "Office supplies", but this detail line should say "Computer

paper".

Company:

Defaults to the general ledger company entered previously.

NOTE: You should NOT change this data. Do not enter invoices for multiple general

ledger companies in the same, single batch.

Expense

Account:

Key the 8-digit general ledger expense account number that is to receive a portion OR the entire invoice amount.

OR

Select a G/L expense account by

clicking the ![]() button (prompt and select) to the right of the

account field.

button (prompt and select) to the right of the

account field.

Distribution

Amount:

Key the amount you wish to distribute to this general ledger account

number.

To accept and include this distribution, click [Process distribution] or press < Enter>.

OR

To return to the first (previous) screen and review invoice, click [Review invoice] or press <F3>. Any data entered on this screen will NOT be

saved.

OR

When distribution is complete and ready to proceed, click [Invoice finished] or press <

F11>. An NEW invoice screen will display.

OR

To delete this invoice, click [Review Invoice]. You

will be returned to the front screen of this invoice. From here, click [Delete

invoice] (or press Shift+F8). A

blank invoice record will display. You

may enter another invoice OR you may exit from this option by clicking [Batch Totals] (or press

<F7>), select [Close batch] (or press

<F7>).

“Account Number is not

valid” Error messages:

If you

entered a general ledger account number that does not exist, the screen will

display a message, "Account Number is not valid". You cannot continue until you do one of these

three options:

Option 1) Change the GL account number if it

was entered inaccurately. Once the

account number is accurately entered,

click [Process

distribution] (or press <Enter>). The

distribution will be added if the newly keyed GL account number is valid.

Option 2) If the GL account number should be

valid. Go to another workstation session

and enter/add the invalid general ledger account number

(refer to Menu GL Maintenance, Item Accounts for assistance). Once the account

number is in the system, click [Process

distribution]

(or

press <Enter>). The

distribution will be added if the keyed GL account number is valid in the GL

accounts.

Option 3) If you would like to delete this

invoice so that you can research at a later time to determine the correct GL

account number,

click [Review Invoice] to return to the front

screen of the invoice and then click [Delete Invoice] to delete the invoice.

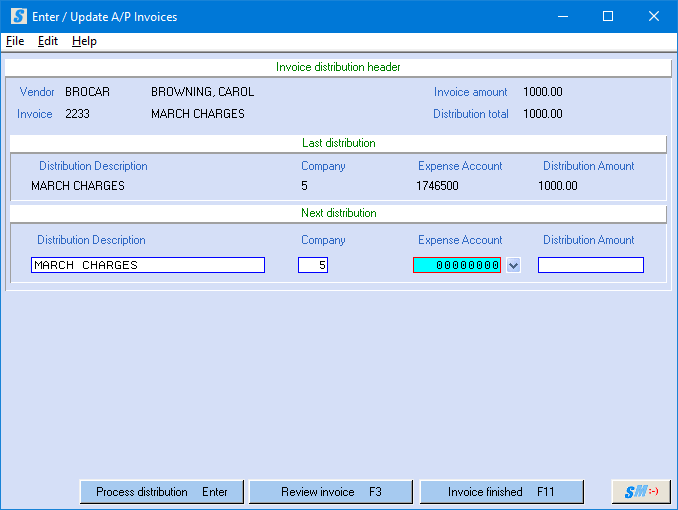

If you chose to [Process Distribution] and continue, the screen will display:

The amount expensed appears in the Distribution Total area at

the top right of the screen and a “Last distribution” line is displayed.

If the Distribution total does NOT match the Invoice amount, repeat the

preceding steps until the full amount of the invoice has been expensed and the

totals match. If necessary, refer to Out Of Balance instructions for further assistance.

When the full amount of the invoice has been expensed accurately and the Distribution Total matches the Invoice Amount, click [Invoice Finished] to save and complete this invoice.

You may then begin entry of another invoice.

NOTE: You cannot leave the invoice if the

Distribution Total (amount expensed) does not match the Invoice Amount.

NOTE: You

are limited to 99 lines of detail per invoice, SkilMatch recommends you STOP at

95 to prevent programming assistance to correct.

“Invoice distributions do not equal invoice amount.” - Out of Balance, Corrective Options:

Option 1) If you are out of balance because

you did not finish expensing the invoice amount, click [Add

distribution] (or press <F9>) and add

additional entry(s) for the balance of the invoice distribution and click [Invoice finished] (or press <F11>) again.

Option 2) If you are out of balance because

the invoice amount is incorrect, click [Review

invoice] (or press

<F3>) to return to the first

screen

of the invoice. Correct the invoice amount and click [OK]

to accept the corrected invoice amount and then click [Review distributions]

(or press

<F7>) to return to the

second screen of the invoice where you may click [Invoice

finished] (or press <F11>).

Option 3) If you are out of balance due to an

error in one of the distributions, click [Review

invoice] (or press

<F3>) to return to the first

screen

of the invoice.

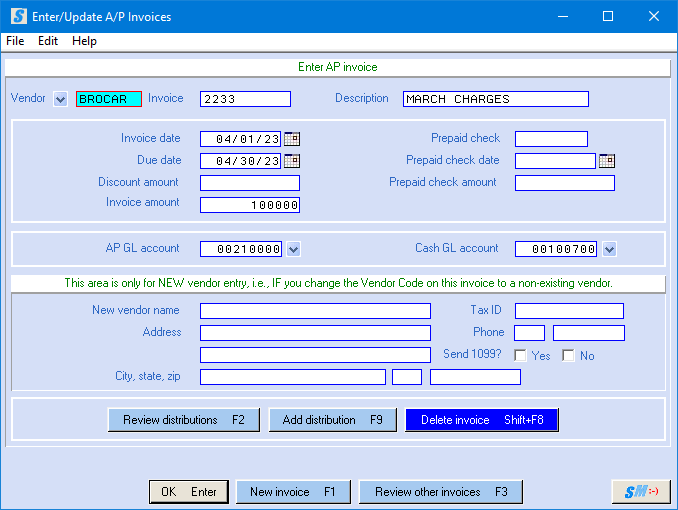

The

screen will display:

Next, click [Review

distributions] (or press

<F2>) to begin moving

through the distributions for this invoice.

If there are NO distributions associated with this invoice, you will

remain on the first screen with message, “Invoice distributions do not equal

invoice amount.” Click [OK]

and then click [Add distribution] (or press <F9>) to add a distribution to this invoice.

A blank distribution screen will display.

If there are distributions associated with this invoice, the first

distribution record will display in the Expense Account and Distribution Amount fields.

Continue

to click [Review more distributions] (or press <F2>) and

each distribution entry will display, one-by-one. Make any corrections needed and click [OK]. When all

distributions have been displayed, the system will return to the front Enter AP Invoice

screen.

On Enter AP Invoice screen

you may select [Review

Distribution] (or press

<F2>)

as many times as needed, then select [Review previous distributions] (or press <F3>) and [Review more distributions] (or press <F2>) to move forward and back

through the entered distributions for this invoice.

If the

Distribution Total (amount expensed) now matches the Invoice Amount, you may

click [Invoice Finished] (or press <F11>) to save and complete this

invoice entry.

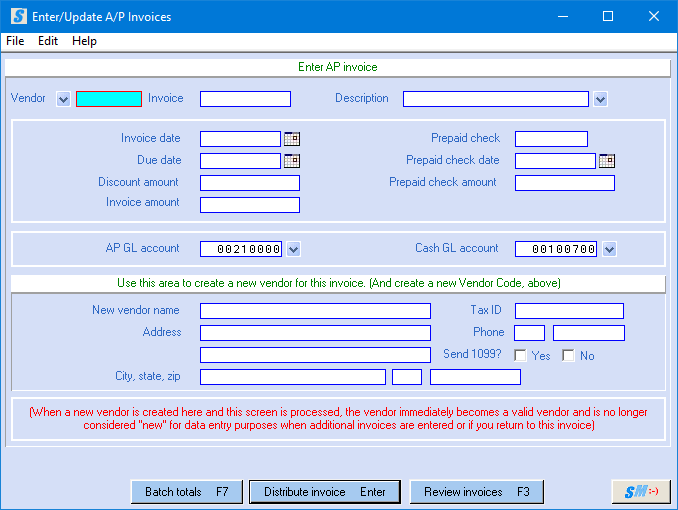

When each invoice entry is complete, you will receive a new

Enter/Update A/P Invoice screen to add additional AP invoices.

You may now continue with entry of the next AP invoice and its

distributions in this batch.

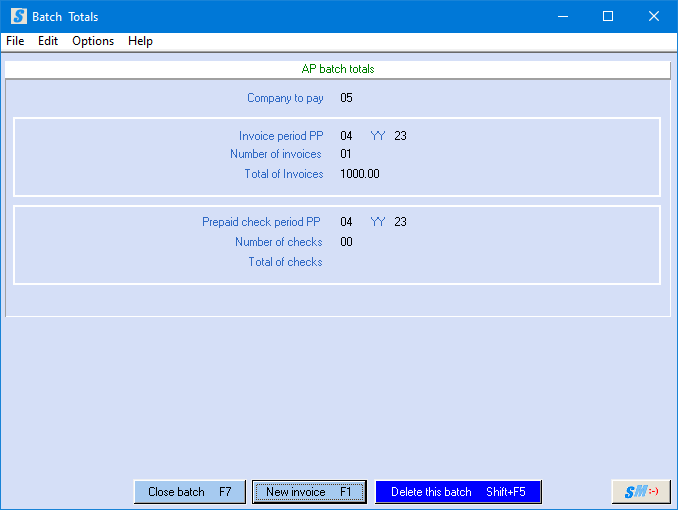

When you have entered all AP invoice for this batch, click [Batch totals] (or press <F7>).

When you select [Batch Totals] (or

press <F7>) to review totals exit from invoice entry, the

screen will display:

Verify the number of invoices

that should be in this batch, the total amount of those invoices, the number of

prepaid checks, and the total of prepaid checks.

If your totals are NOT correct and you want to review entries and

correct your errors, click [New invoice] (or press <F1>), you will be returned to the invoice entry

screen and can click [Review invoices] (or press <F3>) and again select [Review other invoices] (or press <F3>).

This will page forward through your invoices for review. You can select [Review distributions] (or press <F2>) as needed to also review the distributions

to each of the invoices.

OR

If your batch has problems and you would like to review the edit before

attempting to make corrections, click [Close

batch] (or press <F7>). You

will be returned to the “Accounts Payable Transaction Processing” menu and

reports will be in your outque, return to this batch to make any corrective

entries.

OR

If your batch has problems and you would prefer to delete the entire

batch, rather than attempt corrections, click [Delete

this batch] (or press <Shift +F5>).

OR

If your totals are correct and you want to exit from this option, click [Close batch] (or press <F7>). You will be returned to the

“Accounts Payable Transaction Processing” menu.

Accounts Payable Journal Proof (APINV2) - the system will

automatically generate an Accounts Payable Journal Proof that will show the

vendor code, the invoice number, the vendor name, the description, invoice

date, due date, company number, general ledger account number, debit amount and

credit amount, invoice amount, discount amount, and net due on invoice. Also displayed are the intra-company

transfers, batch totals and the difference between total debits and total

credits.

Carefully review this journal proof for errors.

Verify that prepaid checks numbers, dates and amounts are correct.

Inspect all account numbers, vendors, invoice numbers, and descriptions, etc. for accuracy before continuing with posting.

HOW TO PAGE THROUGH ACCOUNTS PAYABLE

INVOICES/DISTRIBUTIONS PREVIOUSLY ENTERED

If you selected an existing batch and wish to “page” through

invoices/distributions already in this batch, the first screen will display:

When you select [Review invoices] (or

press <F3>) to review invoice(s) in the batch, the screen

will display the last invoice entered:

To view a different invoice in this batch, click [Review other invoices] (or press <F3>).

Repeat until the desired invoice displays.

To display the distribution(s) associated with the displayed invoice,

click [Review distributions] (or press <F2>).

The first distribution associated with that invoice will display:

To view a different distribution associated with this invoice, click [Review more distributions] (or press <F2>) again.

Repeat until the desired distribution displays. If the last distribution associated with the

invoice is displayed and you click [Review more

distributions], the next

invoice in the batch will display, or, if this is the last invoice in the

batch, a blank record will display.

When you are finished paging through accounts payable

invoices/distributions previously entered, and you are at a blank record, click

[Batch totals] (or press <F7>). The

batch totals screen will display.

If your totals are NOT correct and you want to review entries and

correct your errors, click [New invoice] (or press <F1>), you will be returned to the invoice entry

screen and can click [Review invoices] (or press <F3>) and again select [Review other invoices] (or press <F3>).

This will page forward through your invoices for review. You can select [Review distributions] (or press <F2>) as needed to also review the distributions

to each of the invoices.

OR

If your batch has problems and you would prefer to delete the entire

batch, rather than attempt corrections, click [Delete

this batch] (or press <Shift +F5>).

OR

If your totals are correct and you want to exit from this option, click [Close batch] (or press <F7>). You will be returned to the

“Accounts Payable Transaction Processing” menu.