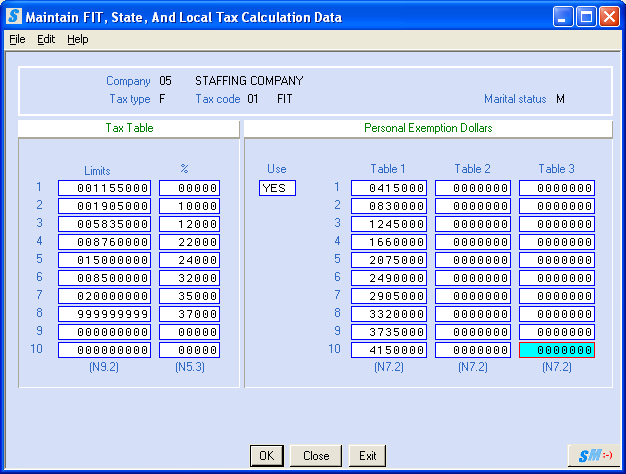

2018 FEDERAL WITHHOLDING

TABLES

(As of January 11, 2018)

The SkilMatch FIT

tables were created using the IRS “early release” information (“Notice 1036”)

published on January 11, 2018. Due to

the features of the new tax law, SkilMatch anticipates further changes to FIT

table information may occur during 2018 and will provide notification when/if

changes are published by the IRS.

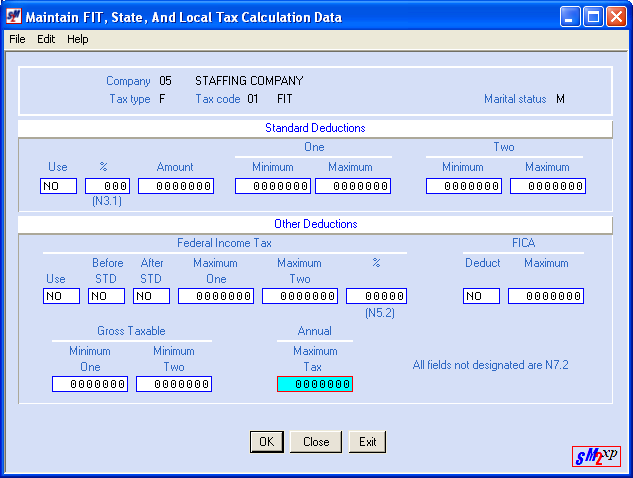

NOTE: The Federal Government only

provides tax tables for Married and Single (no tables for Head of

Household). Although the IRS allows

users to file tax returns as Head of Household, there is no table. Your staff must use the guidelines for Head

of Household on the form W-4 to assist with employee withholdings.

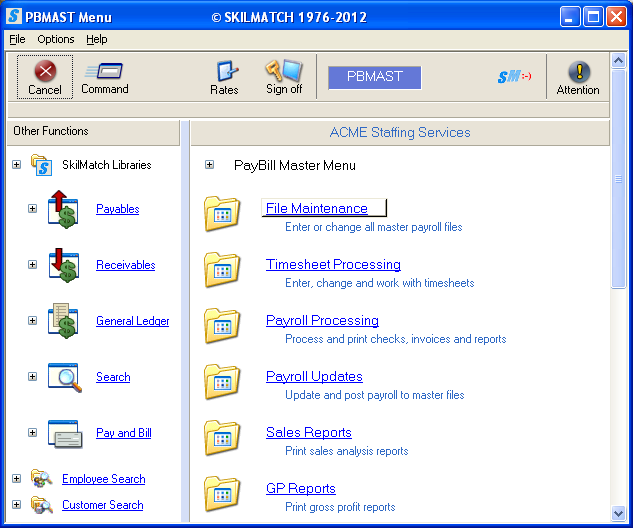

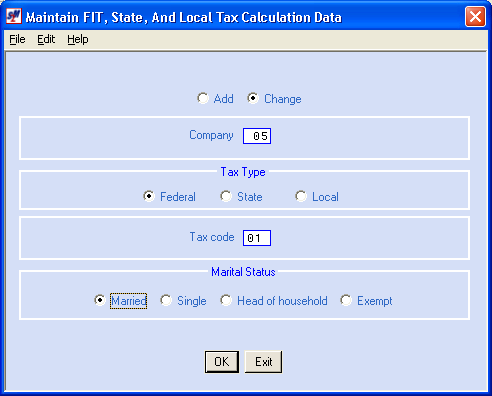

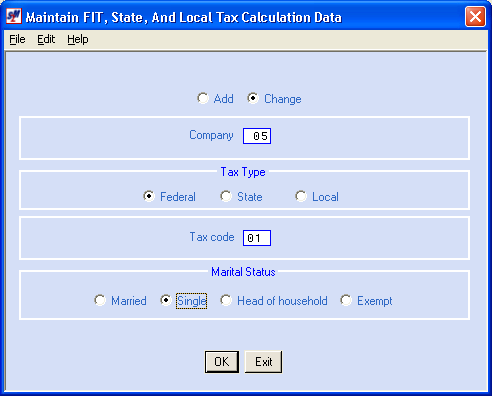

NOTE: Tax table changes are

effective for the company number entered.

You will need to REPEAT the

setup for ALL company numbers for

which you are calculating payroll taxes.

Tax tables will be effective for both Temp and Staff for this company

number.

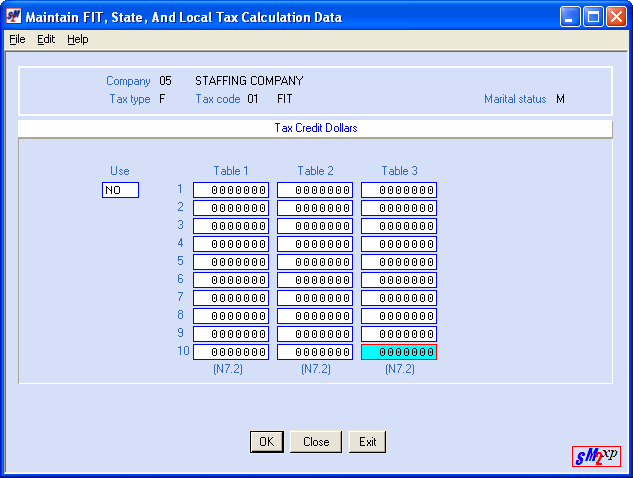

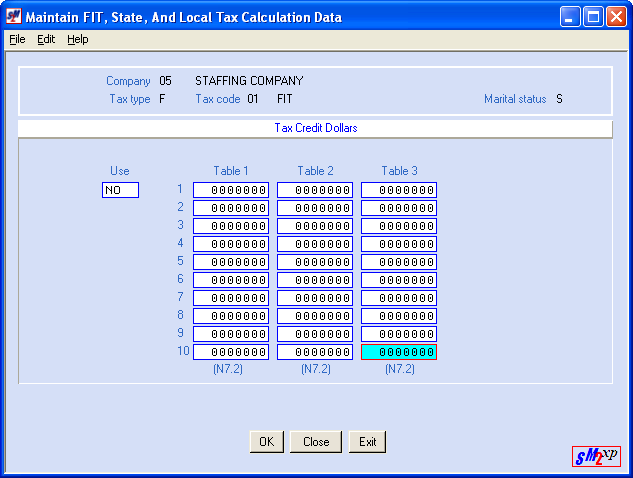

MARRIED

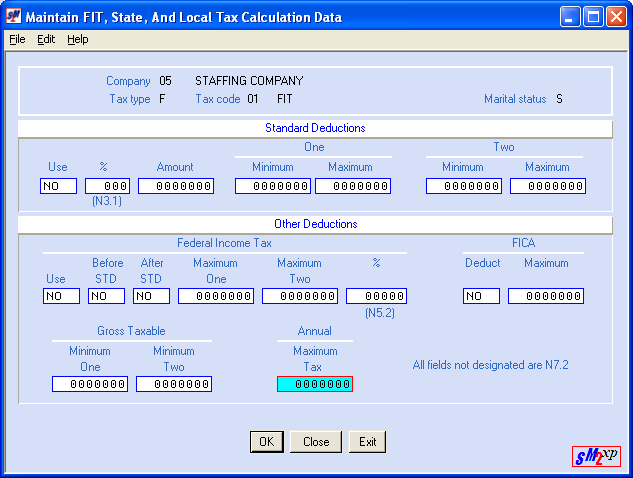

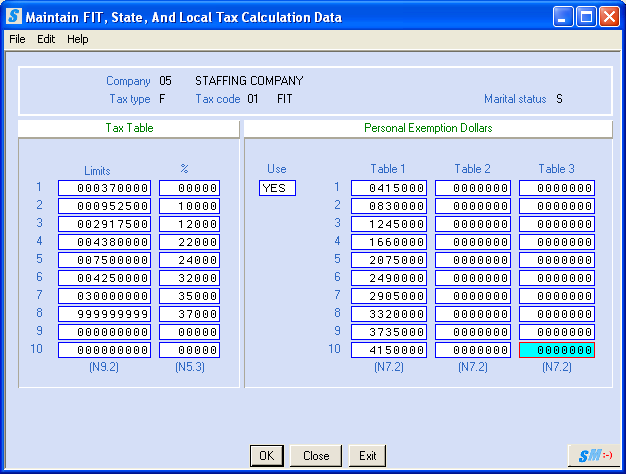

SINGLE

LEGAL DISCLAIMER and Customer

Responsibilities:

When SkilMatch staff

or a SkilMatch program provides information, data, calculation, tax tables,

magnetic media or paper reporting to SkilMatch customers, a “best efforts”

attempt has been made by SkilMatch to verify that the information is correct as

SkilMatch understands it or as it has been explained to SkilMatch. SkilMatch-provided tax tables and reporting

are provided to assist customers in setting up your tax table records and to

assist customers in reporting to government authorities. Tax laws and requirements change frequently

and it is a customer’s responsibility to verify the accuracy of all

SkilMatch-provided information and reporting with your tax advisor, accountant

and/or attorney.

SkilMatch attempts

to monitor for tax table and reporting changes. However, when a customer receives ANY notification of change from

a taxing authority, SkilMatch should be notified. SkilMatch depends on customers who are closest to the taxing

authorities to provide information that will affect their businesses. Any and all written, verbal or electronic

information provided by SkilMatch regarding tax tables and government reporting

(1) is meant to provide general information about the payroll process, (2) is

not intended to provide tax or legal advice, (3) is not intended to address,

and is not meant to address, the entire body of federal, state and local law

and regulation governing the payroll process, payroll taxes, government

reporting or employment law. Such laws

and regulations change frequently and their effects can vary widely based upon

specific facts, circumstances and timing.

Each customer is responsible for consulting with a professional tax

advisor, accountant and/or attorney concerning its specific concerns and

compliance.